Fresh polling data from Global InfoAnalytics indicates growing difficulties for the opposition New Patriotic Party (NPP), with internal divisions and declining public confidence contributing to an erosion of its support base in Akan-dominated regions traditionally considered its political stronghold.

The findings suggest that nearly a year after its defeat in the 2024 general elections, the party is struggling to retain core supporters and is now trailing the governing National Democratic Congress (NDC) in declared party affiliations in key areas.

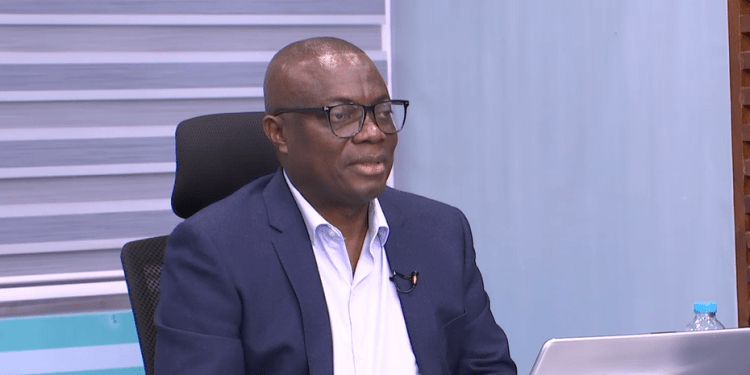

The data emerges from an ongoing face-to-face poll being conducted across more than 83 randomly selected constituencies in all 16 regions of Ghana. According to the Executive Director of Global InfoAnalytics, Mussa Dankwah, early results from Akan-dominated regions show the NDC leading with 36 percent of declared party supporters, while the NPP stands at 31 percent.

Floating voters account for 17 percent, with 3 percent identifying with other political parties. A further 13 percent of respondents declined to disclose their party affiliation, a group that analysts say could prove decisive in future elections.

Mr. Dankwah attributed the NPP’s weakening position in part to bickering and infighting within the party, which he said is straining its traditional base, especially in its own political backyard.

He warned that the implications of the data are serious, given that the regions surveyed include Ahafo, Ashanti, Bono, Bono East, Central, Eastern, Western and Western North. These regions have historically delivered strong electoral margins for the NPP, making any sustained loss of support there particularly damaging.

“If the NPP is unable to hold their own in these regions, the battle ahead will be a very challenging one,” Mr. Dankwah cautioned. He stressed that losing ground in these areas would complicate the party’s efforts to mount an effective national comeback, especially as competition intensifies ahead of future elections.

The poll findings form part of a broader national study that is still ongoing. Mr. Dankwah said the full report, expected in the coming weeks, will provide a comprehensive picture of party affiliations nationwide.

This will include data from the northern regions, the Volta and Oti areas, as well as swing regions that often play a decisive role in determining election outcomes. While the current figures focus on Akan-dominated regions, he suggested that the national data could further illuminate trends affecting both major parties.

A Disconnect between Political Actors and Public Sentiment

Beyond the numbers, Mr. Dankwah has raised concerns about what he described as a disconnect between political actors and public sentiment, particularly within the opposition.

In earlier comments, he questioned how politics in Ghana is sometimes conducted without sufficient effort to understand the mood and expectations of the electorate. In his assessment, while the government appears attentive to public opinion, the opposition risks sidelining voter concerns.

“If you are not reading the room correctly, then it suggests public opinion means nothing to you,” he said, warning that failing to understand whether opposition strategies resonate with voters could lead to serious political consequences.

For Mr. Dankwah, effective opposition requires not only criticizing the government but also ensuring that such criticism aligns with the lived experiences and priorities of the public.

He urged the NPP to take opinion research more seriously and to invest in credible polling to better gauge public sentiment. According to him, if party leaders have reservations about Global InfoAnalytics’ data, they should commission their own independent pollsters.

He argued that such polls should not be limited to internal leadership contests, but should also examine how the party can function as a credible and constructive opposition.

The warning comes against the backdrop of Global InfoAnalytics’ December 10, 2025 poll, which highlighted a significant decline in the NPP’s openly declared supporters.

According to that data, the proportion of respondents who voluntarily identified themselves as NPP supporters fell from 36 percent in October 2024 to 27 percent in October 2025.

Mr. Dankwah described the nine-percentage-point drop as significant, particularly because it reflects a loss among voters who are typically considered the party’s most committed base.

He noted that declines in openly declared support often signal deeper challenges related to party unity, messaging and public confidence. While some supporters may have shifted to other parties, others may now be choosing to remain undecided or unwilling to publicly associate with the NPP.

Taken together, the findings point to a period of reassessment for the opposition party. While the NPP remains a major force in Ghana’s political landscape, the combination of internal tensions, declining declared support and questions about its connection to public sentiment could undermine its effectiveness if left unaddressed.

As the full Global InfoAnalytics report is awaited, Mr. Dankwah’s message is clear: without a more deliberate, data-driven and responsive approach, the NPP risks further erosion of support in regions it can least afford to lose.

READ ALSO: GH¢192m Worth of Shares Traded in November As Bulls Tighten Grip on Ghana’s Capital Market