Nearly a year into President John Dramani Mahama’s return to office, public approval of his performance remains strong, with 67 percent of voters saying they approve of the job he is doing, according to a new survey by Global Info Analytics.

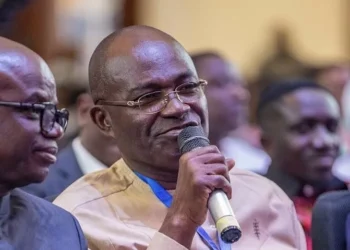

The poll, which is yet to be released in full, shows that 24 percent of respondents disapprove, while the remainder are undecided, suggesting that the President’s political “honeymoon” has not faded despite the pressures of governing. Speaking on the findings, the Executive Director of Global Info Analytics said voter sentiment has remained remarkably stable over recent months.

“Voters who believe Ghana is headed in the right direction remained unchanged between September and December 2025 at 66 percent,” he noted, adding that approval of the President’s performance has also stayed constant at 67 percent over the same period. By most measures, he said, this level of consistency is unusual for an administration approaching its first anniversary.

The poll is cross-sectional in nature but carries an added layer of credibility because of how it was conducted. According to the pollster, constituencies surveyed in September were randomly selected, and the same localities were revisited in the most recent round to assess whether opinions had shifted.

“Nothing has really changed with regard to the direction of the country and the performance of the president,” the Executive Director observed, pointing to what he described as entrenched perceptions among voters rather than temporary sentiment swings. The findings suggest that President Mahama has managed to maintain public confidence during a period that would normally test any new administration.

Typically, early goodwill begins to erode as campaign promises encounter fiscal constraints and political trade-offs. In this case, however, the data indicate that voters’ assessment of the President and the broader national direction has remained steady since at least September.

Ghana’s Economic Rebound

Analysts attribute this resilience in public approval partly to Ghana’s economic performance in 2025, which the Mahama administration has repeatedly highlighted as evidence of a turnaround. Over the course of the year, inflation has cooled significantly, falling from 23.8 percent in December 2024 to 6.3 percent by November, 2025.

The easing of price pressures has provided some relief to households and businesses, reinforcing perceptions that the economy is stabilising. The Ghana cedi’s performance has also featured prominently in public discourse.

At various points in 2025, Bloomberg ranked the cedi as the world’s best-performing currency, a development the government has linked to fiscal discipline and improved confidence in macroeconomic management.

Alongside currency gains, the administration reported a reduction in total public debt of nearly GH₵150 billion over five months, attributing the decline largely to currency appreciation and tighter budget controls.

Fiscal indicators have further strengthened the government’s narrative. As of August 2025, Ghana recorded a primary balance surplus of 1.4 percent of GDP, while the overall fiscal deficit narrowed to 1.5 percent.

These figures, officials argue, mark a decisive shift away from chronic deficits and lend credibility to the administration’s “Reset Agenda,” which prioritises macroeconomic stability and long-term recovery.

Mahama’s Flagship Policy Initiatives

Beyond headline numbers, several flagship policy initiatives have shaped public perceptions. The launch of the 24-Hour Economy policy in July 2025 was a major milestone, with the government positioning it as a strategy to expand production, create jobs, and improve competitiveness.

The policy encourages round-the-clock operations in sectors such as agro-processing, manufacturing, and pharmaceuticals, using three eight-hour shifts, with the potential to generate an estimated 1.7 million jobs over time.

Infrastructure investment has also featured strongly. The government has awarded road contracts valued at about $5 billion under the $10 billion Big Push Infrastructure drive to address longstanding deficits in transport infrastructure, while signalling further commitments in subsequent budgets.

At the same time, tax reforms, including the removal of levies such as the E-levy, the Betting Tax, the COVID levy, and the emissions levy, have been presented as efforts to reduce the cost of doing business and ease pressure on consumers.

International recognition has reinforced domestic confidence. In 2025, Ghana received credit rating upgrades from agencies including Moody’s, Fitch, and Standard & Poor’s, reflecting renewed optimism about the country’s economic outlook.

The administration has also reaffirmed its commitment to the International Monetary Fund programme, with the stated aim of completing key reviews in 2025 and exiting the programme by 2026. For Global Info Analytics, the stability in approval ratings suggests that voters are taking a longer-term view of the government’s performance.

Honeymoon Still On

The Executive Director said the unchanged figures between September and December indicate that perceptions of national direction and presidential leadership have, at least for now, settled.

“By all indicators, nearly a year into office, the honeymoon is still on,” he said. While the full poll results are yet to be published, the topline numbers offer an early snapshot of public mood as the administration approaches its second year.

Whether these levels of approval can be sustained will depend on how economic gains translate into everyday improvements and how the government navigates emerging challenges. For now, however, the data points to a presidency that continues to enjoy broad public backing.

READ ALSO: Ghana’s Primary Target Crushes Debt Demons