Ghana’s banking sector is set for a major regulatory transformation from 2026, as the Bank of Ghana moves to fully adopt a forward-looking, risk-based supervision model.

The shift signals a decisive break from largely compliance driven oversight towards a system that places greater emphasis on risk identification, governance quality, and the sustainability of credit growth. According to the Governor, Dr Johnson Asiama, the new approach is designed to strengthen financial stability while creating room for responsible expansion of lending across the economy.

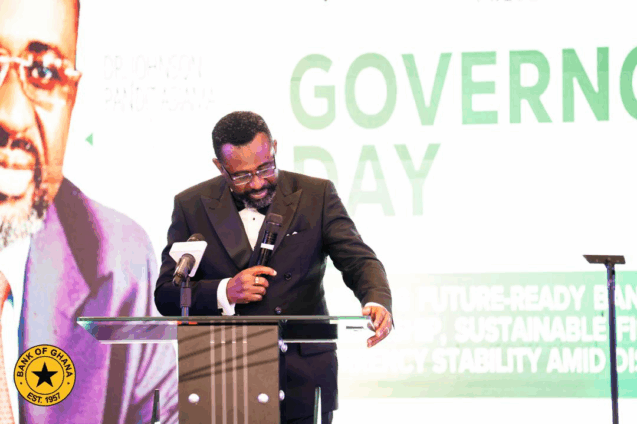

Speaking at the Governor’s Day Programme organised by the Chartered Institute of Bankers, Dr Asiama explained that the reforms would allow supervisors to differentiate more precisely across banks. Institutions with strong governance, sound risk management frameworks, and robust capital positions will be better positioned to grow, while those with persistent weaknesses will face closer scrutiny.

Credit quality over credit growth

At the heart of the planned reforms is a shift in how credit expansion is assessed. While lending growth remains important for economic activity, the central bank is making it clear that quality will now take precedence over volume. “Credit growth will matter, but credit quality will matter more,” the Governor stressed, underlining concerns about underwriting standards, sectoral concentration, and weak risk pricing that have historically contributed to rising non-performing loans.

Under the risk-based supervision model, examiners will focus more sharply on cash-flow analysis, the sustainability of borrowers’ repayment capacity, and how banks price risk across different sectors. This approach is expected to discourage excessive exposure to high-risk segments and promote a healthier allocation of credit to productive areas of the economy.

Governance has emerged as a central theme in the Bank of Ghana’s reform agenda. Dr Asiama noted that expectations for boards and senior management will continue to rise, as governance is increasingly treated as a core pillar of financial stability rather than a box-ticking exercise. Boards will be required to demonstrate clearer oversight of risk appetite, stronger internal controls, and greater accountability for outcomes.

The Governor indicated that supervision will involve deeper engagement with bank leadership on strategic decisions and risk management practices. This includes how institutions respond to emerging risks, manage conflicts of interest, and ensure that management incentives are aligned with long-term stability rather than short-term profit.

From policy intent to daily practice

At the system level, the reforms are expected to move decisively from policy intent into routine supervisory practice. Dr Asiama warned that tolerance for repeated weaknesses will be lower going forward, even as regulatory engagement remains constructive. This signals a tougher stance on banks that fail to address identified deficiencies within agreed timelines.

By embedding risk-based supervision into day-to-day oversight, the central bank aims to create a more predictable and credible regulatory environment. Banks will have greater clarity on supervisory expectations, but they will also face firmer consequences if governance lapses or risk management failures persist.

Resetting the regulator bank relationship

Despite the tightening of supervision, the Governor emphasised that the Bank of Ghana is also investing in how it works with regulated institutions. The central bank plans to improve the clarity of regulatory guidance, streamline internal processes, and provide more predictable timelines for approvals and supervisory engagement.

This recalibration of the regulator bank relationship is intended to support compliance and reduce uncertainty, particularly for well-managed institutions. By combining stricter standards with clearer communication, the central bank hopes to foster a culture of cooperation that supports stability without stifling innovation or growth.

Beyond bank supervision, the reform agenda extends to financial markets and digital infrastructure. Dr Asiama said the focus in financial markets will shift from recovery to depth and diversification. This includes mobilising more long-term capital to support a broader range of issuers and instruments, as well as strengthening the link between savings and productive investment.

In parallel, payments and settlement systems, data standards, and digital infrastructure will remain strategic priorities. Faster settlement processes, richer transaction data, interoperable platforms, and stronger fraud controls are expected to define competitiveness and resilience in the financial sector. These improvements are seen as essential to supporting a modern banking system that can withstand shocks and meet the needs of a growing digital economy.

As Ghana looks ahead to 2026, the planned shift to risk-based supervision represents a defining moment for the banking industry. By placing risk, governance, and capital buffers at the centre of oversight, the Bank of Ghana is signalling its determination to build a more resilient and trustworthy financial system.

READ ALSO: Ghana Cocoa Board Missed the Cocoa Bonanza as Global Prices Hit Record Highs – Randy Abbey Laments