Constitution Review Committee (CRC) has proposed a landmark shift in Ghana’s extractive fiscal regime by recommending that a mandatory 3% of gross revenue from natural resource extraction be allocated directly to host communities.

Under this proposal, the “3% of gross revenue” would be ring-fenced to address the long-standing infrastructure deficits, human developmental needs, and the significant environmental challenges that frequently arise from extraction activities in these localities.

This recommendation signals a departure from the current centralized management of mineral wealth, aiming to ensure that the immediate victims of extraction become the primary beneficiaries of its proceeds.

“The Committee recommend that a percentage of gross revenue (not exceeding 3%) generated from natural resource extraction be granted to communities where the natural resources are exploited for infrastructural needs, human developmental needs as well as for dealing with environmental challenges that might arise from natural resource extraction.”

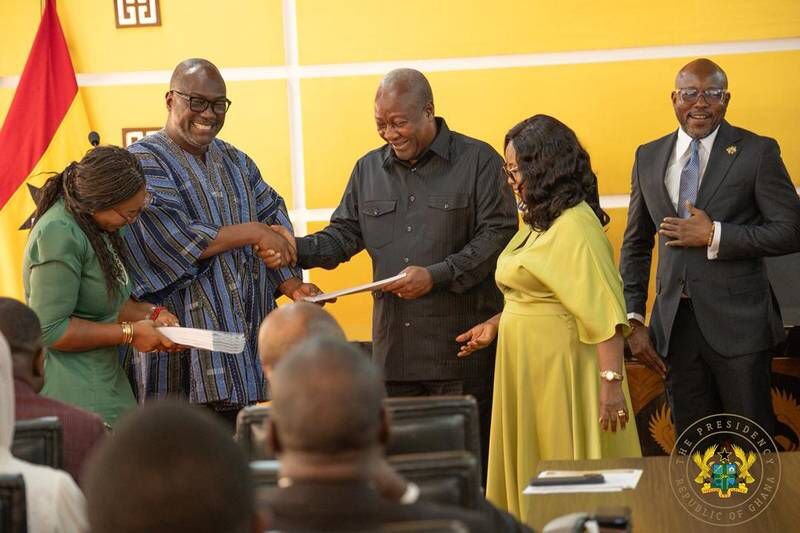

Constitution Review Committee Report

Expanding on this fiscal directive, the CRC suggests that the management of these funds be placed under a localized governance structure, specifically a Board of Trustees designed for maximum inclusivity.

This board would include representatives from the National Development Planning Commission, the relevant regulatory commission, and the local District Chief Executive, alongside a representative of the highest traditional authority in the district.

To ensure social equity, the CRC insists that the board must also feature representatives for the “youth, women and persons with disabilities,” thereby preventing the historical “capture of mineral royalties” by a narrow elite.

Addressing the Legacies of Local Marginalization

The push for a dedicated 3% revenue stream arrives at a time when the “deplorable state of mining communities” has become a flashpoint for civil unrest.

For decades, Ghana’s mineral revenue management has been marred by a perception of “abject neglect” in towns like Obuasi and Tarkwa, where residents live in poverty despite billions in gold exports.

The current system, which channels the majority of funds into the Consolidated Fund, has been criticized by experts who argue that “the mineral sector lacks a transparent framework for tracking revenue,” unlike the oil sector’s Petroleum Revenue Management Act.

This lack of transparency fueled a deep-seated “resentment between the government and local communities,” with many residents feeling that their lands are exploited while they bear only the “environmental costs of land acquisition and water pollution.”

By mandating a fixed percentage of gross revenue, rather than relying on the fluctuating and often delayed disbursements of the Minerals Development Fund (MDF), the CRC’s proposal offers a more predictable and substantial financial baseline for local growth.

It directly addresses the “imbalances between mining companies and host communities” by making local development a statutory requirement rather than an act of corporate charity.

Structural Reforms to Combat Revenue Mismanagement

Central to the CRC’s recommendation is the creation of a diverse Board of Trustees, which serves as a remedy for the “misuse of mineral royalties” frequently reported at the district assembly level.

Research has shown that in many instances, mining royalties are diverted by local authorities toward “recurrent expenditures like funeral donations and office painting” rather than critical infrastructure.

The inclusive nature of the proposed board specifically the inclusion of the youth and persons with disabilities is a strategic move to ensure that the “utilization of mineral royalties” aligns with the actual needs of the vulnerable.

By including the National Development Planning Commission and traditional authorities on the same board, the Constitution Review Committee (CRC) seeks to harmonize national development goals with local cultural sensitivities.

This structural reform is intended to bridge the “communication gap between the state and host communities,” which has historically led to projects that do not reflect the people’s priorities. The recommendation that Parliament be “obliged to enact detailed provisions” ensures that these guidelines are not merely aspirational but carry the full weight of the law, providing a clear “road map for accountability” in the extractive sector.

Transitioning from Conflict to Sustainable Development

If adopted, this 3% allocation could be the catalyst for resolving the “agitations and protests” that have characterized the relationship between mining towns and the state.

Currently, many communities view mining as a “bad deal,” where surface rights are ignored and “livelihoods are destroyed without adequate compensation.”

The CRC’s focus on “dealing with environmental challenges” within the fund’s mandate acknowledges the reality of mercury poisoning and land degradation that the state has struggled to mitigate.

Experts believe that this new fiscal arrangement will empower communities to build “independent local economies” that can survive long after the mines have closed. By shifting the focus from “fiscal returns for the government” to tangible “human developmental needs,” the CRC proposal offers a path toward a more “ethical and inclusive mining industry.”

This recommendation essentially asks the state to honor the “constitutional trust” it holds on behalf of the people, ensuring that the wealth beneath the soil finally translates into prosperity for those living above it.

READ MORE: Risk, Governance, Capital Buffers Take Centre Stage In Sweeping Banking Reforms From 2026