Dr. Peter Terkper, a Financial Economist and Policy Analyst, has raised alarm over the lack of transparency within the Domestic Gold Purchase Programme (DGPP), arguing that institutional secrecy is masking significant fiscal losses.

He contends that while the policy was designed to bolster the economy, the absence of clear structural disclosure has prevented the public from understanding the magnitude of the “accrued losses” until external bodies like the International Monetary Fund (IMF) intervened.

This “transparency gap” is particularly concerning as it mirrors the fiscal challenges faced by other state entities like the Cocoa Board, where hidden liabilities eventually became a national burden.

“It would have been better if Gold Board itself came out to tell us what was happening than allowing IMF to come out before we start to explain. You are having a very fantastic policy, but because you’ve not been transparent, people will think that something has been given if such information come out. The structure that Gold Board is currently having will continue to incur these losses if we don’t reform the entire system.”

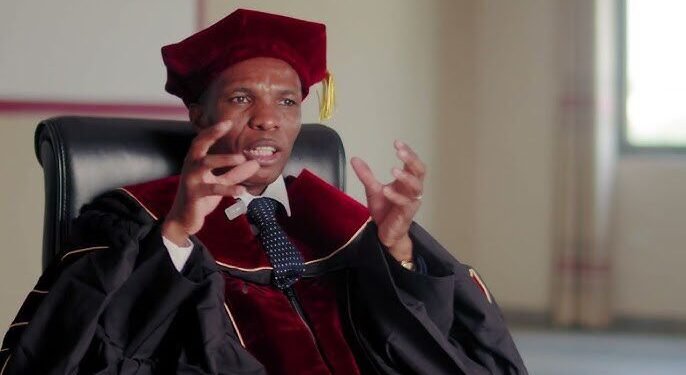

Dr. Peter Terkper

The policy analyst expanded on this by noting that the current “Gold Board” (GoldBod) structure is inherently susceptible to “forex losses” because of the disconnect between local purchasing and international dollar pricing.

Since gold is an internationally priced commodity, the state creates an immediate “exchange problem” when it buys gold from local miners in Cedis but effectively trades in a dollar-denominated market.

Dr. Terkper emphasized that no government deliberately seeks to “destroy the fiscal aspects of the economy,” yet the failure of public institutions to self-report these challenges suggest a systemic “clash between policy intent and operational reality” that requires urgent reform.

Institutional Opacity and Economic Efficiency

Poor transparency in the extractive sector does not merely hide numbers; it actively degrades the efficiency of strategic initiatives.

When the “structure of the policy” remains a mystery to the public, it becomes impossible to conduct the “medium to long term” analysis required to prevent operational losses from becoming permanent liabilities.

In the extractive space, efficiency is tied to market confidence and fiscal discipline; however, when “somebody has to always prompt us” via external reports, it signals to investors and citizens alike that the internal mechanisms for accountability are broken.

This lack of clarity forces the economy to absorb “forex risks” without a clear strategy for mitigation, hollowing out the very fiscal gains the DGPP was meant to provide.

The Forex Trap and Market Misalignment

A critical failure identified in the current system is the “currency issue” arising from the state’s role as a middleman in the gold trade.

Dr. Terkper points out that just as businessmen adjust prices to “minimise the forex losses” when the Cedi depreciates, the state must navigate the same “exchange issues” when importing fuel or building reserves through gold.

By buying a dollar-indexed commodity in local currency and then selling it or using it to back imports, the government creates a “forex exchange risk” that is currently not being transparently managed.

Without a “reform of the entire system,” the state continues to act as a buffer for currency volatility, often at a massive, unrecorded cost to the taxpayer.

Path Toward Fiscal Transparency and Reform

To move forward, the extractive sector requires a shift toward proactive disclosure where institutions like GoldBod lead the conversation on their financial health.

The analyst warns that if the “politicians are making analysis” based on tilted conversations rather than raw, transparent data, the country risks repeating the same fiscal mistakes seen in the past.

Real transparency involves letting the public know “how the structure is” before a crisis hits, ensuring that policies are not just “fantastic” on paper but sustainable in practice.

Reforming the system involves aligning the DGPP with international best practices and ensuring that every ounce of gold acquired serves as a true asset rather than a “hidden liability” on the national balance sheet.

READ ALSO: Ghana’s Economy Stalls in Traffic Gridlock