Financial economist and policy analyst, Dr. Peter Terkper, has raised a red flag over the Ghana Gold Board’s (GoldBod) direct involvement in the Domestic Gold Purchase Programme (DGPP) transactions.

He argued that the recent “sharply and deadly” spike in gold prices creates a volatile environment where the state’s regulatory body should not be a primary player.

By acting as a participant in the trade, GoldBod exposes the national treasury to massive valuation risks and operational deficits that it is fundamentally unequipped to manage.

Dr. Terkper maintains that the board must pivot back to its core mandate as a supervisor to insulate the public purse from the “quasi-fiscal losses” that have recently drawn the scrutiny of the International Monetary Fund (IMF).

“So what Gold Board must do in order to prevent these losses is that Gold Board must play the role as a regulator and not part of the transaction. Regulator means that let those who are in the space operate just like they’re operating in the past. At the end of the day, you still receive your fees.”

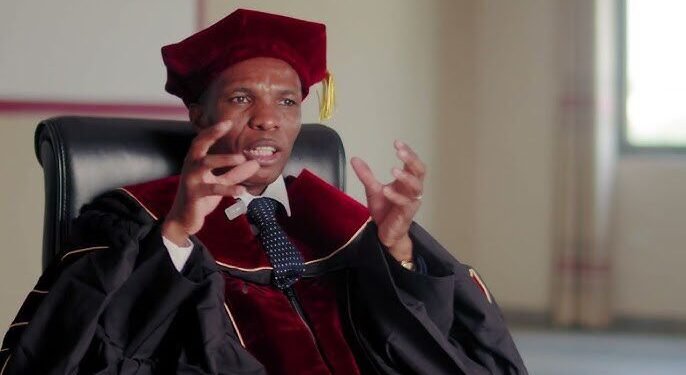

Dr. Peter Terkper

The danger of GoldBod remaining in the transaction chain is rooted in the “expertise” gap and the historical precedent of hidden state liabilities.

Dr. Terkper highlighted that when the state becomes a trader, it assumes commodity risks that should ideally be borne by the private sector.

He draws a parallel to previous economic crises where energy and cocoa debts were treated as “footnote items” until the IMF mandated their inclusion on the national balance sheet, pushing Ghana’s debt-to-GDP ratio above 100%.

To avoid a repeat of this fiscal overextension, GoldBod must allow “licensed buyers” to operate the trade while it focuses on an “e-regulatory” role. This ensures the state collects its guaranteed fees without the “expertise” burden or the financial liability of market-driven price fluctuations.

Mitigating Risk Through Structural Separation

For the extractive industry to remain sustainable, the separation between the “referee” and the “player” must be absolute.

Dr. Terkper notes that the current structure where GoldBod is involved in the actual purchase and sale of gold compromises its ability to monitor the industry effectively.

When the regulator is also a competitor, the focus on “supervisory and monitoring” tasks is often diluted by the complexities of high-stakes commodity trading.

By stepping out of the transaction loop, GoldBod can more effectively “close the gap” on smuggling.

This is achieved not through state-led buying, but through rigorous oversight of the “licensed buyers” who possess the market expertise to navigate the global gold price surge.

Aligning with IMF Transparency Standards

The IMF’s insistence on bringing these losses into the “balance sheet of the budget” underscores the gravity of the current situation.

Dr. Terkper explained that “at the end of the day, it’s part of the state,” and hiding these costs only delays an inevitable fiscal correction.

Moving away from direct trading allows GoldBod to function as a lean, efficient “supervisory” entity.

This transition ensures that “all these losses will not be on you,” as the board would no longer be responsible for the “transactional” shortfall.

Instead, the board would oversee the flow of gold through the formal system, ensuring that the state benefits from revenue through traditional regulatory channels rather than speculative trading margins.

Strengthening the E-Regulatory Framework

The future of Ghana’s gold sector depends on a robust “e-regulatory” and supervisory role that empowers licensed private actors while maintaining state control.

Dr. Terkper emphasizes that the board’s expertise lies in policy and monitoring, not in the “expertise” of daily market transactions.

By focusing on its role as a regulator, GoldBod can ensure that “those who have the license to operate” do so under strict compliance.

This shift would make the board “more effective,” allowing it to dedicate its resources to modernizing the “supervisory role” that protects the nation’s mineral wealth.

Ultimately, removing GoldBod from the DGPP transaction chain is the most viable path to securing long-term benefits and avoiding the “deathly” fiscal traps of commodity volatility.

READ ALSO: Otokunor Secures Pennsylvania Deals for Agricultural Reset