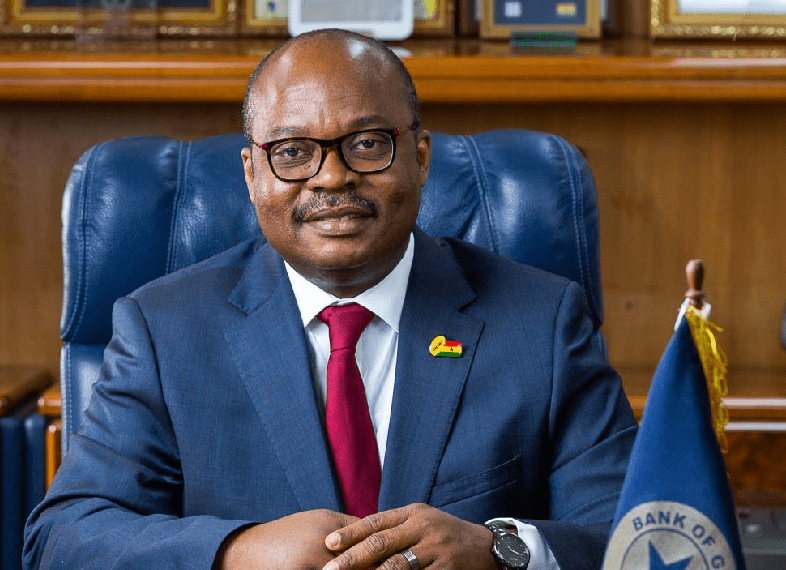

The Governor of the Bank of Ghana (BoG), Dr. Ernest Yedu Addison has encouraged banks to patronise repurchase agreement (repo) under the newly introduced Global Master Repurchase Agreement (GMRA) considering the risk implications of collateral lending.

Giving some insights into the reason for the adoption of the new system, Dr. Ernest Yedu Addison has intimated that “the Bank of Ghana recognises the key role that financial markets play in the effective transmission of monetary policy. Therefore, in the three-and-a-half years, the Bank has championed reforms in the repo markets resulting in the adoption and implementation of a Global [Master]sic Repurchase Agreement (GMRA) effective October 1, 2020

“These reforms have led to the most improvement in Ghana’s ranking in the ABSA Africa Financial Markets Index, climbing five places on the pillar for the ‘Legality and enforceability of standard financial markets master agreements’ in a single year,” Dr. Addison pronounced.

The Bank of Ghana Governor, however, whined that data at the Central Securities Depository (CSD) indicates that “repo activity under the GMRA is yet to pick up and banks continue to use collateral lending rather than repo under GMRA transactions”.

According to BoG’s guidelines for repos in Ghana, “the GMRA shall provide the general framework under which repos are transacted in Ghana. The parties to a repo transaction must sign the GMRA.

“In the case of banks and SDIs, this is a regulatory requirement in order to recognize the reduction of credit risk by collateral in the calculation of regulatory capital requirements. The agreement shall be subject to the laws of England”.

“The reforms in the financial markets are yielding the expected benefits to the securities market, with increased levels of bond settlements and transactions on the secondary market,” Dr. Addison enunciated adding that secondary bond market transactions which were settled through the banks on the Central Securities Depository (CSD) platform increased significantly.

Dr. Ernest Addison further asserted that by the end of October 2020, these secondary bond market transactions surged substantially to settle at GH¢86.2 billion from GH¢55.7 billion recorded in October 2019, representing a 54.7 percent growth year-on-year over the bond market transactions settled for last year.

“In addition, the reforms have broadly eliminated settlement delays and reduced its attendant systemic risks,” he said.

Dr. Addison has also cautioned that “going forward, the financial sector will require constant regulatory and policy attention to mitigate the risks. The economic impact of the pandemic may result in higher non-performing loans and some capital erosion of banks

He went on to assure Ghanaians that “The Bank of Ghana is putting greater focus on identifying the early warning signals and initiating prompt corrective action.

“Looking ahead, the Bank of Ghana will continue to strengthen all the regulatory measures implemented over the last three and half years to maintain confidence and safeguard financial stability.

“In the aftermath of the pandemic, (2021, 2022 or 2023) we would have to follow a careful unwinding of countercyclical measures that we have implemented and allow the financial system to function without the regulatory forbearance that we have put into place.

“Banks will have to be vigilant and upgrade their capabilities, improve governance and risk culture and we are optimistic that with this approach, we will build a robust, resilient and capable financial sector to support Ghana’s beyond Aid Agenda,” Dr. Addison concluded.