Letshego Ghana Savings and Loans PLC, a subsidiary of the regional inclusive finance group Letshego Africa, is set to make a significant stride in its financial journey with the launch of its GHS 500 million domestic medium-term note program by targeting GHS 100 million in first tranche of bond issuance this week.

This strategic move underscores Letshego’s unwavering commitment to economic development and financial inclusivity in Ghana. The initiative, which marks a historic milestone for Letshego, is meticulously crafted to offer a wide array of notes tailored to suit the dynamic investment landscape while adhering to Ghana’s regulatory standards. It reflects Letshego’s forward-thinking ethos, reaffirming its pivotal role in shaping the economic future of Ghana.

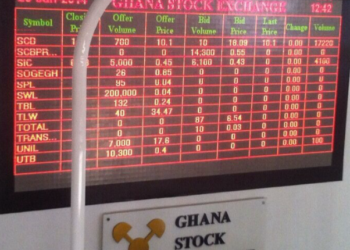

In a bid to deepen market activities, Letshego is gearing up to issue the first tranche of GHS 100 million, as revealed by the company’s Chief Executive Officer, Nii Amankra Tetteh. This initial step forms part of a broader strategy to fortify the Ghana Fixed Income Market (GFIM) of the Ghana Stock Exchange (GSE), following the successful expansion of the program from GHS 300 million to GHS 500 million.

“The funds raised from this bond issuance are earmarked to significantly bolster Letshego’s lending offerings, thereby providing vital financial support to individuals and enterprises across the nation,” remarked Mr. Tetteh. He emphasized that the anticipated enhancement of credit availability at competitive rates is poised to empower businesses and contribute to broader economic growth.

A Move To Tap Into The Bond Market

Letshego Ghana’s move to tap into the bond market not only signifies its commitment to meeting the evolving financial needs of Ghanaians but also highlights its confidence in the local economy’s resilience and growth potential.

By fostering increased access to credit and injecting liquidity into the market, Letshego is not only driving its own expansion but also playing a crucial role in catalyzing sustainable development across various sectors.

Moreover, the bond issuance is expected to attract a diverse pool of investors, including institutional investors, asset managers, and individual investors, thereby fostering broader participation in the country’s capital markets. This, in turn, is likely to deepen the market and enhance its efficiency, ultimately benefiting both investors and the economy at large.

Prospective investors are urged to consult their financial advisors for a comprehensive understanding of the program’s scope and potential, as detailed in the Prospectus. This document serves as a testament to Letshego’s steadfast commitment to financial excellence and its dedication to fostering a prosperous economic environment.

Letshego Ghana Savings and Loans PLC extends a warm invitation to investors to participate in this promising venture. More than just an investment opportunity, it represents a partnership aimed at catalyzing socio-economic progress and strengthening financial stability in Ghana.

Investors can find further information and details in the Prospectus, which will provide insights into the opportunities presented by Letshego’s bond initiative and its broader impact on the financial landscape of Ghana. Let’s embark on this journey together towards a brighter and more inclusive economic future for all.

Belief in Collaborative Growth

Letshego Ghana’s invitation to investors underscores its belief in collaborative growth and its recognition of the vital role played by diverse stakeholders in driving sustainable development. By joining forces with investors, Letshego seeks to not only expand its financial footprint but also create tangible benefits for communities and businesses across Ghana.

The bond Issuance represents more than just a financial transaction; it symbolizes Letshego’s commitment to making a meaningful difference in people’s lives. Through responsible lending practices and strategic investment initiatives, Letshego aims to empower individuals, entrepreneurs, and enterprises to reach their full potential, ultimately contributing to the socio-economic advancement of the nation.

As investors consider the opportunity presented by Letshego’s bond program, they are encouraged to delve into the Prospectus, which will provide a comprehensive overview of the company’s vision, strategy, and the potential impact of their investment. Letshego remains steadfast in its dedication to transparency, integrity, and delivering value to its stakeholders.

In embracing this venture, investors are not only aligning themselves with a reputable financial institution but also becoming catalysts for positive change. Letshego Ghana looks forward to forging lasting partnerships with investors who share its vision of building a more inclusive and prosperous future for Ghana.

As Letshego Ghana embarks on this forward-thinking endeavor, it highlights the importance of collaboration between financial institutions, regulators, and market participants in driving economic growth and fostering financial inclusion.

By leveraging its expertise and resources, Letshego is poised to make a meaningful impact on Ghana’s financial landscape, empowering individuals and businesses alike to thrive in an increasingly dynamic and competitive environment.

This comes on the back of a similar note issued by Kasapreko Plc, a leading indigenous company in Ghana. Kasapreko made waves in the financial market with the successful listing of its GHS 600 million note on the Fixed Income Market of the Ghana Stock Exchange (GSE).

The listing of Kasapreko Plc’s GHS 600 million note on the Ghana Stock Exchange (GSE) Fixed Income Market has not only captured the attention of investors but has also been hailed as a significant milestone for the Ghanaian capital market.

The Tranche 1 and Tranche 2 listing, totaling GHS 150 million, has garnered remarkable attention from investors, resulting in a 100% subscription rate.

READ ALSO: DBG and Partners to Invest GH¢1 Billion in Women-Led Businesses