Russia’s invasion of Ukraine has led to significant economic repercussions and sparked a series of retaliatory measures from Western countries.

The freezing of Russian assets abroad, including in the U.S., has been one such response, aimed at pressuring Russia to change its behavior towards Ukraine.

In quest to hold Russia accountable for its actions in Ukraine, the situation has morphed into a potential economic standoff with far-reaching consequences.

Putin’s decree allowing Russia to claim U.S. assets in retaliation for any Russian assets seized in the U.S. is a concerning escalation in international tensions.

While retaliation may seem like a straightforward response, it risks further destabilizing already fragile relations between Russia and the West.

Resorting to tit-for-tat measures only serves to deepen the economic and diplomatic rift between Russia and the West. It sets a dangerous precedent for further escalation and undermines efforts to find peaceful resolutions to conflicts.

Moreover, targeting U.S. assets in Russia could have far-reaching implications, not only for bilateral relations but also for global economic stability.

It risks prompting a cycle of retaliation and counter-retaliation, ultimately harming innocent civilians and businesses caught in the crossfire.

According to economists, Russia’s ability to mete out like-for-like retaliation if Western leaders seize its frozen assets has been eroded by dwindling foreign investment, but it may go after private investors’ cash instead.

Former Russian leader, Dmitry Medvedev acknowledged last month that Russia holds an insignificant amount of American state property and that any response Russia makes would be asymmetrical, focusing on private individuals’ assets.

By allowing Russian entities to claim U.S. assets in retaliation, Putin is effectively legitimizing the seizure of private property as a tool of state policy.

This not only undermines the rule of law but also sets a dangerous precedent for future conflicts, where individuals and businesses become pawns in geopolitical disputes.

Moreover, Putin’s decision to target U.S. assets in response to sanctions imposed over Russia’s invasion of Ukraine highlights the interconnected nature of global finance.

In an increasingly interconnected world, actions taken by one country can have ripple effects that reverberate across borders.

As such, the cycle of revenge initiated by Putin’s decree has the potential to disrupt not only U.S.-Russian relations but also the broader global economy.

Additionally, the threat of retaliation against the European Union for its plan to utilize income from frozen Russian assets to aid Ukraine adds another layer of complexity to the situation.

Russian Foreign Ministry Spokesperson, Maria Zakharova’s warning of the EU facing the “full measure” of Russian retaliation underscores the high stakes involved and the potential for further escalation.

What makes this cycle of revenge particularly concerning is its potential to spiral out of control.

As each side retaliates against the other, the risk of unintended escalation grows exponentially.

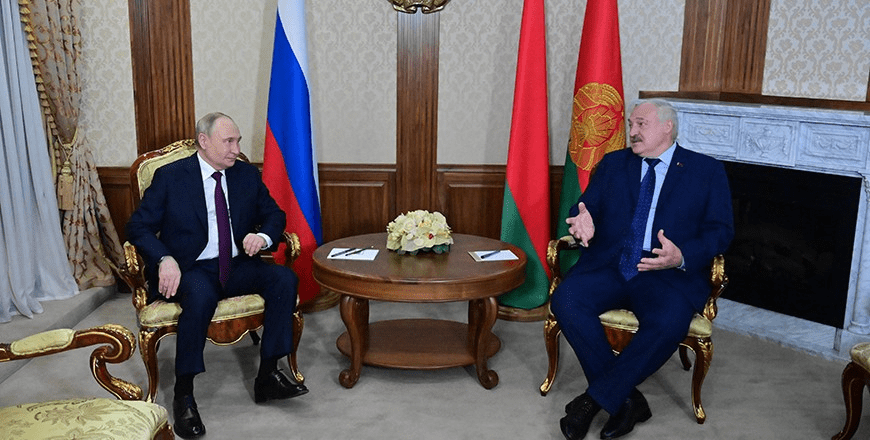

Putin Visits Staunch Ally

President of Russia, Vladimir Putin is currently in Belarus on an official visit.

He and President of Belarus, Alexander Lukashenko will first of all discuss security matters while economic affairs will be discussed together with members of the governments.

Taking into account Vladimir Putin’s recent visit to China, Lukashenko mentioned plans to discuss relations in the context of interaction with the People’s Republic of China.

“I think Xi Jinping will be glad that we discuss these matters. I have very interesting proposals concerning our region and further on, concerning the Caucasian region. We discussed it very seriously during the visit to Azerbaijan,” the Belarusian leader said.

Putin also confirmed the intention to discuss the exercise meant to practice the application of non-strategic nuclear weapons with Lukashenko.

READ ALSO: MFC Calls Out Government On Adorye’s Arrest, Cries Witch-Hunt