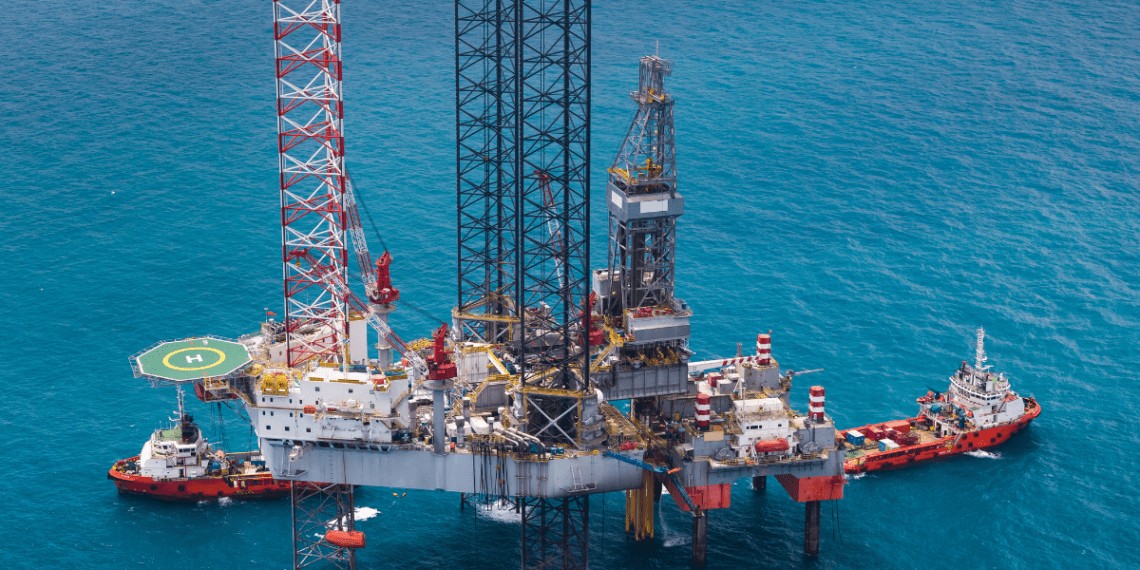

Ghana’s discovery of oil reserves in 2007 marked a significant turning point in the country’s economic trajectory. However, nearly two decades later, concerns persist about how these valuable resources are being managed and utilized.

The journey with petroleum revenues has been marked by significant milestones and ongoing challenges. The Public Interest and Accountability Committee (PIAC), established to oversee the management of these resources, has just released its 2024 Semi-Annual Report.

The report, signed by Constantine K.M. Kudzedzi, PIAC’s Chair highlighted key findings and policy recommendations aimed at optimizing the use of Ghana’s petroleum revenues.

A standout finding from the report is the 10.7% increase in crude oil production in the first half of 2024 compared to a 13.2% decline during the same period in 2023. This positive trend, PIAC noted, was largely driven by the Jubilee South East (JSE) Project.

Consequently, PIAC revealed that “The total petroleum receipts for the period increased by 55.6 percent from US$540,456,124.27 in H1 2023 to US$840,765,265.80 in H1 2024 mainly due to increased production for the period.”

Despite the increased revenue, the report highlighted a recurring issue with outstanding surface rental arrears. Surface rental fees, payments required by oil companies for the right to operate in Ghana’s oil blocks, remain unpaid, totaling $1,212,335.53.

This figure according to PIAC, excludes “that of the terminated Petroleum Agreements (PAs),” a gap that has raised concerns about the Ghana Revenue Authority’s (GRA) ability to recover these funds in line with Regulation 5(1)(b) of L.I. 2381.

Another major concern PIAC raised is the retention of a $100 million cap on the Ghana Stabilisation Fund (GSF) for 2024, a decision that contradicts the Petroleum Revenue Management Regulations, 2019 (L.I. 2381).

“A proper application of the capping formula under L.I 2381 would have returned an amount of US$530.10 million in the reporting period.”

Public Interest and Accountability Committee 2024 Semi-Annual Report

This deviation, PIAC argued, undermines the fund’s purpose as a financial buffer during periods of economic instability.

Observations on Institutional and Regulatory Gaps

Beyond revenue figures, PIAC’s report highlighted issues surrounding institutional compliance with PRMA regulations. Notably, “the GNPC has not established the reserve fund, as required by Section 18 of PNDCL 64.”

This reserve fund would provide a financial buffer to support GNPC’s long-term operational plans. PIAC noted that without this fund, GNPC may face budgetary constraints, especially since PRMA allocations for GNPC’s expenditures may be discontinued by 2026.

“Although the Discounted Industrial Development Tariff (DIDT) was suspended by the Ministry of Energy in January 2023, the GNGLC continued to invoice lean gas volumes at discounted tariffs.”

Public Interest and Accountability Committee 2024 Semi-Annual Report

For the period under review, PIAC noted that no new Petroleum Agreements were signed, a continuation of a trend since 2018.

PIAC further revealed that compared to the first half of 2023, drilling activities in the Jubilee field declined, an issue that may affect future production potential and revenue generation.

PIAC’s Recommendations for Policy and Regulatory Action

In light of these findings and observations, PIAC has put forth several recommendations aimed at addressing compliance issues and ensuring responsible petroleum revenue management.

PIAC urged the Ghana Revenue Authority (GRA) to take immediate action in recovering outstanding surface rentals. It also recommended that surface rentals be collected by February 28 each year, as specified in Regulation 5(1)(b) of L.I. 2381.

“The Committee recommends that GNGLC complies with the directive of the Ministry of Energy to suspend the implementation of the DIDT.”

Public Interest and Accountability Committee 2024 Semi-Annual Report

PIAC called on the Ministry of Finance to prioritize allocations to the Industrialisation Priority Area through consistent disbursement of the Annual Budget Funding Amount (ABFA). This move is seen as essential for supporting Ghana’s industrialization goals.

Again, PIAC advised Parliament to decline or review any cap on the Ghana Stabilisation Fund that does not align with the statutory provisions.

Furthermore, it recommended that the Minister of Finance adhere to Regulation 8 of L.I. 2381 to ensure appropriate GSF contributions.

Since its inception, PIAC has been responsible for monitoring and ensuring accountability in the management of Ghana’s petroleum revenues. With this latest report, the Committee has now published 26 statutory reports.

Each report seeks to inform Ghanaian citizens and stakeholders on how the country’s petroleum funds are managed, thereby fostering transparency and contributing to policy discourse.

The 2024 Semi-Annual Report specifically addresses the allocation and utilization of petroleum funds and reviews the performance of government agencies charged with upholding the PRMA. While Ghana’s petroleum industry continues to show promise, the management of our oil revenues remains a work in progress.

It is crucial that all stakeholders – government agencies, parliamentarians, civil society organizations, and citizens alike – remain committed to transparency, accountability, and alignment with national development priorities. Only through collective effort can Ghana harness the full potential of its petroleum resources to drive inclusive economic growth and improve living standards across the country.

READ ALSO: Speaker Bagbin Lauded over Defense against Judicial and Executive “Overreach”