Dr. Steve Manteaw, Co-Chair of the Ghana Extractive Industries Transparency Initiative (GHEITI), has warned that prolonged delays in parliamentary ratification of Atlantic Lithium’s Ewoyaa mining lease could jeopardize the project’s viability and dent investor confidence in Ghana’s emerging critical minerals sector.

Responding to Atlantic Lithium’s recent calls for fiscal concessions, Dr. Manteaw emphasized that legislative inertia could have damaging consequences in a global lithium market already facing downward price pressures.

“If we continue to delay the ratification of the Ewoyaa lease, the project viability will be thrown into jeopardy.

“Lithium prices are already under pressure as battery-makers explore alternative chemistries. Ghana cannot afford further hesitation.”

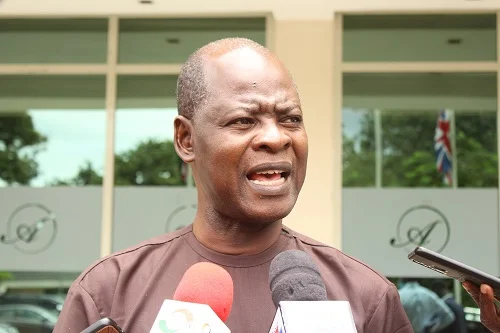

Dr. Steve Manteaw, Co-Chair of the Ghana Extractive Industries Transparency Initiative (GHEITI)

Dr. Manteaw warned that every month of legislative delay adds to development costs and erodes investor confidence.

“Capital markets move fast. If Ghana sends a message of legislative gridlock, Atlantic Lithium might redirect its capital to more stable jurisdictions.”

Dr. Steve Manteaw, Co-Chair of the Ghana Extractive Industries Transparency Initiative (GHEITI)

He also stressed that the implications extend beyond the Ewoyaa project itself. As Ghana seeks to position itself as a player in the global battery supply chain, swift action on pioneering projects like Ewoyaa is critical.

Dr. Manteaw explained, “A delay here could close the door on future downstream projects, like local refining or battery-component assembly.”

Atlantic Lithium Limited, a multi-listed exploration and development company, secured a mining lease for the Ewoyaa Lithium Project in October 2023.

The lease marked a milestone for Ghana, positioning it to become West Africa’s first hard-rock lithium producer. At the time, global lithium prices were soaring, driven by booming demand for electric vehicle (EV) batteries.

However, the global market dynamics have since shifted. Advances in sodium-ion battery technology and improved lithium recycling techniques have led to a sharp drop—over 20%—in lithium prices from their 2023 peaks.

Atlantic Lithium acknowledged this reality in its recent statement, noting that the changed market environment has made the early-stage economics of Ewoyaa more challenging, prompting discussions with the government for potential fiscal adjustments.

Balancing Lithium Revenue Needs and Investor Confidence

While Dr. Manteaw acknowledged the importance of ensuring Ghana secures a fair fiscal return from its mineral resources, he urged policymakers to strike a careful balance between revenue collection and maintaining an attractive investment environment.

“We need to support these early pioneers with predictable tax and royalty regimes.

“That doesn’t mean forgoing all revenue—it means structuring concessions so that both the state and investors benefit as the project matures.”

Dr. Steve Manteaw, Co-Chair of the Ghana Extractive Industries Transparency Initiative (GHEITI)

Atlantic Lithium’s Executive Chairman, Neil Herbert, echoed this sentiment, emphasizing the need for a collaborative approach.

“Through collaboration and prudent fiscal measures, we can advance Ewoyaa to production and deliver lasting value for all stakeholders.”

Dr. Steve Manteaw, Co-Chair of the Ghana Extractive Industries Transparency Initiative (GHEITI)

Yet, Dr. Manteaw stressed that time is of the essence, noting that policy delays risk damaging Ghana’s credibility among global investors in the rapidly evolving critical minerals space.

Dr. Manteaw urged lawmakers to prioritize the ratification of the Ewoyaa lease during the current legislative session.

“A clear, timely decision will safeguard the project, preserve Ghana’s reputation, and help anchor the country’s entry into the global battery supply chain.”

Dr. Steve Manteaw, Co-Chair of the Ghana Extractive Industries Transparency Initiative (GHEITI)

The stakes are high, and the clock is ticking. As Ghana navigates the complexities of resource governance, the Ewoyaa project serves as a litmus test for the country’s ability to balance state interests with investor confidence.

With the right policies and partnerships, Ghana has the potential to unlock significant economic value and position itself as a leader in the critical-minerals sector. However, achieving this vision will require swift, transparent, and collaborative decision-making.

READ ALSO: Mahama Promises Revamp of Tema Oil Refinery Through PPP