Ghana has experienced an unprecedented rise in demand for petroleum products during the fourth quarter of 2024, defying significant economic hurdles, including the persistent challenge of securing foreign exchange for importing these critical commodities.

Despite these difficulties, the petroleum sector has demonstrated remarkable resilience, bolstered by strategic interventions from the Bank of Ghana (BoG) and the efforts of Bulk Oil Distributors (BDCs).

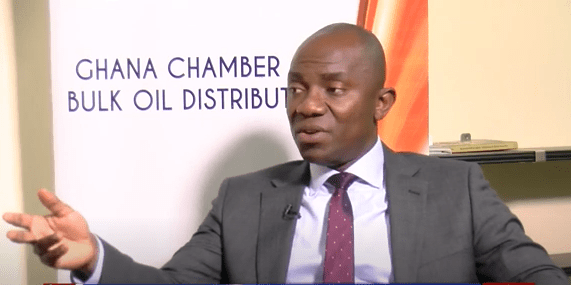

Dr. Patrick Kwaku Ofori, CEO of the Ghana Chamber of Bulk Oil Distributors (CBOD), recently shared insights into the sector’s performance and the critical measures that ensured stability.

“If you compare the first three quarters of this year with that of the previous year, you can clearly see that demand for petroleum products has gone up by 30% despite the challenges we face with forex availability to procure products.”

Dr. Patrick Kwaku Ofori, CEO of GCBOD

The 30% increase in petroleum demand during 2024’s fourth quarter represents a significant leap for a country grappling with forex shortages, which have strained the importation of essential goods.

According to Dr. Ofori, this growth is indicative of both increased economic activity and the resilience of Ghana’s oil distribution network.

The rise in demand can be attributed to factors such as increased industrial and transportation activity, as well as the gradual recovery of Ghana’s economy from the lingering effects of the COVID-19 pandemic and global inflationary pressures.

This demand surge has underscored the importance of a robust petroleum supply chain and the need for reliable forex access to sustain imports.

Key to the sector’s ability to meet this heightened demand was the timely intervention of the Bank of Ghana, according to Dr. Ofori.

“In the last quarter, we saw the intervention from the Bank of Ghana.

“They stepped in, in addition to the normal BDC auction, by providing additional forex through commercial banks for the sector.”

Dr. Patrick Kwaku Ofori, CEO of GCBOD

Dr. Ofori noted that this proactive approach by the BoG was instrumental in reassuring international oil traders of Ghana’s credibility as a trading partner.

The interventions were particularly critical in October 2024, when market uncertainty over the availability of foreign exchange threatened to disrupt the importation of petroleum products.

The BoG’s actions stabilized the Ghanaian cedi and boosted confidence among traders and suppliers.

“Credit to the Governor and his team for stepping in.

“When there’s a struggle for dollars, and international traders are uncertain whether they’ll get paid in USD, it can disrupt supply. The BoG’s support reassured our partners and kept the nation afloat.”

Dr. Patrick Kwaku Ofori, CEO of GCBOD

Resilience of Bulk Oil Distributors

While acknowledging the central bank’s efforts, Dr. Ofori highlighted the pivotal role played by Ghana’s Bulk Oil Distributors in navigating the forex scarcity.

The BDCs, he stated, demonstrated their resilience and capacity to sustain the nation’s petroleum supply even in the absence of consistent government intervention.

“The BDCs stepped in and carried the country through tough times,” he said. “This isn’t something new for them, but it shows their capacity to protect the space irrespective of government intervention.”

According to Dr. Ofori, this resilience underscores the need for government policies that create an enabling environment for the private sector to thrive, rather than direct state involvement in the oil distribution network.

Despite the progress made, Dr. Ofori remarked,“There has been a bit of policy inconsistencies, which we’ll need to address going forward.”

These inconsistencies include variations in import duties, pricing regulations, and unclear directives that can create uncertainty within the industry. Stakeholders have repeatedly called for streamlined and predictable policies to foster confidence among investors and traders.

Looking ahead, Dr. Ofori urged the government and other stakeholders to maintain their support for the sector. He emphasized that the focus should be on fostering a business-friendly environment that encourages free trade and smooth operations.

“If the government intervenes, it should be to drive business and allow for the free flow of products without the need for state entities,” he added.

To ensure continued stability and growth, Dr. Ofori stressed the need for collaboration between the government, the BoG, and the private sector.

He also called for sustained efforts to address forex shortages, improve policy consistency, and enhance infrastructure for petroleum storage and distribution.

Ghana’s petroleum sector has weathered significant challenges in 2024, emerging stronger despite forex scarcity and economic headwinds.

The demand surge in the fourth quarter reflects both increased activity within the economy and the sector’s resilience.

READ ALSO: Mahama Defends the Establishment of Preparatory Anti-Corruption Team