Ghana is facing one of its worst economic setbacks in recent history as cocoa export earnings plummet to $1.7 billion in 2024—the lowest in 15 years.

This sharp decline represents a staggering 25.4% drop from the previous year, raising concerns about the nation’s economic stability and the future of its cocoa sector.

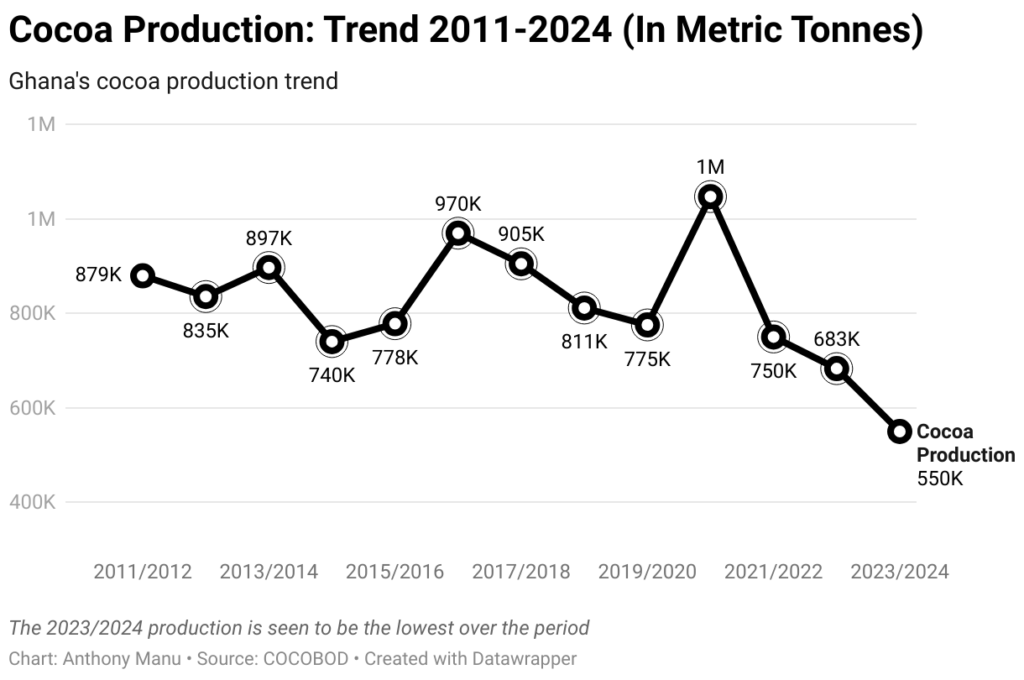

An analysis of data from the Bank of Ghana reveals that the downturn is primarily due to a significant reduction in cocoa production. In just three years, Ghana’s cocoa output has dwindled from over one million metric tonnes in 2021 to slightly above 500,000 tonnes in 2024. This drastic fall has been attributed to a combination of factors, including illegal mining activities (galamsey), smuggling, crop diseases, and unfavorable weather conditions.

Illegal mining, commonly referred to as galamsey, has severely affected cocoa-growing areas by degrading fertile lands and contaminating water sources with toxic chemicals. Many farmers, enticed by the quick financial gains of selling or leasing their lands to illegal miners, have abandoned cocoa cultivation altogether. As a result, vast stretches of cocoa farmland have been lost, leading to a significant drop in production.

Smuggling has also contributed to Ghana’s cocoa crisis. With neighboring Côte d’Ivoire and Togo offering better prices for cocoa beans, many farmers and middlemen are tempted to smuggle their produce across borders for higher profits. This has further reduced the official volume of cocoa available for export, depriving the government of crucial foreign exchange earnings.

Crop Diseases and Climate Challenges

The cocoa sector has also been plagued by devastating crop diseases, including the Cocoa Swollen Shoot Virus Disease (CSSVD), which has wiped out thousands of hectares of cocoa farms. Farmers struggling with declining yields have received little support in combating these diseases, making it difficult to sustain production levels.

Climate change has exacerbated the problem, with unpredictable rainfall patterns and prolonged dry seasons affecting the quality and quantity of cocoa yields. Rising temperatures and shifting weather conditions have made cocoa farming more challenging, reducing Ghana’s competitiveness in the global cocoa market.

Missing Out on Record-High Cocoa Prices

Despite Ghana and Côte d’Ivoire jointly producing over 60% of the world’s cocoa, both countries have struggled to reap the benefits of the recent surge in global cocoa prices. In 2024, cocoa prices soared by an unprecedented 157%, yet Ghana’s earnings have hit a record low.

This paradox is largely due to forward sales agreements, where Ghana’s cocoa is sold in advance at fixed prices. While this approach helps the government secure financing ahead of time, it prevents the country from benefiting from unexpected price hikes in the global market. As a result, Ghana has been unable to capitalize on the rising demand for cocoa, further worsening its economic challenges.

The drop in cocoa export earnings has dire consequences for Ghana’s already fragile economy. Cocoa is a key contributor to the country’s foreign exchange reserves, and its decline is expected to exert additional pressure on the Ghanaian cedi. With reduced forex inflows, the country may struggle to meet its import obligations, further exacerbating inflation and the cost of living.

Moreover, the fall in cocoa earnings could impact Ghana’s ability to negotiate favorable terms in the syndicated loan market. The country has traditionally relied on annual cocoa-backed loans to stabilize its economy, but with declining production and revenue, lenders may become increasingly hesitant to extend credit.

To reverse this downward trend, the government and stakeholders in the cocoa industry must take urgent steps to address the underlying challenges. Strengthening measures against illegal mining and smuggling, investing in disease-resistant cocoa seedlings, and providing financial support to struggling farmers are essential for reviving production.

Additionally, Ghana must reconsider its approach to cocoa pricing and forward sales agreements to ensure that it does not miss out on future price surges. By adopting a more flexible pricing strategy, the country can better position itself to take advantage of global market trends.

The road to recovery will not be easy, but with the right policies and interventions, Ghana can reclaim its position as a leading cocoa exporter. Failure to act swiftly, however, could see the country’s cocoa industry sink further into decline, threatening both economic stability and the livelihoods of millions of Ghanaians.

READ ALSO: GNPC, Springfield Strengthen Partnership to Boost Indigenous Growth