The Ghanaian bond market witnessed a significant resurgence last week, with trading activity surging by 67% week-on-week to GH¢1.67 billion.

The uptick in market participation was largely driven by treasury bills, which dominated trade volumes as investors positioned themselves ahead of the national budget reading scheduled for March 11, 2025.

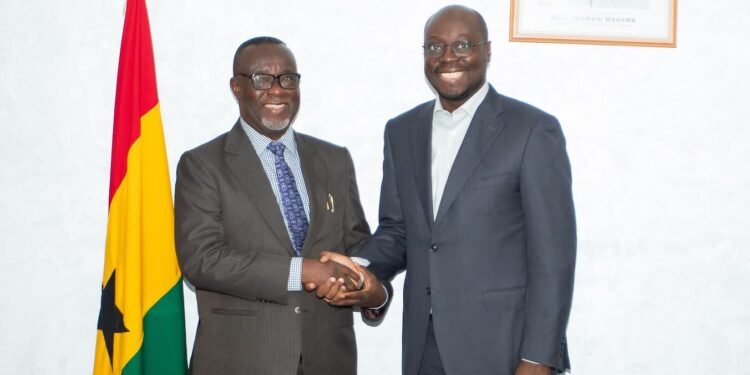

Market analyst Mr Isaac Kwesi Mensah, a Corporate Finance Research Analyst at SIC Brokerage, in an interview with the Vaultz News, anticipates a stronger demand at the shorter end of the yield curve in the coming weeks, reflecting investors’ preference for short-term securities amid economic uncertainties.

“Over the past weeks, the secondary bond market saw a rapid improvement in trading volumes, with market participants displaying increased interest in both short- and long-term government securities. This sharp rise in turnover suggests a renewed investor confidence in the market, possibly influenced by expectations surrounding the upcoming budget statement and fiscal policy direction.”

Mr Isaac Kwesi Mensah

Meanwhile, Treasury bills led the surge, as investors sought to take advantage of the relatively stable yields and reduced risk associated with shorter-term instruments. This trend aligns with the analyst’s projections that demand for short-term securities will continue to grow, especially as market players anticipate government policy measures that could impact longer-dated instruments.

Investor Preference for Shorter-Term Bonds

With the national budget presentation approaching, Mr Kwesi Mensah iterated that he expects stronger demand at the shorter end of the yield curve.

“This is driven by investors seeking to hedge against potential fiscal policy shifts that could impact longer-term bonds. The uncertainty surrounding macroeconomic policies, government expenditure, and revenue projections has heightened investors’ appetite for short-term securities, which offer more liquidity and lower risk exposure.”

Mr Isaac Kwesi Mensah

The market analyst further explained saying, “Investors are adopting a cautious approach ahead of the budget reading. The expectation is that government’s fiscal policies will influence yield movements, prompting a strategic shift towards shorter maturities.”

Mr Mensah opined that the anticipation surrounding the national budget presentation is a key driver of market activity. He explained that investors are closely watching for policy announcements that could impact government borrowing, fiscal consolidation efforts, and overall debt sustainability.

“The government’s fiscal position and planned expenditure for the year will play a crucial role in shaping investor sentiment. If the budget outlines aggressive borrowing plans, yields on longer-term bonds could rise, making short-term instruments more attractive. Conversely, a commitment to fiscal discipline and deficit reduction could improve investor confidence in longer-term bonds, leading to yield compression.”

Mr Isaac Kwesi Mensah

General Category Bonds See Decent Activity

Beyond treasury bills, general category bonds also saw decent activity, particularly the February 2028 and February 2030 bonds. These two instruments accounted for 68% of total trades, reflecting strong investor interest in medium-term securities. The average yield-to-maturity (YTM) for these bonds stood at 25%, indicating relatively stable returns for investors willing to hold these securities.

Overall, bonds maturing between 2027 and 2030 made up 77% of total trades, reinforcing the growing appetite for mid-term instruments. The average YTM for this category remained at 25%, suggesting a balanced risk-reward outlook for investors.

On the other hand, longer-term bonds, covering maturities from 2031 to 2038, accounted for 23% of total trades. The average YTM for these securities eased slightly to 26%, signaling a moderate shift in investor preference away from the longer end of the curve.

Outlook for the Bond Market

On the outlook for the bond market, the market analyst predicted that short-term securities will continue to attract demand, particularly as investors await policy clarity from the budget statement. The direction of yields will largely depend on government’s borrowing strategy and economic growth projections.

“We anticipate continued investor preference for treasury bills and shorter-dated bonds in the near term. However, should the budget provide assurance on fiscal sustainability, we could see renewed interest in longer-term instruments.”

Mr Isaac Kwesi Mensah

Mr Mensah indicated that the recent surge in bond market activity indicates a more vibrant trading environment, but investors remain cautious. “As the budget reading approaches, market dynamics are expected to shift based on fiscal policy direction, inflation outlook, and government’s financing needs,” he said.

In the meantime, the analyst noted that the secondary bond market is likely to maintain its current momentum, with treasury bills and medium-term bonds leading the charge. Investors will continue to recalibrate their portfolios based on economic developments and monetary policy signals, ensuring a dynamic and responsive bond market.

READ ALSO: Ghana Needs Economic Shock Absorbers, Not IMF Interventions- Prof. Gatsi