The Monetary Policy Committee (MPC) of the Bank of Ghana (BoG) has, once again, maintained the policy rate at 28%, citing continued progress in inflation management and the need to sustain macroeconomic stability. The announcement, delivered on May 23, 2025, by Governor Dr. Johnson Asiama, has drawn mixed reactions from financial market participants.

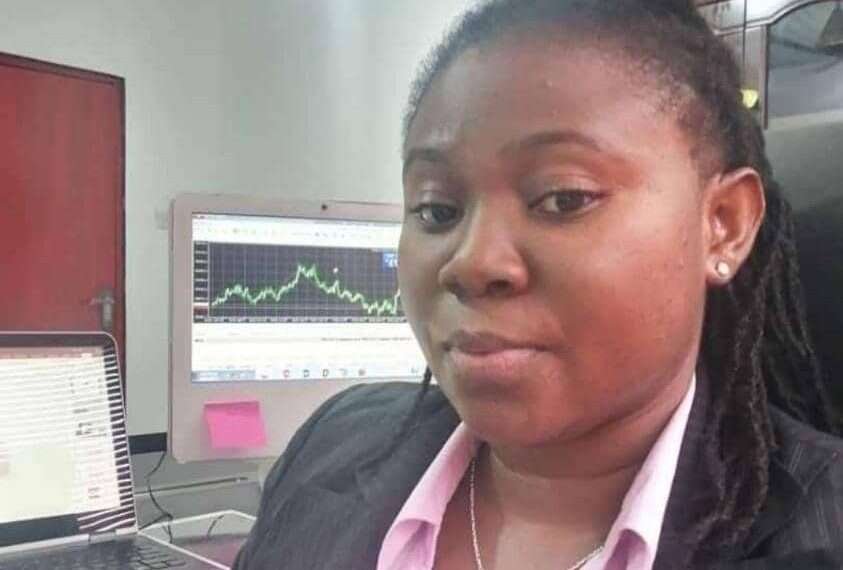

In an exclusive interview with Vaultz News, Mrs. Ruth Ofori, a seasoned financial analyst and Chief Executive Officer of Lolyfx LTD, shared in-depth insights on what this decision means for Ghana’s stock market. According to her, while the central bank’s action supports economic stability, it also keeps equities in a holding pattern—awaiting clearer signals for growth.

Mrs. Ofori explained that the BoG’s cautious stance on interest rates reflects a commitment to consolidating gains made in inflation reduction. However, for the stock market, that caution translates into stagnation.

“By maintaining the policy rate at 28%, the BoG is sending a message that inflation is under control but not yet low enough to justify easing. Unfortunately, this doesn’t bode well for more bullish activity on the stock market.”

Mrs. Ruth Ofori

She noted that while the rate hold prevents any new shocks to the economy, it also fails to provide the kind of monetary stimulus that could boost trading activity and corporate earnings. “At this point, equities are essentially treading water,” she added.

One of the key drawbacks of the maintained policy rate, according to Mrs. Ofori, is the continued high cost of borrowing. Many listed companies—especially those in manufacturing, construction, and financial services—remain constrained by expensive credit.

“These firms are struggling to expand and invest due to high interest costs. When companies can’t grow earnings due to tight credit, their stock valuations remain suppressed. Investors pick up on that, and they stay away or shift focus to more attractive options.”

Mrs. Ruth Ofori

Limited Investor Shift from Fixed Income

Mrs. Ofori also pointed out that the high policy rate continues to make government securities more attractive than equities. “With Treasury bills and bonds yielding significant returns at relatively low risk, many investors prefer to park their funds in fixed income instruments rather than take on equity risk,” she stated.

This has led to liquidity constraints in the equity market, as fewer investors are willing to engage actively in stock trading. “Even institutional investors are cautious because the risk-return ratio just doesn’t favor equities in the current environment,” she added.

From an international investment standpoint, Mrs. Ofori believes that the policy rate decision sends a mixed message. While the high rate can attract foreign capital into bonds and short-term instruments, it does not incentivize long-term investment in equities.

“Foreign investors are still wary. They want to see a more pronounced downward trend in inflation and a sign that the economy is ready for a monetary easing cycle. Until then, foreign portfolio flows into the stock market will remain tentative at best.”

Mrs. Ruth Ofori

Flat Trading Equities

One of the immediate effects of the rate hold, as highlighted by Mrs. Ofori, is that the local bourse will witness flat trading outcomes on the Ghana Stock Exchange (GSE) when market opens. “We may not be seeing the kind of daily trading activity that signals strong investor interest or market optimism in the coming days,” she said.

She emphasized that low volumes often beget more caution, creating a feedback loop that stifles performance. “Without strong turnover and participation, it’s difficult for the market to price in potential growth or recovery.”

On what can trigger a turnaround? Mrs. Ofori believes the BoG must begin laying the groundwork for a future rate cut—one that will stimulate demand and support private sector growth.

“If inflation continues its downward path, the central bank should consider reducing the policy rate gradually. That would ease credit conditions, encourage business expansion, and reinvigorate the stock market.”

Mrs. Ruth Ofori

However, she acknowledged that this must be balanced against fiscal policy discipline and external risks, especially global interest rate movements and commodity price volatility. “Monetary easing must be data-driven, not politically motivated. But without it, equities will remain sluggish,” she warned.

Final Thoughts

Mrs. Ofori concluded by reiterating that while the BoG’s decision to maintain the policy rate supports overall economic stability, it leaves the stock market in a holding pattern. “We need more than just stability—we need signs of growth. The stock market thrives on optimism, liquidity, and forward-looking policy. Right now, we’re only halfway there.”

With the next MPC meeting, market participants will be watching closely for any shifts in the central bank’s posture. Until then, as Mrs. Ofori aptly put it, Ghana’s equities may continue to “tread water.”

READ ALSO: Ghanaian Industries Eye Relief as AGI Pushes for Interest Rate Reduction