Deutsche Bank has significantly raised its gold price forecast for 2026 to $4,000 per ounce, citing robust central bank demand, a weakening US dollar, and rising concerns over the independence of the Federal Reserve.

The revision marks an 8% upgrade from its previous forecast of $3,700 and underscores growing conviction among analysts that bullion still has more room to run after an already record-breaking rally this year.

“The recent rally in gold still has further headroom to run.

“We now project an average price of $4,000 for 2026, supported by macroeconomic volatility, official sector purchases, and continued weakness in the US dollar.”

Deutsche Bank analysts led by Michael Hsueh

One of the main factors cited by the bank is increasing uncertainty over US monetary policy amid political pressures.

The analysts highlighted changes in the composition of the Federal Open Market Committee (FOMC) and President Donald Trump’s repeated efforts to influence the central bank’s decisions.

The note warned, “These dynamics could impact how the Fed adjusts its policy tools in response to shifting economic conditions next year.” Investors are particularly wary of potential interference that could undermine the Fed’s credibility at a time when markets are already grappling with global volatility.

Central Banks Drive Demand

Deutsche Bank also emphasized the unprecedented role of central banks in driving the gold rally.

“Central banks are acquiring gold at roughly double the pace seen between 2011 and 2021, with China emerging as the single largest contributor.”

Deutsche Bank analysts led by Michael Hsueh

This sustained official sector demand has provided a steady floor under prices, adding to gold’s appeal as a safe-haven asset at a time of geopolitical and financial uncertainty.

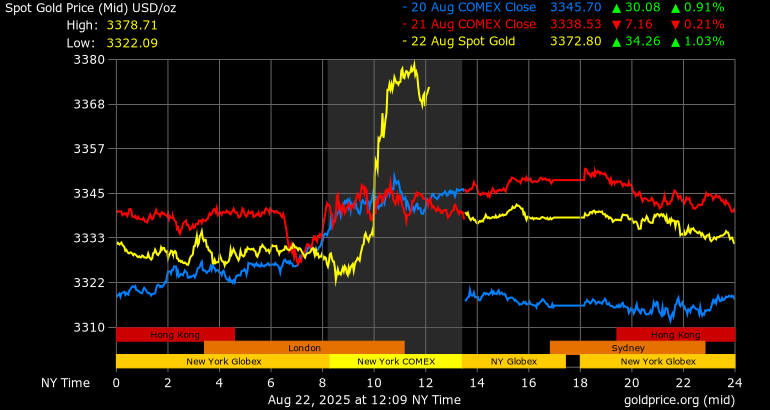

Gold has been on a remarkable run throughout 2025, surging 41% year-to-date and breaking through the $3,700 per ounce level for the first time in history.

The rally has not only outpaced traditional equity benchmarks like the S&P 500 but also pushed bullion above its inflation-adjusted peak from 1980.

A weaker dollar has been a key driver. The greenback has slipped to its lowest levels since July, making dollar-denominated gold cheaper for holders of other currencies and further stoking demand.

“Gold’s outperformance this year reflects a confluence of supportive factors: weaker dollar, central bank demand, and heightened political and economic uncertainty,”

Deutsche Bank analysts led by Michael Hsueh

Despite the bullish outlook, Deutsche Bank cautioned investors about potential headwinds that could temper gains.

Stronger equity market performance could reduce demand for gold as a safe haven, while greater clarity around President Trump’s trade and immigration policies may help stabilize markets and shift investor sentiment.

“Although the long-term fundamentals remain supportive, the possibility of risk appetite returning to equities or unexpected policy clarity could weigh on gold’s trajectory.”

Deutsche Bank analysts led by Michael Hsueh

Deutsche Bank’s $4,000 forecast follows a wave of increasingly aggressive projections from other institutions.

Earlier this month, Goldman Sachs suggested that gold could even approach $5,000 per ounce if just 1% of privately held US Treasuries were reallocated into bullion.

While such projections highlight differing levels of optimism, the consensus across Wall Street is that gold remains one of the most attractive asset classes heading into 2026.

A New Era for Gold?

The ongoing rally has prompted debate over whether gold is entering a new era of structural strength rather than a short-term cyclical spike.

“Gold has broken out beyond its historical reference points. It has surpassed its inflation-adjusted 1980 peak and is trading in uncharted territory.

“What we are witnessing may represent a fundamental re-pricing of gold as a core asset class in global portfolios.”

Deutsche Bank analysts led by Michael Hsueh

As 2026 approaches, the gold market will likely remain a barometer for global uncertainty. With central banks leading the charge, and major financial institutions raising forecasts, gold’s trajectory will be closely watched as both a hedge and an investment opportunity.

READ ALSO: Market Cheers as Ghana’s Treasury Auction Breaks Four-Week Drought with 15.8% Oversubscription