Ghana has been urged to scale up investment in its petroleum sector to unlock the country’s vast hydrocarbon potential and achieve its projected 20 percent share of West Africa’s $80 billion oil and gas market by 2033.

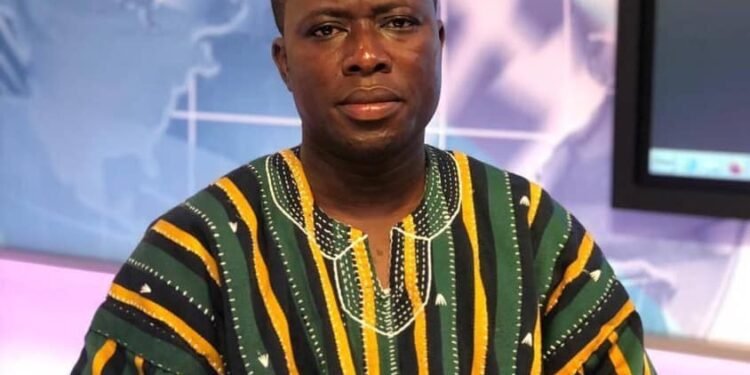

The call was made by Richard Ellimah, Chair of the Sub-Technical Committee of the Public Interest and Accountability Committee (PIAC), during a virtual media engagement on PIAC’s 2025 Semi-Annual Report, organised with the support of Good Governance Africa.

Mr. Ellimah stated that the Deloitte report focuses on assessing the country’s resource potential, emphasizing that those familiar with Ghana’s energy sector are well aware that such potential exists.

“But what we haven’t done well is to translate that potential into actual exploration and production.

“If we can invest properly and exploit our hydrocarbons efficiently, we could indeed achieve that 20 percent share of the $80 billion Deloitte has projected.”

Richard Ellimah, Chair of the Sub-Technical Committee of PIAC

Mr. Ellimah’s remarks follow a recent Deloitte report which forecasts that Ghana’s oil and gas sector could contribute approximately $16 billion to the region’s total market value within the next eight years, provided the country deepens exploration and investment in production.

Investment Key to Unlocking Ghana’s Hydrocarbon Future

According to Mr. Ellimah, the optimism surrounding Ghana’s potential must be backed by sustained financing and government commitment to drive exploration activities.

He cautioned that without new investments, production will continue to decline, diminishing the country’s competitiveness in the sub-region.

“It all comes down to investment. We have seen a consistent decline in production over the years because we are not investing enough in the sector. And if we don’t, this projection might not even come to pass.”

Richard Ellimah, Chair of the Sub-Technical Committee of PIAC

Ghana’s crude oil production has fallen steadily since 2019, with output dropping from nearly 200,000 barrels per day (bpd) at its peak to around 125,000 bpd in 2025.

Analysts attribute the decline to the absence of new field developments since 2017 and prolonged regulatory disputes that have discouraged exploration.

Deloitte’s West African Oil Market Outlook paints a promising yet cautionary picture for the region’s petroleum industry.

The report projects that West Africa’s oil and gas market will grow to $80 billion by 2033, with Ghana expected to contribute $16 billion, Nigeria dominating with 60 percent, and the remainder shared among Angola, Côte d’Ivoire, and others.

The report highlights that the region’s growth will be driven by rising global energy demand, improved fiscal regimes, and expanding exploration activity, but warns that Ghana’s success will depend on its ability to resolve regulatory bottlenecks and rebuild investor confidence.

Deloitte also forecasts a compound annual growth rate (CAGR) of 6.5% for West Africa’s oil market from 2025 to 2033, positioning the region as a key global energy frontier.

PIAC Advocates Broader Sectoral Growth Beyond Upstream

Adding to the discussion, Mark Agyemang, a fellow member of PIAC’s sub-Technical Committee, emphasised that Ghana’s petroleum growth should not be confined to the upstream segment.

He urged the government to adopt a holistic strategy that integrates midstream and downstream opportunities into the national industrialisation agenda.

“The oil industry has three main segments upstream, midstream and downstream, and all are driven by economic growth.

“If Ghana’s industrialisation agenda succeeds in attracting automobile makers and heavy industries, that will drive demand across the midstream and downstream, which in turn will expand the overall market share.”

Richard Ellimah, Chair of the Sub-Technical Committee of PIAC

He noted that sustained industrial activity would stimulate demand for refined products such as petrol, lubricants, and petrochemicals, thereby broadening the economic footprint of the oil sector.

The Deloitte report and PIAC’s observations come at a time when Ghana’s oil sector is grappling with challenges ranging from regulatory uncertainty to investor apprehension.

The country has not signed a new petroleum agreement in nearly five years, and a series of legal and policy disputes such as the unitisation standoff between ENI and Springfield Exploration and Production has raised questions about fiscal predictability and contract enforcement.

Mr. Ellimah observed that while Ghana remains an attractive jurisdiction with political stability and resource potential, “policy inconsistency has made investors more cautious.”

He urged the government to “rebuild trust with the investor community through transparency, fair regulation, and clear fiscal terms.”

Cost of Inaction and the Road Ahead

Industry experts warn that Ghana’s declining production levels could result in billions of dollars in lost revenue over the next decade if no urgent action is taken.

The Public Interest and Accountability Committee’s 2025 Semi-Annual Report revealed that crude oil production fell by nearly 26 percent year-on-year in the first half of 2025, underscoring the urgent need for new investment.

For Mr. Ellimah and Agyemang, the path forward lies in strategic policy consistency, incentivising exploration, and leveraging regional partnerships to attract capital.

As Ghana prepares to update its Energy Transition Framework and position itself within a rapidly evolving global energy landscape, analysts say that the next decade will be pivotal.

The government’s commitment to balancing fossil fuel development with green transition goals will determine whether Ghana secures its place as a top player in the sub-region’s $80 billion oil market.

Ultimately, the Deloitte projection has reignited an important conversation, one that challenges policymakers to act decisively in order to convert resource potential into national prosperity.

READ ALSO: BoG’s $1.15bn FX Injection Sparks Clash with IMF and World Bank Over Cedi Stabilization