Finance Minister, Dr. Cassiel Ato Forson, has proposed November 13 for the presentation of the 2026 Budget Statement and Economic Policy to Parliament, subject to Parliamentary approval.

The 2026 Budget Statement and Economic Policy will mark the first major budget presentation for the government since coming into office on 7th January 2025.

Economic analysts believe that the 2025 Budget operated and was within the framework of the previous government. However, disbursement, implementation, management, and policies are the heritage of the current government.

The 2026 Budget will undoubtedly be the exclusive product of the Mahama-led government. The upcoming Budget is expected to give assurances and hope that the current economic gains will be sustained.

Preparation of 2026 Budget

The Ministry of Finance has had several stakeholder consultations ahead of the 2026 Budget reading. The Ministry is believed to have completed stakeholder engagements, including industry and specialised consultations, and has concluded on key policies and programmes to be represented in the 2026 Budget Statement.

Earlier last week, the Deputy Finance Minister, Mr. Thomas Nyarko Ampem, led the Ministry to host banking and non-banking financial institutions, think tanks, professional bodies, trade organizations, social partners, civil society organizations (CSOs), faith-based organizations (FBOs), academia, and other organized groups.

He also confirmed that the Ministry engages with ordinary Ghanaians and markets to gain firsthand feedback on the impact of policies.

Act that Mandating Budget reading

Under the Public Financial Management Act (PFMA), the Finance Minister, on behalf of the President, is required to lay before Parliament the Budget for the next year, not later than the 15th of November of each financial year.

The Act mandates the Minister of Finance to “prepare the annual and supplementary budget estimates and reports for submission to Parliament.” The Minister must also “coordinate and mobilise resources, including financial assistance from development partners, and integrate the resources into the planning and budgeting.”

Expectations

In previous discussions, the Minister of Finance revealed that the 2026 Budget will focus on job creation and stimulating economic growth, aligned with the inclusivity and sustainable development trajectory of the government. The Budget is also expected to support the government’s ambitious initiatives, including the Big Push and the 24-Hour Economy initiative, with either financial commitments or policies to finance the projects.

Ghanaians, especially businesses, have huge expectations on tax policy reforms, of which some commitments have been made with the repealing of the e-levy, betting tax, and emissions levy in April, while some remain issues to be addressed, like the Covid-19 tax. Calls have also been made for the government to widen the tax net by mobilizing more revenue from the informal sector.

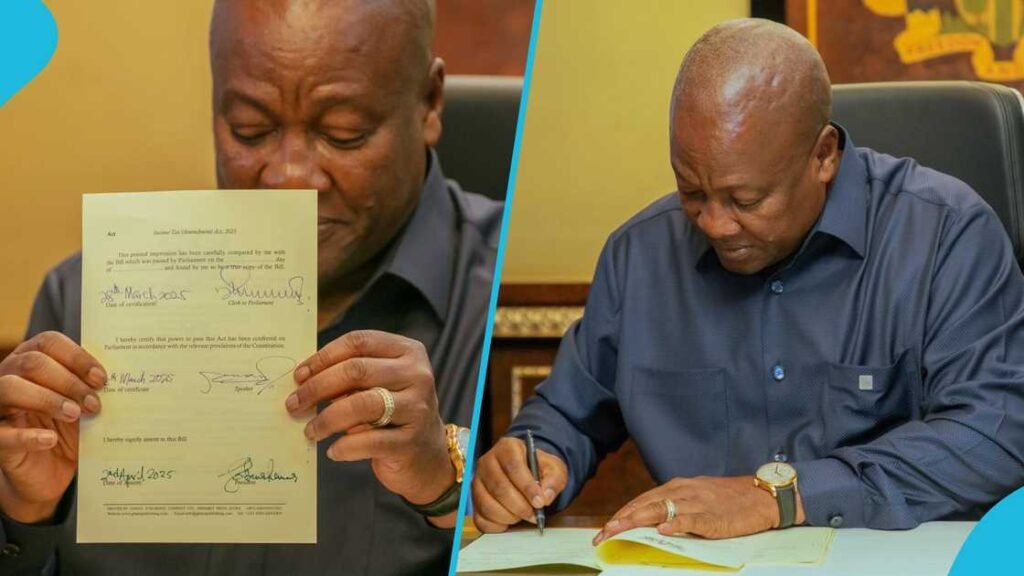

The President has assented to a number of bills passed by Parliament, including Value Added Tax (VAT) Amendment Bill, Income Tax Amendment Bill 2025, Petroleum Revenue Management Amendment Bill, 2025, Public Financial Management Amendment Bill, Earmarked Funds Capping and Realignment Bill, Energy Sector Levy Act, the Gold Board Bill 2025, and the Growth and Sustainability Levy Act. Some Ghanaians have called for clarity on the implications of the reforms on the financials of the country going into 2026.

Ghanaians are expecting the VAT structure for next year to be added to the Budget. The Value Added Tax (VAT) will also be reviewed in the Budget with “the effective rate expected to decline from 22% to 20%,” Mr. Anthony Sarpong, Commissioner-General of the Ghana Revenue Authority (GRA) clarified.

The infamous road tolls also await implementation. The Minister for Roads and Highways, Governs Kwame Agbodza, in July this year, hinted of the reintroduction of electronic road tolls. Ghanaians expect the budget to touch on the new toll system and other revenue mobilisation means.

Economic experts are also looking forward to the government’s strategy to maintain current fiscal discipline amid the many infrastructure projects. Also, some question whether the government will resume the capital market in 2026.

Economists and industry players are interested in knowing how the Finance Minister intends to manage the fiscal deficit and expenditure levels while maintaining debt obligations, infrastructure needs, and macroeconomic stability in 2026.

Hon. Ato Forson is expected to review the Covid-19 levy as the IMF program ends in May next year. With Ghana scheduled to exit the IMF programme in May 2026, the 2026 Budget is anticipated to outline the government’s strategy for post-programme economic management.

All stakeholders in the Ghanaian economy patiently await to see what the Budget holds to inform decisions. The 2026 Budget is, therefore, expected to be a critical policy document, shaping Ghana’s fiscal direction and economic strategy in the post-IMF period.

READ ALSO: Calls Mount on President Mahama to Appoint Substantive Defence Minister