The Bank of Ghana (BoG) is taking a historic step toward reshaping the nation’s financial sector through the introduction of a non-interest banking framework designed to uphold Ghana’s secular principles while promoting ethical and inclusive finance.

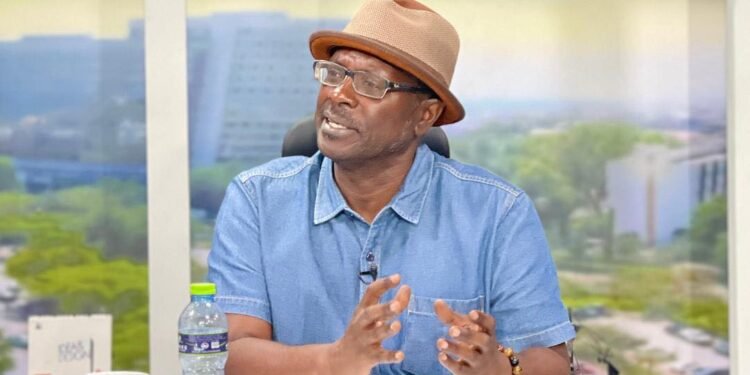

According to Professor John Gatsi, Advisor to the Governor on Non-Interest Banking and Finance, the framework will be comprehensive, carefully phased, and guided by the principles of market neutrality and sound regulation.

Speaking during a webinar organised by the Chartered Institute of Bankers (CIB) Ghana, Prof. Gatsi explained that the Bank of Ghana’s approach to non-interest banking is deliberately structured to maintain the secular identity of the country while ensuring fair participation by all market actors.

He emphasized that although the system is inspired by global ethical finance models, it will not be tied to any religious ideology. “We must preserve the neutrality of the market,” he stressed. “Non-interest banking in Ghana will not be driven by religious identity but by ethical financial practice and inclusivity.”

According to him, the central bank’s decision to preserve secular integrity is crucial to ensuring that all Ghanaians—irrespective of faith or background—can access non-interest financial products without bias or exclusion.

Controlled Launch for Effective Implementation

Prof. Gatsi disclosed that the Bank of Ghana intends to roll out the new framework in stages to allow regulators and financial institutions to learn, adapt, and strengthen compliance systems before expanding its scope.

“At the outset, non-interest banking will be limited in scope—excluding microfinance institutions, rural banks, and community banks,” he said. “We want to start well, have control, and manage before escalating.”

This phased strategy will help the regulator identify implementation challenges early and provide room to refine the framework before extending it to all segments of the financial sector.

The Bank of Ghana is determined to create a system that allows conventional and non-interest financial institutions to coexist without distorting the financial market. Under the proposed framework, the regulator will issue two distinct licences—one for conventional banks that wish to operate non-interest “windows” alongside traditional services, and another for full-fledged non-interest banks that will function entirely within the non-interest model.

Prof. Gatsi noted that this dual approach will foster competition and innovation while preventing market fragmentation. The framework also outlines strict branding and naming rules, prohibiting institutions from using names or imagery that imply religious affiliation—whether Islamic, Christian, or otherwise.

Strong Regulatory Foundation

The legal and regulatory basis for the initiative draws from Act 930—the Banks and Specialised Deposit-Taking Institutions Act, 2016. The Act provides for key prudential standards including anti-money laundering (AML) compliance, liquidity management, and capital adequacy requirements, all of which will apply equally to non-interest banks.

While non-interest institutions will rely on asset-backed structures and risk-sharing models rather than conventional interest-based instruments, they must still meet the same prudential benchmarks. This ensures that financial integrity, safety, and consumer protection remain uncompromised.

Beyond banking, the non-interest finance framework will extend to Ghana’s capital markets and insurance industry. The Bank of Ghana is collaborating with the Securities and Exchange Commission (SEC) and the National Insurance Commission (NIC) to develop harmonised guidelines for Sukuk (non-interest bonds) and Takaful (non-interest insurance).

“We want to ensure that the banking, capital market, and insurance frameworks evolve together and not in isolation,” Prof. Gatsi explained.

This coordinated effort will establish a unified foundation for ethical finance in Ghana, creating a conducive environment for investors and institutions seeking alternatives to interest-based products.

Governance will play a central role in the success of Ghana’s non-interest banking system. Prof. Gatsi revealed that the Bank of Ghana’s model will incorporate a two-tier governance structure: each licensed institution will have an internal governance committee to vet and approve non-interest products, while a central oversight body at BoG will validate compliance with ethical and prudential standards.

“Governance is at the heart of non-interest banking,” he said, stressing that transparency and accountability are essential for public trust and system stability.

Capacity Building and Next Steps

To support the rollout, the Bank of Ghana will host a capacity-building programme on December 1, 2025, for banks, insurers, and capital market participants. The programme will focus on Sukuk structuring, non-interest product development, licensing processes, and governance models as part of a broader education and compliance strategy.

The draft non-interest banking guideline, currently undergoing internal validation, will soon be presented to the Governor for review and approval. The final version is expected to be published by the end of 2025, marking a major milestone in Ghana’s journey toward ethical and inclusive finance.

Globally, non-interest and ethical finance continue to gain traction. According to Standard Chartered, Islamic finance assets surpassed US$5 trillion in 2024 and are projected to reach US$7.5 trillion by 2028. The global Sukuk market alone is expected to grow from US$1.08 trillion in 2024 to US$1.295 trillion in 2025, reflecting growing investor appetite for asset-backed, ethical financial instruments.

Prof. Gatsi noted that Ghana’s entry into this space is not an experiment but a deliberate step toward expanding financial inclusion and strengthening market integrity. “This is about deepening financial inclusion and creating space for alternative forms of finance that align with Ghana’s secular and regulatory principles,” he affirmed.

READ ALSO:Ghana’s Youth Unemployment Soars: Youth Minister Charts Bold Vision to Reverse Trend