Ten years ago, the Ghana Fixed Income Market (GFIM) was just an ambitious concept—an initiative designed to deepen Ghana’s capital market and provide a transparent, efficient platform for trading government and corporate bonds.

Today, it stands as one of the most dynamic segments of the Ghana Stock Exchange (GSE), crossing a staggering GH¢1.2 trillion in cumulative trade volumes despite the shocks of the Domestic Debt Exchange Programme (DDEP).

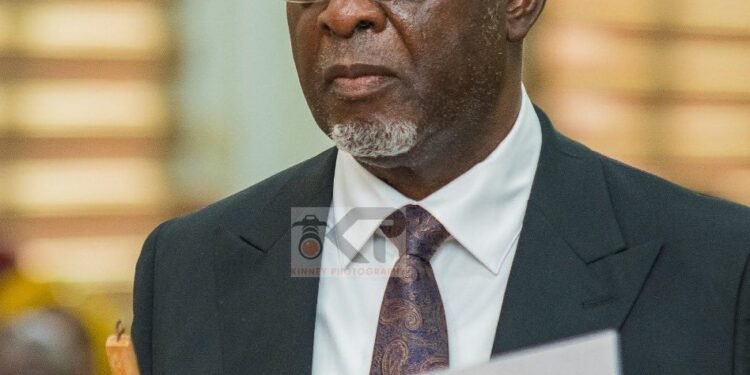

At the 10th anniversary celebration of the GFIM, the Governor of the Bank of Ghana (BoG), Dr. Johnson Asiama, highlighted this milestone as a powerful symbol of market resilience and investor confidence.

“From a mere GH¢5.2 billion (in trading volumes) from its inception, cumulative trading has now crossed GH¢1.2 trillion. This means that GFIM has moved from concept to connecting investors with a purpose—to finance Ghana’s development.”

Dr. Johnson Asiama

The Governor’s remarks underscored not only the market’s remarkable journey but also its critical role in sustaining Ghana’s broader financial ecosystem through turbulent economic times.

Defying the Debt Exchange Impact

The Domestic Debt Exchange Programme (DDEP), introduced in 2023 as part of Ghana’s debt restructuring measures, sent tremors across the financial market. Trading volumes on the fixed income market plummeted sharply—from GH¢230 billion in 2022 to GH¢98 billion in 2023.

However, the market’s resilience began to show early in 2025. According to data from the GSE, trade volumes had surged to GH¢214 billion as of October 2025, signaling renewed investor confidence and stronger participation from both institutional and retail players.

Dr. Asiama attributed the rebound to the “robust systems and confidence-building mechanisms” embedded within the GFIM framework. He lauded the GSE and market participants for maintaining transparency and innovation amid fiscal uncertainties. “The success of GFIM demonstrates that with the right institutional framework, transparency, and market discipline, Ghana can build financial systems that withstand economic shocks,” he noted.

Despite the record-breaking trading volumes, the BoG Governor expressed concern over the overreliance on government securities in the bond market. The majority of fixed income instruments traded on GFIM are government-issued bonds, leaving limited room for corporate participation.

Dr. Asiama urged the Ghana Stock Exchange and the Securities and Exchange Commission (SEC) to collaborate on strategies that will encourage corporate bond issuances. “It is time to diversify. We must build a fixed income market that supports private sector growth just as effectively as it finances government needs,” he said.

GSE’s Vision: Expanding the Investment Frontier

Adding to the optimism of the event, Abena Amoah, Managing Director of the Ghana Stock Exchange, outlined an ambitious vision for expanding the country’s investment base. She emphasized the need to democratize access to investment opportunities and drive financial inclusion through technology.

“We want to increase the number of Ghanaians with investment accounts from about 2 million today to 10 million. We also want to grow corporate debt issuers from the current 14 who have GH¢24 billion on the market to over a hundred issuers.”

Abena Amoah

Ms. Amoah further appealed for speedy cabinet approval that would allow state-owned enterprises (SOEs) to raise capital on both the fixed income and equity markets. She argued that such reforms would inject efficiency into public enterprises while attracting long-term, patient capital for infrastructure and industrial development.

Established in August 2015, the Ghana Fixed Income Market was conceived as part of Ghana’s broader financial sector reforms aimed at strengthening the capital market and improving liquidity in government securities.

Over the decade, GFIM has evolved into a vibrant marketplace for both institutional and retail investors, facilitating transparent trading in treasury bills, notes, bonds, and corporate debt instruments. Its introduction of electronic trading platforms, enhanced settlement systems, and real-time price discovery has significantly boosted market confidence and participation.

Today, the GFIM serves as a vital pillar in the country’s financial architecture, providing the government with a reliable avenue to raise funds while enabling investors to diversify their portfolios. For private sector players, it offers a path to secure long-term financing—essential for industrialization and infrastructure growth.

READ ALSO:Mahama Assures Immediate Establishment of Farmers’ Service Centers