IMANI Africa’s Vice President, Bright Simons, has raised serious concerns over the government’s decision to present a revised mining lease for the Ewoyaa Lithium Project to Parliament with a reduced royalty rate.

The project, Ghana’s first major lithium mine, is being developed by Atlantic Lithium Limited, a Sydney-based mining company.

According to Mr. Simons, the government’s justification for halving the country’s royalty stake from 10% to 5% lacks transparency and economic rationale.

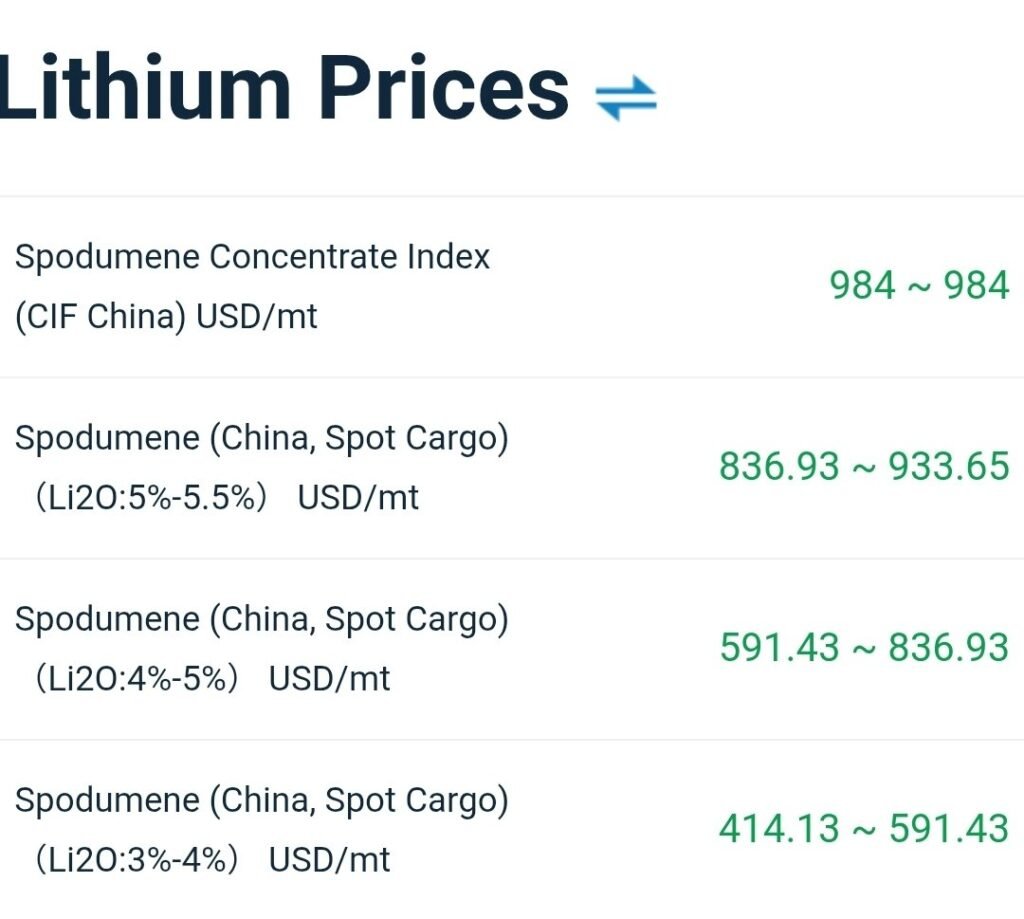

“Ghana’s Mines Minister says lithium prices have fallen from over $3,000 since the country’s first lithium mine agreement was signed with Atlantic, to just over $630 today.”

IMANI Africa’s Vice President, Bright Simons

The Minister told Parliament that the sharp fall in global lithium prices had rendered the original terms unsustainable for the company, hence the need to revise the agreement.

However, Simons argues that the figures presented by the Minister are questionable and inconsistent with available market data.

Dispute Over Royalty Reduction

Mr. Simons noted that Atlantic Lithium has claimed the mine would not be profitable at a 10% royalty rate given the alleged fall in lithium prices.

“Because of that, the 10% royalty stake many Ghanaians were unhappy with would now be slashed to 5% because Atlantic says otherwise the mine won’t be profitable.”

IMANI Africa’s Vice President, Bright Simons

The revised mining agreement has since been sent to Parliament for ratification, sparking renewed public debate over Ghana’s negotiating stance in resource deals.

However, Mr.Simons criticised the Lands Minister for presenting figures without a supporting profitability analysis.

“He didn’t add any profitability analysis based on a revised ‘definitive feasibility study.’ But that’s not even the big issue.

“The big issue is that his numbers are his alone. They cannot be found anywhere on the record.”

IMANI Africa’s Vice President, Bright Simons

Drawing from the original 2023 agreement, Mr. Simons provided a contrasting view of the project’s financial viability.

When the initial deal was signed in October 2023, the global benchmark price for spodumene (6% Li₂O CIF China) the form of lithium to be mined in Ewoyaa, stood at just over $2,200 per ton.

Mr. Simons stated, “Because of lithium prices then, and the agreement terms, the profitability of the project was insanely high.” The project’s breakeven period was estimated at 19 months, or roughly 1.6 years.

“Gross margin per ton on project cash cost basis was 76%.

“On an all-in (AISC) basis, the gross margin was 62%. Net margin over the life of the mine stood at 35%.”

IMANI Africa’s Vice President, Bright Simons

Mr. Simons emphasized that under those conditions, investors could recover their entire investment in less than two years.

Atlantic’s Profitability Still Intact, IMANI Argues

Despite claims of declining profitability, Mr. Simons believes Atlantic Lithium still stands to make significant returns, even at current prices. “Remember that the mine’s all-in cost per ton is about $610. So, even at current prices, they make a profit of about 30% per ton,” he explained.

He added that paying Ghana around $98 per ton under the original 10% royalty rate would still leave the company with roughly $260 profit per ton.

He remarked sarcastically, “Atlantic says that would be terrible! Bear in mind that corporate taxes are on operating income and not gross margin,” suggesting that the company’s profitability concerns are overstated.

Mr. Simons also outlined the shifting position of Atlantic Lithium over the past year. He recalled that when chiefs from the Ewoyaa area were mobilized by the company to urge parliamentary ratification in January 2025, lithium prices were around $800 per ton.

When the agreement was before Parliament in August 2024, prices hovered around $780 per ton, yet the company pushed strongly for approval.

“Then the government changed. Suddenly, Atlantic changes its mind and starts to insist that unless the 10% royalty rate that many Ghanaians protested against for being too low was slashed to 5%, they won’t be able to mine.”

IMANI Africa’s Vice President, Bright Simons

He pointed out the inconsistency in this narrative, noting that as of the Minister’s latest address, lithium prices had rebounded to around $990 per ton representing a more than 25% increase from the period when the company was lobbying for approval of the old deal.

“How then can lithium prices be the reason for slashing the royalty rate, other than reasons best known to Mr. Minister?”

IMANI Africa’s Vice President, Bright Simons

Concerns Over Transparency and Accountability

Beyond the immediate financial implications, Mr. Simons warned that the lack of transparency in the government’s handling of the revised agreement poses long-term risks for Ghana’s resource governance.

“The reason Mr. Minister can produce such numbers of his own design and use them to justify such a massive giveaway is because he has gauged the national mood.

“He knows the people who understand these things will stay mute.”

IMANI Africa’s Vice President, Bright Simons

The IMANI Vice President’s remarks reflect growing public concern that Ghana could be forfeiting critical value from its mineral wealth at a time when global demand for lithium, a key component in electric vehicle batteries remains strong.

As the Ewoyaa Lithium Mining Lease awaits parliamentary ratification, calls are mounting for greater scrutiny, full disclosure of financial assumptions, and a renegotiation that protects Ghana’s long-term economic interests.

READ ALSO: Ato Forson Promises Renewed Investment for Benso Oil Palm Plantation