Mining Consultant Ing. Wisdom Gomashie has shared a detailed set of expectations for Ghana’s mining sector, as the nation anticipates the presentation of the 2026 national budget.

Speaking ahead of the budget reading, Ing. Gomashie urged the government to focus on transparency, fiscal prudence, and structural reforms that can enhance value addition and community development within the mining industry.

He stressed the need for “a clear update on Ghana Goldbod’s funding mechanism” and a comprehensive disclosure of the “profits accrued on Goldbod’s activities so far, not just exports.”

For him, a transparent account of Goldbod’s performance is vital to ensuring that the state’s gold-related initiatives contribute directly to national reserves and fiscal stability.

He believes that without clear reporting on its funding sources and earnings, its impact on the broader economy will remain ambiguous.

Analysts have long called for periodic disclosures on Goldbod’s transactions and investments.

Ing. Gomashie’s call echoes this sentiment, suggesting that the 2026 budget should address not only production and export figures but also the revenue performance and governance structure of the initiative.

Call to Remove VAT on Exploration

Another major proposal from the mining consultant concerns taxation. Ing. Gomashie expects the government to “remove VAT on exploration” to attract investment in early-stage mineral discovery. However, he emphasised that such incentives must come with conditions.

He suggested that companies benefiting from VAT waivers should be obliged to contribute to national development once commercially viable deposits are confirmed.

This conditional incentive, according to him, would create a balance between encouraging exploration and ensuring that the state ultimately gains from resource discoveries.

Ing. Gomashie further called for budgetary allocations toward geological investigations and artisanal and small-scale mining (ASM) formalisation initiatives.

He argued that investing in geological data acquisition will reduce uncertainty for investors and help government regulate the sector more effectively.

“Funding for Geological Investigation and other ASM Formalisation initiatives must feature prominently in the 2026 budget.”

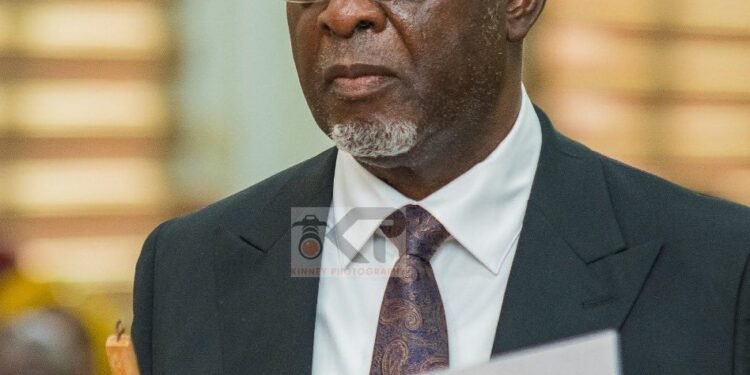

Mining Consultant Ing. Wisdom Gomashie

Such measures, he explained, will not only improve transparency in mineral mapping but also help formalise small-scale miners, reducing illegal mining and its environmental consequences.

Conditional Windfall Tax Proposal

Addressing fiscal opportunities, the consultant floated the idea of a conditional windfall tax on gold mining companies.

With gold prices expected by some analysts to reach US$ 5,000 per ounce by the end of 2026, Gomashie believes the state could capture additional revenue during boom periods.

“A possible conditional introduction of windfall tax on gold mining companies should be considered as the commodity prices keep soaring.”

Mining Consultant Ing. Wisdom Gomashie

He stressed that such a tax should be structured carefully to avoid discouraging production while ensuring that extraordinary profits are shared equitably with the state.

Looking beyond revenue, Gomashie urged the government to present “possible snapshots on Nationalization and indigenization Frameworks” for the mining sector in the 2026 budget.

He argued that empowering local participation and ownership in mining operations is critical to long-term sustainability.

He also advocated for “possible linkage of government industrialisation policies to the minerals and mining local content list,” adding that this connection could “deepen job creation within mining communities.”

Infrastructure and Policy Adjustments

Ing. Gomashie’s expectations also extended to infrastructure and fiscal policy reforms. He called for a “Mining Communities Road Network Framework” to ensure equitable development in mining-affected areas and an “update on fiscal adjustments on the Ewoyaa Lithium Lease.”

The Ewoyaa lithium project, considered one of Ghana’s flagship critical mineral investments, has drawn both local and international attention regarding its tax arrangements and benefit-sharing model.

Ing. Gomashie believes clarity in this area is crucial to maintaining investor confidence while safeguarding national interest.

As Finance Minister prepares to unveil the 2026 budget, the mining sector will be watching closely to see whether these priorities are addressed.

Ing. Wisdom Gomashie’s insights highlight both the challenges and opportunities facing Ghana’s mineral economy, from transparency in Goldbod to new fiscal tools and sustainable development frameworks.

READ ALSO: IC Research Predicts a Further Decline in Inflation to 6.5% for November