The Chief Executive Officer (CEO) of the Universal Merchant Bank, Nana Dwemoh Benneh has disclosed that engaging fintechs, to help improve financial services, will enhance Small and Medium Enterprise (SME) access to finance.

Also, by engaging Regulatory Technology (RegTech), to help firms simplify regulatory requirements, will help improve SME access to finance, Mr. Benneh revealed while speaking at the just ended Commonwealth Trade and Investment Summit.

With regards to customer identification procedure that is used to identify customers before granting access to finance, the use of Ghana Identification card (Ghana card) will help financial institutions with “their Know-Your-Customer (KYC) and risk assessment checks” for SMEs, Mr. Benneh disclosed.

Mr Benneh also disclosed that “KYC has historically been successful in smaller, communal, informal settings, but the shift to a more formalised financial setup is responsible for the lag”.

The CEO expressed strong sentiments that KYC will have a ‘domino-effect’, as compliance and operational cost to financial service providers (FPSs) will improve due to customer authentication measures being put in place.

Meanwhile, SMEs despite accounting for about 70% of all businesses in the country, according to the CEO have historically struggled to access credit on account of porous identification systems.

Banks, on the other hand, have had to resort to charging what, in their estimation, are appropriate risk-adjusted rates even as the industry average of non-performing loans lingers at around 15%.

By contrast, similar-sized economies non-performing loans on the continent are less than 10%, with South Africa at 3.9%; Rwanda at 4.4% and Nigeria at 6%.

Fintechs’ modus operandi

Mr. Benneh, speaking on the theme ‘Fintech to Consumer Finance’ highlighted the use of advanced technology as well as social media by fintech companies in their operations.

“We have FinTechs which are very much focused on using telephony activity and social media activities to build the profiles of individuals. And employs innovations such as facial recognition to enable us quickly identify the clients and conduct KYC at reduced times,”

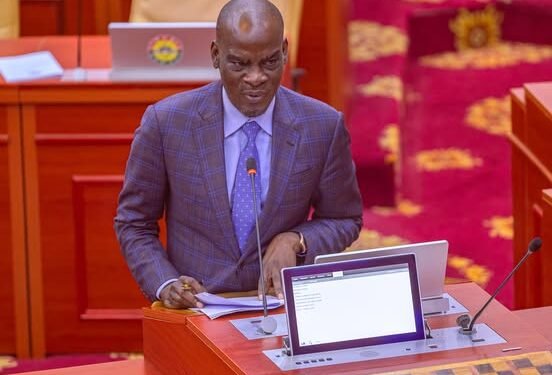

Nana Dwemoh Benneh

Furthermore, he gave credence to the implementation of the ‘Ghana card’, as plans are underway to merge the identification system with existing financial service providers’ data.

“In Ghana, we have seen the state implement a more robust ID platform called the Ghana Card that dovetails and enhances these fintech innovations. This is being reconciled with telco data, health insurance and pension data, and the expectation is that this will facilitate ease of access to credit and payment solutions for SMEs.”

Nana Dwemoh Benneh

In the meantime, the Summit which was organized both virtually and in-person, brought together other distinguished panellists in their capacities as Commonwealth Government Leaders as well as Business Leaders.

Some of these panellists include, the Chairman of the Commonwealth Enterprise and Investment Council, Lord Marland Odstock; the External Relations Minister-Government of Jersey, Senator Ian Gorst.

Also, in attendance were, Regional CEO-Insurance Growth Markets at Prudential, Wilf Blackburn; CEO at Crown Agents Bank, Bhairav Trivedi; and the Global Head SC Ventures at Standard Chartered, Alex Manson.

The summit focused on “rebuilding economies and identifying new trade opportunities in a pandemic-adjusted era”.

The panellists were unanimous in their belief that financial inclusion is a basic human right and technology will help spearhead its growth in the medium- to long-term.

READ ALSO: Fintech set to colonize traditional banking