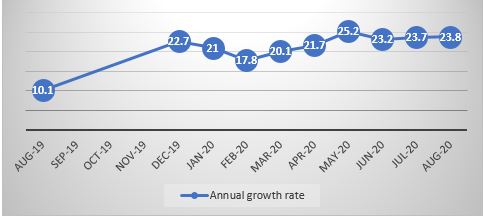

Total assets of the banking sector increased from GHS115.2 billion in August 2019 to GHS142.6 billion in August 2020, representing a growth of 23.8 percent, according to data released by the Bank of Ghana on Friday, September 25, 2020.

The Bank of Ghana (BOG) attributed the gradual rebound in credit growth to response in previously announced policy measures aimed at supporting credit extension and loan restructuring in reaction to the pandemic’s impact on local businesses.

The Bank of Ghana (BOG) said, “the data shows that recoveries from loans, a significant increase in deposits growth, and borrowing from parent companies have funded banks investments, while these factors, in addition to regulatory reliefs provided earlier in the year by the Bank of Ghana have supported lending to the rest of the economy”.

Month-on-month, the assets grew by 3 per cent, increasing from GHS138.5 billion in July 2020 to GHS142.6 billion in August 2020.

Total deposits in the sector also increased from GHS76.0 billion in August 2019 to GHS91.6 billion in August 2020. This means that total deposits increased by GHS15.6 billion over the one-year period. In percentage terms, this represents a growth rate of 20.5 percent. In the same period, total advances also increased by 15.6 percent, that is, from GHS38.9 billion in August last year to GHS45 billion in August this year.

Figure 1 Annual growth rates in Banking sector assets

Source: Bank of Ghana.

Non-performing loans was also on the decline since August 2019. The data showed that non-performing loans declined month-on-month from 16.1 percent in July 2020 to 15.5 percent in August 2020. Loans classified as non-performing have declined from 17.8 percent to 15.5 percent over the past one year.

The recent increase in the total banking sector assets comes after the banking sector clean-up that was necessitated by the financial sector crises in 2017.

The finance minister, Ken Ofori-Atta indicated earlier this year that “government started to address the challenges of distressed financial institutions in 2017 with a programme to clean up the Sector, and is continuing with the implementation of various reforms to strengthen the Sector”.

The clean-up exercise, according to the finance minister, was necessitated by weak and failed institutions, which inadvertently brought hardships to families and businesses.

Many households had their monies locked up with these firms, affecting their livelihoods and the successful running of their businesses.

Ken Ofori-Atta further explained that “as at the end of first quarter 2020, a total amount of GH¢13.6 billion (3.5 percent of GDP) has been spent on the resolution of failed banks, Specialised Deposit-taking Institutions (SDIs), Micro Finance Institutions (MFIs), the establishment of the Consolidated Bank Ghana Limited (CBG), as well as the capitalisation of the Ghana Amalgamated Trust (GAT).

“Additionally, with the President’s directives to fully pay all depositors whose funds were locked up with the failed SDIs and MFIs, an amount of GH¢5 billion was spent. This brings the total expenditure on financial sector interventions as at June 2020 to GH¢18.6 billion (4.8 percent of GDP). Government has also committed an amount of GH¢3.1 billion (0.78 percent of GDP) towards supporting investors in failed asset management companies regulated by the Securities and Exchange Commission (SEC).”

More recently, government has released a total of GHS3.56 billion for the settlement of the remaining depositor claims of the 347 defunct Microfinance companies, 23 savings and loans and finance houses. Disbursement of this fund commenced on Wednesday, September 16, 2020 at the various branches of the Consolidated Bank Ghana.