Bright Simons, vice president of IMANI Africa has raised critical questions about the operations and future plans of Atlantic Lithium, the Australian-listed company seeking to establish Ghana’s first lithium mine.

His observations, shared after a visit to the proposed mining areas, shed light on the challenges and complexities surrounding the project as well as broader issues about policy alignment and stakeholder engagement in Ghana’s nascent green minerals sector.

“When I saw them recently raising $6.7 million to ‘advance’ the project closer to a ‘final investment decision’, it suddenly hit me that I haven’t actually ever gone to the ‘ground’ to track their project footprint.”

Bright Simons, Vice President of IMANI Africa

However, Simons’ on-the-ground assessment revealed a gap between public perception and the actual state of operations, raising concerns about the feasibility of the company’s plans and their alignment with Ghana’s Green Mining Policy.

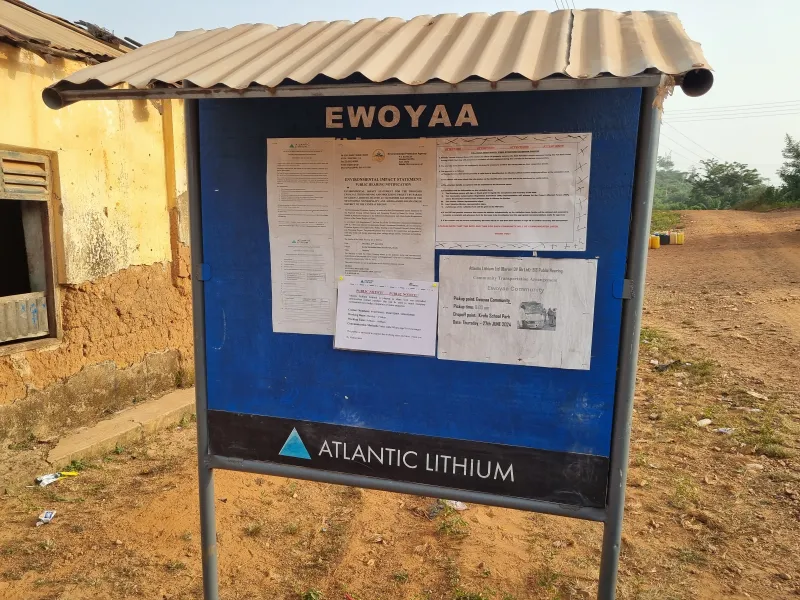

Simons described his trip to Ewoyaa and its surrounding areas, where the mining operations are expected to take place, as illuminating yet underwhelming. Despite the company’s significant fundraising efforts, there has been little visible activity since June 2023.

According to Simons, “Locals in Ewoyaa that we spoke to said that all activities seemed to have ceased since June of this year. Hence, rather sadly, there is nothing going on to video and photograph.”

The scale and setup of the operation also came under scrutiny. Ewoyaa, the project’s namesake village. “I could barely count 50 houses,” Simons recounted.

Simons noted that naming the project after Ewoyaa might create the false impression of a large, centralized mining hub, whereas the actual mining footprint is dispersed across multiple small villages within the Mfantseman Municipality.

Key affected communities include Anokyi, Abonko, Krampakrom, Afrangua, Krofu, Ewoyaa, and Ansaadze. These areas, primarily reliant on farming, will experience varying levels of impact, from land loss to disruptions in communal activities.

At one location near Ewoyaa, Simons observed idle containers from earlier exploratory campaigns and non-descript bungalows in Bafikrom, about 10 kilometers away.

These modest facilities highlight the start-up nature of Atlantic Lithium’s operations but also raise questions about whether the company has the capacity to deliver on its ambitious plans.

Logistical Challenges and Feasibility Concerns

Simons expressed skepticism about the feasibility of Atlantic Lithium’s disclosed strategy. The company plans to begin with an outsourced modular plant while building a larger facility.

However, the initial investment of under $16 million appears unrealistic, given the logistical hurdles. Many of the proposed mining sites are far from paved roads and high-voltage power transmission lines, contrary to suggestions in the company’s feasibility study. Additional investment in infrastructure, including roads and utilities, would likely be required.

“Living quarters for staff in the area, with attendant requirements for utilities etc., may be necessary since the villages closest to the operational areas don’t seem to have the requisite manpower.

“Workers would probably be coming from the Mankessim and Saltpond area. There are no simple public transport links. Shuttles might work, though.”

Bright Simons, Vice President of IMANI Africa

These challenges, combined with the apparent lack of ongoing site preparations, cast doubt on whether the project is on track for a final investment decision or operational readiness in the near term.

Simons also raised concerns about community engagement and the transparency of public consultations. While Environmental Protection Agency (EPA) notices were displayed in some villages, others appeared to have been left out.

The dispersed nature of the mining operation complicates efforts to define the project’s catchment area and ensure meaningful consultation.

Although the entire Mfantseman Municipality could theoretically be considered the project’s scope, the consultations conducted so far have been localized and limited in scale.

Interestingly, Simons found that many local residents viewed the project as a distant prospect, not something requiring immediate attention or concern.

This sentiment contrasts sharply with narratives from some chiefs who, during visits to Accra, have portrayed the project as a source of imminent employment for their communities.

The disconnect between local perceptions and external messaging underscores the need for clearer communication and more inclusive consultations.

“The outgoing government refused to publicly engage Civil Society Organisations (CSOs) about the contents of the Green Mining Policy, which remains unpublished till date.

“Hopefully, the incoming administration would be more transparent and insist on greater policy consultations ahead of the lease’s ratification by Parliament.”

Bright Simons, Vice President of IMANI Africa

Simons’ visit serves as a timely reminder of the complexities involved in balancing investment, sustainability, and social equity in resource extraction.

For Ghana, the development of its lithium reserves represents both an opportunity and a test: a chance to emerge as a key player in the global energy transition, but only if managed with care, transparency, and foresight.

READ ALSO: Bulls on Rampage as GSE Adds Over 14 Points