China, the world’s second-largest economy, is accelerating its leadership in the global energy transition with groundbreaking strides toward low-carbon energy sources and electric vehicle (EV) dominance.

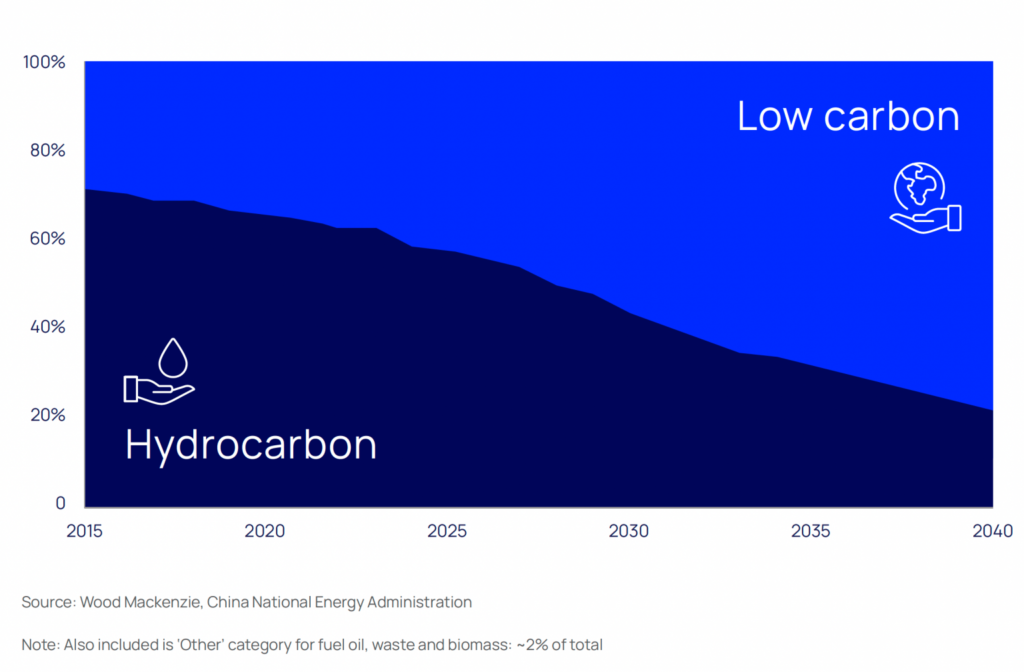

According to a recent report by resource consultancy Wood Mackenzie, the country is on track to source half of its electricity from low-carbon energy, including hydroelectric, solar, wind, nuclear, and energy storage technologies, by 2028.

The ambitious shift in energy infrastructure underscores China’s commitment to both decarbonization and energy security amid surging demand and global competition.

Malcom Forbes-Cable, vice president of upstream and carbon management consulting at Wood Mackenzie, highlighted the scale of this transformation in the report.

“Never has the world witnessed the pace of growth or transformation of an energy system that China is currently achieving.

“By 2025, China’s installed solar and wind capacity will exceed that of both Europe and North America.”

Malcom Forbes-Cable, vice president of upstream and carbon management consulting at Wood Mackenzie

Forbes-Cable attributed this growth to a combination of government policy, technological advancements, and a strong focus on energy market reforms.

China’s energy ambitions extend beyond electricity supply to transportation, where its EV market has achieved impressive dominance. Battery electric vehicles (BEVs) are expected to represent about two-thirds of all passenger car sales by 2034.

When hybrid electric vehicles (HEVs) are factored into the equation, this percentage jumps to a staggering 89%. According to Wood Mackenzie, BEV sales are forecasted to grow by 8% annually through 2030, while sales of traditional internal combustion engine (ICE) vehicles will decline at an annual rate of 11%.

“This extraordinary growth of the Chinese EV auto industry is transforming the domestic market and flowing through to the global market,” Forbes-Cable wrote, emphasizing that China’s EV expansion is reshaping both supply chains and market dynamics.

This growth comes with significant implications for global automakers competing with China’s technological and manufacturing capabilities. Indeed, China is not only transitioning its transportation system domestically but also emerging as a formidable competitor to Western carmakers in global markets.

Consumer Preference for Local Brands

One of the key drivers of China’s EV dominance is its ability to balance affordability with technological innovation. Analysts attribute this to the cost-to-quality ratio that Chinese automakers, such as BYD and Geely, have perfected—offering competitive pricing without compromising quality.

Consumers’ preference for local brands reflects this trend, with Chinese companies increasingly capturing market share both domestically and globally.

Experts like Amrith Ramkumar of The Wall Street Journal suggested that the rapid innovation, combined with strategic government support, is setting the stage for Chinese companies like CATL and BYD to become global leaders in EV manufacturing.

“A lot of the Chinese EVs, investors and executives say, are superior in many ways, and they cost a fraction of what EVs cost in the US and Europe.

“You can factor in tariffs, but even with the tariffs, the Chinese cars still might be roughly cost-competitive, which is mind-boggling.”

Amrith Ramkumar of The Wall Street Journal

Beyond transportation, China’s energy transition is redefining its entire electricity system. According to Wood Mackenzie, by 2029, half of China’s electricity supply will come from low-carbon sources.

This will include renewables like solar and wind, as well as nuclear and hydroelectric power. The report suggests that by 2037, solar and wind energy will outpace coal-fired power generation, marking a seismic shift in the country’s electricity mix.

This clean energy transition is being fueled by an array of government policies focused on improving energy security, ensuring economic growth, and addressing climate change through decarbonization.

Between 2018 and 2023, China’s annual electricity demand grew by 6%, and forecasts predict steady demand growth of 5% annually through 2030. This demand is driven by electrification, technological investment, high-tech manufacturing, and an increase in residential and commercial power consumption.

China’s energy and EV transition highlights its long-term strategy, driven by a mix of geopolitical imperatives, technological leadership, and sustainability goals.

The strategy involves leveraging subsidies, technological development, and industrial policies to ensure that the country maintains its global economic influence while addressing both climate change and population needs.

This rapid transformation signals that China’s clean energy and EV dominance will likely shape the future of both global trade and climate change mitigation efforts.

As the Wood Mackenzie report suggested, the world has never before seen the scale or speed of an energy transition on this scale. As China continues to lead the way, its vision for low-carbon energy and technological innovation will undoubtedly influence the path toward a greener future.

READ ALSO: Georgian Lawmakers Vote In Kavelashvili As President