Ghana’s bauxite deal with Chinese State-owned firm, Sinohydro poses environmental risks to the country’s key forests, a report has warned.

As a result, the report recommends that, although renegotiating the agreement may be difficult, it is more likely for Sinohydro and its lenders to adopt a renegotiation. This is due to the economic downturn caused by the COVID-19 pandemic.

Should that happen, the report advocates that Ghana could negotiate a more flexible payment schedule dependent on aluminium industry revenue levels.

Also, Ghana could opt for a prolonged grace period and loan repayment period. This will allow the Ghana Integrated Aluminium Development Corporation (GIADEC) more time to develop Ghana’s Aluminium industry sustainably.

Furthermore, the Minerals Commission should refrain from issuing licenses for proposed bauxite mines in the Atewa Forest Reserve. At least, until a reassessment of the merits of siting mines in the Atewa Forest has been completed. This should be based on scientific evidence and input from local communities.

The report further underscores the need for EPA’s autonomy from political influence. It also recommends that parliament should reform the EPA Governing Board membership. While doing so, also determine the grounds upon which the President authorizes to terminate Governing Board of Directors.

Background to Ghana-Sinohydro deal

Facing a huge infrastructure financing gap, costing about US$30 billion, Ghana signed an agreement with Chinese State-owned firm, Sinohydro Corporation in 2018. The agreement was to secure financing for Ghanaian infrastructure projects worth US$2 billion.

In exchange, Ghana would use income generated from the sale of bauxite, refined bauxite, and aluminium to repay the loans.

Ghana also agreed to collateralize the loan by creating an offshore escrow account. This account would be Ghana’s sole account for receiving revenues generated from the sales of the refined bauxite.

Even then, NGOs and the public raised concerns over planned Integrated Aluminium Industry Plan projects. Thus, triggered by the environmental and social risks they pose. Terrence Neal, author of the report, brings more clarity to the imminent risk that may raise its ugly head, going forward.

Criticisms about Agreement

The Duke University report cautions that Ghana’s experience with the Sinohydro agreement may create a scenario where the government prioritizes fiscal and economic factors to the detriment of environmental protection and sustainability objectives.

Essentially, the report draws sharp criticisms against the agreement. Accordingly, it points out that the environmental costs associated with the deal far outweighs the potential benefits.

By far, Ghana’s laws expressly require that the Environmental Protection Agency (EPA) conducts environmental impact assessment before permits can be issued out to developers of bauxite mines. This is so that, projects of such nature can commence.

According to law, the EPA uses high-level discretion in these processes. However, all the planned projects may be approved, the report cautions. That notwithstanding, the processes involved may be influenced by presidential priorities and politics, without consideration for prioritizing risk avoidance, the report argues.

So far, US$646 million of the total amount have been approved for disbursement, the report says.

“If Ghana fails to comply with its collateral or repayment obligations, Sinohydro is entitled to repayment of outstanding loan balances. And may seize the full balance of the escrow account.”

Nonetheless, the report raises red flag concerning Ghana’s ability to repay the loan. Because, Ghana cannot generate sufficient funds from the country’s aluminium industry to satisfy the loan repayment and collateral obligations.

The major contention with Duke University’s environmentalists is the plan to permit bauxite mining in Atewa Forest, a biodiverse forest preserve. The forest is the main source of three major rivers that provide water for five million people.

Rising concerns about risks

Recently, three global manufacturing companies- BMW Group, Tetra Pak and Schuco International indicated their disinterest to source bauxite from Ghana’s Atewa Forest, due to the environmental risks linked with mining in the forest.

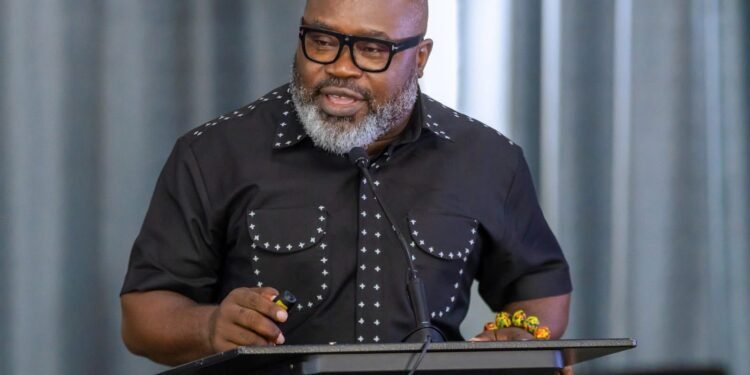

Terrence Neal, a natural resources governance researcher and author of the report said that:

“By calling out the risky nature of mining bauxite in the Atewa Forest, BMW Group, Tetra Park and Schuco International have certainly put the business community on notice.

“… their peer firms are likely to proceed with caution when sourcing bauxite from Ghana in the future.”

Neal intimated that studies suggest Chinese extractive firms are often less experienced. Not only that, they have less developed internal systems for interacting with locals and other stakeholders than their Western counterparts.

Furthermore, they place less emphasis on voluntary environmental and social standards when operating overseas, he noted.

However, he underscored that the above does not suggest there cannot be any way to leverage the resource-financed agreement to meet sustainable development standards and objectives.