Domestic fuel prices are likely to reach GHS10.00 in the first pricing window of May 2022, considering the scenario that fuel prices rise by 5 per cent on average in each pricing window.

Between January 1, 2022 and March 1, 2022, price at the pump has increased by more than 18 per cent among the three big oil marketing companies (OMCs), with current fuel price reflecting a 3.75 per cent increase, specifically, for TotalEnergies (i.e. from GHS7.99 to GHS8.290).

Ex-pump prices during the second pricing window of February 2022 for Total Energies and GOIL jumped by more than 6 per cent and 7 per cent respectively.

What lies at the core of this dilemma is the worsening geopolitical tensions between Russia and the West as well as other destabilizing macro-critical factors such as the depreciation of the cedi which continues to weigh on fuel prices.

According to Fritz Moses, a research analyst at the Institute for Energy Studies (IES), “it is largely the cedi depreciation that is driving [the rise in fuel prices], adding that “the cedi has depreciated by 4.2 per cent to settle at GHS6.85 in the last pricing window.”

Considering the former case, however, deepening sanctions by the West on Russia in terms of its participation in the swift financial system, targeting oligarchs, among other new sanctions now appear to be biting Moscow hard, gradually squeezing the life out of Russia’s once vibrant economy.

Share Offloads in Russia’s Energy sector

Although neither EU nor the U.S. has applied sanctions to cut off investment into Russia’s energy sector due to fears of worsening energy security issues, BP and Shell have jointly decided to abandon their stakes in the Kremlin’s oil and gas industry, leading to impairments of over $25 billion and $3 billion respectively. And now, though unintended, the world’s second-largest natural gas producer and third-largest oil exporter is being hit.

According to Reuters, Shell has decided to offload its 27.5 per cent stake in the flagship Sakhalin 2 LNG plant, and which is owned and operated by Russian gas giant Gazprom as well as exit its joint venture with Gazprom on the Salym Petroleumm Development, while BP is to offload its 19.75 per cent shares in Russia’s oil giant Rosneft.

Particularly, Shell’s Chief Executive Ben van Beurden said in a statement:

“We are shocked by the loss of life in Ukraine, which we deplore, resulting from a senseless act of military aggression which threatens European security.”

Ben van Beurden, CEO

BP’s chief executive, Bernard Looney, speaking on BP’s exit to the BBC said:

“I am convinced that the decisions we have taken as a board are not only the right thing to do, but are also in the long-term interests of BP.”

Bernard Looney , CEO

Due to these signals of exit by oil majors, investors are thus responding to the potential crippling impact on the Russian energy sector.

As of March 2, 2022, Brent crude now sells at $109.91 while WTI crude now stands at $108.25, fast-approaching the $125 per barrel mark, according to analysts.

Develop Home-grown strategies to Cushion Domestic Market

Speaking to the Vaultz News on these developments, Dr Yussif Sulemana, Petroleum Production Specialist at Petroleum Development, Oman said:

“With respect to these possibilities of share offloads, the impact will only come if Russia does not have that ability in terms of financial muscle and technical capability to reabsorb those shares. But Russia has been in the industry for quite a long time, and they should at this moment have the [wherewithal] to reabsorb those shares if it comes to that.

“And if actually, these players force to offload those shares, it will come at a cheaper cost to Russia… and I think there is also potential within the eastern part of the world like China, and others to be interested in those shares. Overall, these developments are not a good thing for the energy industry… we are just hoping and praying that we can have a quick resolution to the Russian crisis.”

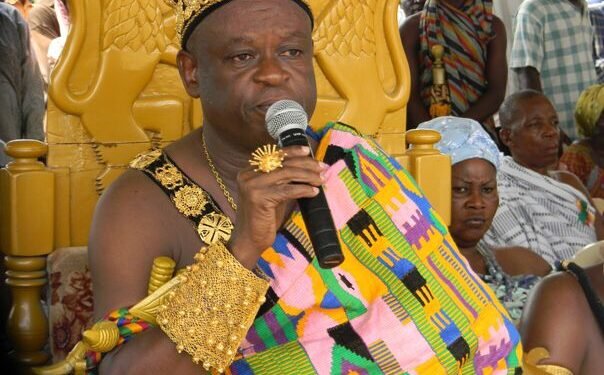

Dr Sulemana

Considering the repercussions of the escalating tensions on the Ghanaian economy, the petroleum expert said:

“With or without the Russian crisis, we need to have home-grown strategies… that will be able to counteract this volatility in the international market when they do hit…

“We need to make a concerted effort to link up the upstream and downstream… have a local refinery base… a reliable buffer in terms of storage capabilities. These are key opportunities that we can take advantage of, if this conflict continues to escalate.”

Dr Sulemana

According to Dr Sulemana, as it stands now, “energy transition in terms of renewable energies should have been in the position… to rub shoulders with the world of hydrocarbons in terms of competitiveness. So my fear is, if oil price is around 100+ and we can’t have renewable energies fill up the space, then we have a long way to go.”

READ ALSO: Failure to Consult, Causing Problems in passage of E-levy- Dr Obed Asamoah