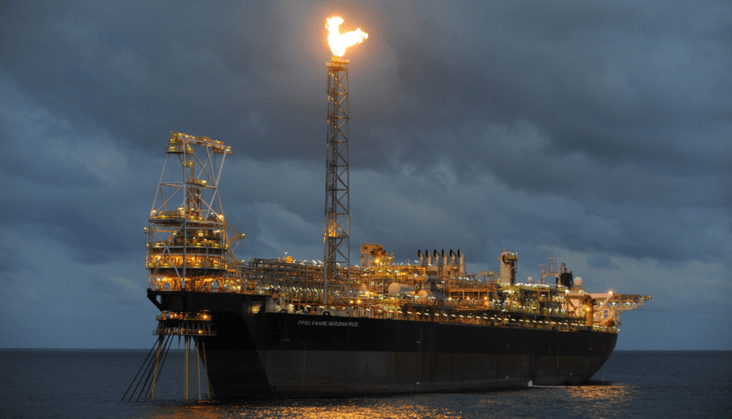

GNPC received a total amount of US$2,405.99 million, representing 30 per cent of total revenues accrued from Ghana’s upstream petroleum activities since 2011 to June 30, 2022, according to a semi-annual report released by the Bank of Ghana (BoG).

This represents both level A and B receipts, indicating funds for GNPC’s equity financing and funds for the NOC’s discretionary use, respectively. Other allocations over the period show that the Annual Budget Funding Amount (ABFA) received a total of US$3,082.68 million representing 38 per cent of the total revenue.

Likewise, the Ghana Stabilisation Fund (GSF) and the Ghana Heritage Fund (GHF) each received an amount of US$1,819.47 million (23%) and US$770.69 million (10%) respectively.

The Petroleum Holding Fund Account (PHF) at the end of H1 2022, held a balance of US$0.37 million which comprised a mandatory balance of US$0.20 million and PHF overnight interest of US$0.017 million.

“In line with Section 23(4) of the PRMA, Act 815 and Act 893, as amended the cap remained unchanged at US$100 million as set by the Minister of Finance (As part of the Minister’s mandate under the PRMA 2011, (Act 815) Section 23(3)) with a Parliamentary resolution.”

BoG

The accumulated excess over the cap withdrawn in H1 2022 was US$144,888,360.88 while the new accumulated excess over the cap at the end of H1 2022 stood at US$273,788,783.74.

Returns on Investment of GHF

In H1 2022, the Bloomberg Barclays U.S. Treasury Index returned -9.14 per cent. The total return on investment of the Ghana Heritage Fund (GHF) for H1 2022 was down by 7.45 per cent. The two-year annualized return and three-year annualized return were down by 4.95 per cent and 1.18 per cent respectively for GHF.

For the review period, the difference between the U.S. 10-year Treasury note yield and the 2-year note yield widened by 72.25 per cent from 77.40 per cent in December 2021 to 5.15 per cent at the end of H2 2022. The 3-month Treasury bill rate rose by 160 bps from 0.03 per cent to end H1 2022 at 1.63 per cent.

The U.S 10-year Treasury note yield increased by150 bps from 1.51 per cent in December 2021 to 3.01 per cent in June 2022, while the yield of the 2-year note, sensitive to imminent Fed moves, rose sharply by 223 bps from 0.73 per cent in December 2021 to 2.96 per cent at half-year-end.

The 30-year Treasury bond yields increased by 128 bps within the same period. This led to a decrease in capital appreciation as bond prices fell sharply on net. In H1 2022, the Ghana Petroleum Funds returned a net realised income of US$7.13 million compared to US$8.74 million in H1 2021.

The Ghana Stabilisation Fund contributed 10.77 per cent or US$0.77 million to total net income compared to US$0.10 million in H1 2021 whilst GHF contributed 89.23 per cent or US$6.36 million compared to US$8.64 million in H1 2021.

The Ghana Petroleum Fund (GPF) reserves at the end of H1 2022 was US$1,223.70 million (GHF was US$849.91 million and GSF was US$373.79 million) compared to US$815.29 million in H1 2021 (GHF was US$676.45 million and GSF was US$138.84 million).

READ ALSO: Export Revenues from Ghana’s Major Commodities to Rise in 2022