Dr Yusif Sulemana, a Petroleum Expert and the Senior Oil Production Operations Specialist with Petroleum Development Oman, has expressed doubts over the significant impact of the government’s directive to GOIL to reduce fuel price on the market.

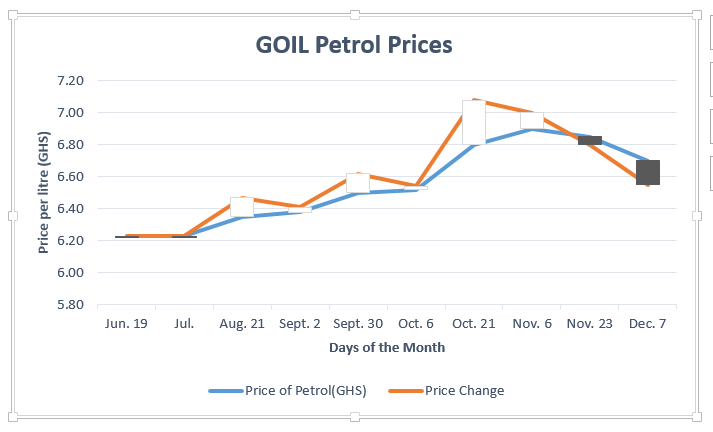

This comes at a time when the government, in a stakeholder consultation with transport operators in the country directed that the Ghana Oil Company (GOIL) reduce its fuel charge by 15 pesewas to GHS6.70.

By this action, the government seeks to inject some level of price competition into the downstream sector such that the bigger OMCs like Shell and TotalEnergies would have no choice than to reduce their prices, thus warranting this move.

While this reflects a temporary measure by the government to avert strike actions staged by transport unions in the country, it will be mere ‘exaggeration’ to indicate that this will suffice to drastically drive fuel prices down, Dr Sulemana disclosed.

“…This is a temporal measure, however, I think the direction that the government is taking is to bring back GOIL to play the role that it played just after the price deregulation.”

Dr Yusif Sulemana

The period after the deregulation of the downstream petroleum industry marked a boom period for GOIL in terms of increasing its market share, “and how they did it was to churn out volumes by delivering quality products at competitive prices”.

As of 2016, GOIL had been “able to capture the market” with a share of 17.5 per cent. Fast forward, GOIL has become “so commercialized to the extent that they are now competing with the larger OMCs like TotalEnergies and Shell.

“So, if government wants to let GOIL play the role of a market stabilizer, we need to see how it will work out. The amount that GOIL is asked to reduce, I doubt that it will have that significant impact, but what it symbolizes is a good move.”

Dr Yusif Sulemana

Further Price Hikes Despite Omicron

Following recent global market dynamics, market fears about the impact of the Omicron variant led to reduced oil prices by around $10 a barrel last week, however, big OMCs failed to reduce fuel prices with the exception of GOIL, which sold fuel for GHS6.85 down from GHS6.90.

Should that trend persist alongside this directive by the government, it would only be a matter of time for Shell and TotalEnergies to have no alternative than to reduce their prices. However, this distorts the market and has the tendency to worsen the financial viability of OMCs that may have already been weakened by the high crude prices.

Meanwhile, since Covid, Oil Marketing Companies (OMCs) have been far more reluctant to pass on any savings, at the time crude sold less at the pump, although they are in a position to pass on any savings in wholesale price to petroleum consumers far more quickly.

At present, Omicron fears seem to be allaying, and OPEC+ is sticking to its defined oil output for the last quarter. These positives are aiding to push fuel prices up, making 5% gains on December 6, 2021, after plunging as a result of the Omicron-induced fears. Therefore, “taking GOIL in isolation to cool down the market will be very difficult,” Dr Sulemana said.

Besides, “… now GOIL is also a commercial entity. How much can we pin GOIL down just to be able to cool down the market?” This means that given its current role of commercialization, GOIL has little room to reduce prices against opposing market conditions due to the dire effects such an action may have on its financials as well as the greater uncertainties that plague the market.

Directive to Further Constrict GOIL’s Financials

Looking at GOIL’s financials, the company made a profit before tax of GHS14,336,000 between the period of June and September 2021, compared to an amount of GHS20,164,000 during the same period in 2020 where crude price experienced a free fall.

These figures suggest the above reluctance during periods of lower crude prices as well as the dire situation such a move by the government can have on GOIL’s financial standing due to its commercial interest should this short term measure drag into 2022.

“Using GOIL at this moment is a crucial one… I think it is too early to see how it is going to have an impact but from where I sit, it is not going to have that significant impact. It is showing… that GOIL could stabilize the market. Yes, indeed, GOIL can stabilize the market. And if GOIL can sacrifice their margin and still stay within some profit margin, they will be able to cool down the market.

“But GOIL is a commercial entity with commercial interest and so how much down they can go will determine their survival. So, if they go down too much, they might crumble.”

Dr Sulemana, Petroleum Expert

PSRL Levy Nears Reversal, Review Taxes

The critical nature of the issue is heightened by the fact that the government’s recently zeroed Price Stabilisation and Recovery Levy (PSRL) which took effect on November 1, 2021, nears reversal at the end of the year.

The key factor for the government to consider is to look beyond the short term measure of using GOIL to stabilize the market and rather look at long term solutions, Dr Sulemana said.

“We need to think out of the box. It is probably to look at what I have always been calling for: How we can link up our upstream and downstream seamlessly, so that each sector can support the other. When the upstream is struggling, the downstream can support and [vice versa].

“The other option is probably to look at the taxes again. I believe we haven’t done that. My expectation was that these taxes would have been reviewed during this budget. Nothing else can be done except the taxes are reduced at this moment.”

Dr Yusif Sulemana, Petroleum Expert

However, “this is also a tricky situation” such that “if OMCs will be willing to keep down their margins or to keep their margins as it is, then government will have the flexibility of reducing the taxes. “But, if government is not assured of OMCs staying their margins or reducing them as it reduces taxes, then… the status quo will remain.”

Market watchers are eager to see how this policy by the government will impact the market, but bigger steps need to be taken. Given global market uncertainties, postponing the review of the taxes till the mid-year budget review in 2022 will be a long delay and may likely bring back agitations.

READ ALSO: Petroleum Taxes Will Be Difficult to Cancel- Hassan Tampuli