Dr Yussif Sulemana, an energy strategist and Senior Oil Production Specialist at Petroleum Development of Oman, has suggested that if the government does nothing to manage the unabated rise in fuel prices, it may as well find it difficult to manage anything in the economy.

The persistent rise in fuel prices continue to pose serious challenges to the economy as evidently seen in the rise in inflationary pressures; households and businesses lament over the neck-breaking levels of cost of living and production; the services sector has had its share in rising transactions costs leading to a slow down in patronage of goods and services.

With no immediate end in sight regarding the Russia-Ukraine war, global oil prices are likely to continue to rise further, worsening an already bad situation. Currently, oil prices are still hovering above $100/bbl feeding through the rise in pump prices on the domestic market. This phenomenon of rising oil prices will continue “until we are able to arrest the burn out of what is happening in the downstream side”.

Although the country is benefitting from the rise in oil prices on upstream operations, this is however, having a rippling effect on fuel prices on the downstream market. Meanwhile the country’s sole oil refinery is still not working at full capacity and the taxes/levies charged on petroleum products are still in place. Hence, this nullifies the gains made in the upstream petroleum market.

Weaknesses in Strategic Frameworks to Blame

Dr Sulemana said these issues are as a result of “the weaknesses within our strategic frameworks”. This is the more reason why “sometimes we complain about capital flight; that the money is not staying in Ghana because investors are taking the money out. In these times, countries need to look inwards, other than that all the hard earned monies from the downstream sector will be flown out,” he said.

“Assuming we had a robust refinery where we can refine [oil] and our Bulk Distribution Companies (BDCs) and Oil Marketing Companies (OMCs) can get these products locally, where will Oil Trading Companies (OTCs) come in this and where will the money travel.

“Any economy that is faced with skyrocketing fuel prices is bound to struggle; no matter the skills of the managers of the economy, if you can’t arrest fuel prices, you cannot manage anything.”

Dr Sulemana

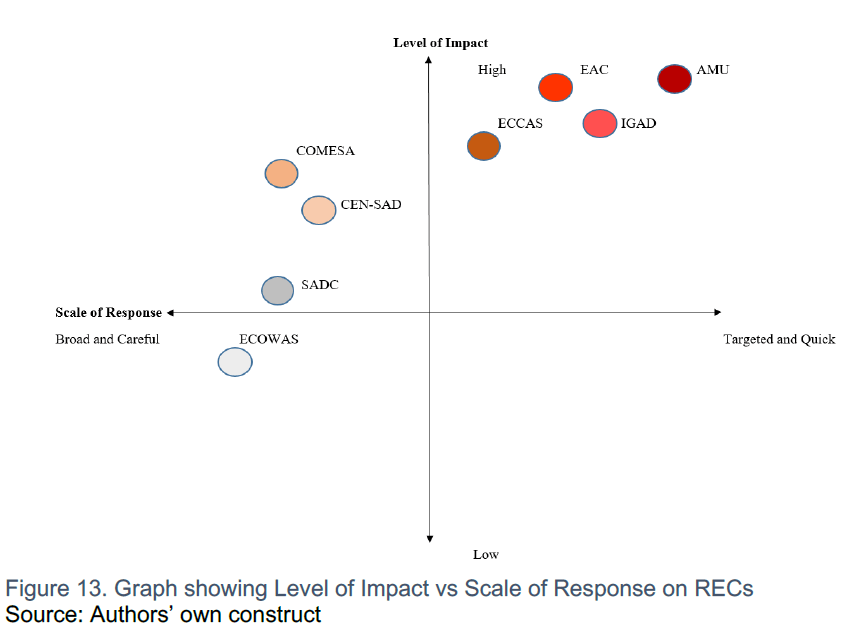

Additionally, a recent research conducted by Dataking Consulting on the impact of the Russia-Ukraine war on the eight regional economic communities of Africa, indicated that in the ECOWAS region, the impact of the war is mildly negative relative to the other regional blocs.

While commodity exporting countries in the region such as Ghana benefit from the rise in commodity prices due to the vast resource endowment, its high dependence on the imports of petroleum products will cascade into higher inflationary pressures, draining households’ budgets.

The findings showed that it will be disastrous for African governments to adopt a ‘wait-and-see approach’ to things, supposing that these conditions will self-correct eventually, should the Russia-Ukraine war de-escalate.

The authors proposed that governments in the ECOWAS region must adopt policy options that are “broad and careful” including medium-to-long term policies such as revamping or building robust local refineries.

READ ALSO: GSE Composite Index Increases More than 100 Points in May