The price of Liquefied Petroleum Gas (LPG) in the local market is expected to rise by approximately 3% per kilogram in the coming days, influenced by rising international market prices, exchange rate fluctuations, and a slight uptick in global crude oil prices.

This development has raised concerns among both consumers and industry players, who are closely monitoring the situation to determine its potential impact.

According to the Vice Chairman of the LPG Marketing Companies Association, Gabriel Kumi, the price hike is being driven by several interrelated factors.

“A careful look at the prices on international markets reveals that the price has started going up. Over the last two weeks, it has increased by about 3%,” Kumi noted.

Additionally, fluctuations in the exchange rate have played a significant role. The depreciation of the local currency, the cedi, has contributed to the upward price trend.

“The cedi has depreciated slightly over the past two weeks.

“Anytime the cedi depreciates, and international prices also see an upsurge, you are likely to see an increase in the price of LPG in the local market.”

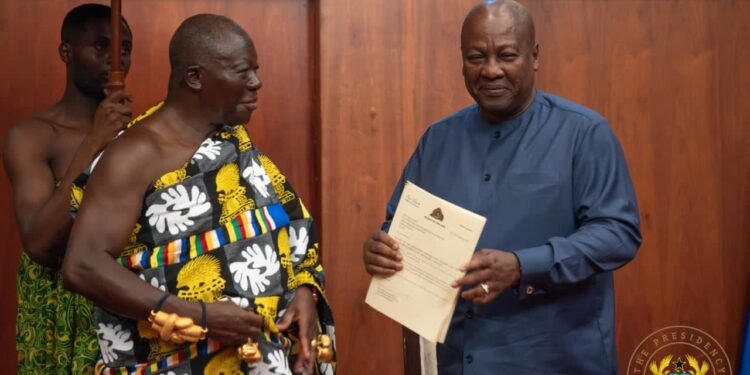

Gabriel Kumi, Vice Chairman of the LPG Marketing Companies Association

The situation is further compounded by rising crude oil prices. Although global oil prices have remained relatively stable, recent increases in crude prices to approximately $75 per barrel have added pressure to the cost of LPG.

The anticipated 3% increase in LPG prices means consumers will face higher costs for the product, which is widely used for cooking and heating in homes and businesses across the country.

For instance, a household purchasing 10 kilograms of LPG could see an additional cost of approximately 3%, depending on regional and market variations.

The Vice Chairman stressed that the ability of LPG suppliers to absorb some of the additional costs could influence the final price paid by consumers.

“If we are lucky and our suppliers, the Bulk Distribution Companies (BDCs), absorb some of the expected percentage increase, we could see a more stable price.

“But if not, there will be no option but to pass it on to our cherished consumers.”

Gabriel Kumi, Vice Chairman of the LPG Marketing Companies Association

Despite this, suppliers face their own challenges, including rising import costs and shrinking profit margins due to fluctuating international prices and exchange rates.

Global Trends and Local Implications

The increase in LPG prices is not unique to Ghana but reflects global market trends. International energy markets have experienced price volatility driven by a combination of factors, including post-pandemic demand recovery, geopolitical tensions, and efforts by major oil-producing countries to stabilize supply.

Crude oil prices, which heavily influence the cost of refined petroleum products such as LPG, have been fluctuating but remain elevated compared to historical lows seen during the pandemic.

The current price stability around $75 per barrel represents a recovery from a year of uncertainty in global energy markets.

In Ghana, the reliance on imported petroleum products makes the local market particularly sensitive to global price movements and exchange rate fluctuations.

The depreciation of the cedi adds an extra layer of complexity, as the country must spend more local currency to purchase the same amount of LPG on the international market.

Industry players remain cautiously optimistic about the potential for price stabilization. “We are hopeful that crude oil prices and the cedi stabilize. If these factors align, we could maintain a relatively stable LPG price on the market,” Kumi said.

However, the Vice Chairman acknowledged that the industry’s ability to manage costs is limited. “If suppliers and BDCs find themselves unable to absorb additional costs, consumers will inevitably bear the brunt of the price increase,” he added.

This sentiment reflects a broader challenge within the industry, where balancing operational sustainability and affordability for consumers remains a delicate task.

As the price of LPG rises by an anticipated 3% per kilogram, consumers, suppliers, and policymakers face a shared challenge in navigating the impacts of international market dynamics, exchange rate pressures, and crude oil fluctuations.

While the industry remains hopeful for price stability in the coming months, the current situation underscores the importance of addressing structural vulnerabilities within the energy sector to build resilience against future price shocks.

For now, households and businesses must prepare for higher costs, even as efforts to stabilize the market continue. The evolving situation serves as a reminder of the interconnectedness of global energy markets and the critical role of local policy and industry actions in managing their impact.

READ ALSO: Gyampo Criticizes Akufo-Addo’s Governance, Urges NPP to Rebuild