Ghana’s mining sector has long been regarded as one of the key pillars of the country’s economy. The extraction of gold and other mineral resources has generated substantial revenues that have powered economic growth and contributed significantly to the country’s GDP.

However, despite the robust performance of the mining industry, questions remain regarding the long-term sustainability and strategic management of these mineral riches.

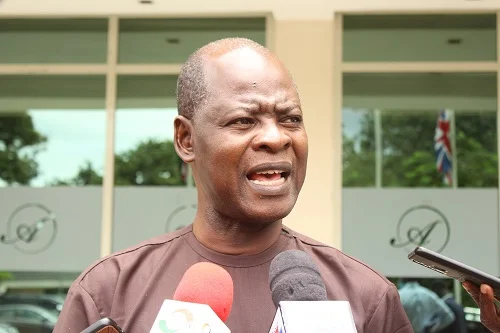

Dr. Steve Manteaw, Co-Chair of the Ghana Extractive Industries Transparency Initiative (GHEITI), has argued that Ghana’s mining revenues are heavily skewed towards consumption, with insufficient focus on strategic, long-term investments that could secure sustainable development.

“We’ve tended to treat natural resource revenues, including revenues from gold, as income for consumption.

“So, whatever we earn in the budget, we spend it the next year.”

Dr. Steve Manteaw, Co-Chair of the Ghana Extractive Industries Transparency Initiative (GHEITI)

The country’s approach—channeling mining revenues into immediate consumption rather than strategic investments—may be shortchanging Ghana’s future prosperity.

This pattern, Dr. Steve Manteaw warned, may undermine the long-term potential of Ghana’s mineral wealth. Despite the country’s gold-rich status, little has been done to transform these resources into lasting developmental assets.

Instead, revenues are often used for recurrent expenditure, such as administrative costs and public sector salaries, rather than capital investments like infrastructure, education, or healthcare.

In 2024, the mining sector was a significant contributor to the growth of Ghana’s industry sector, which expanded by 7.1% year-on-year.

This growth was largely driven by mining and construction, with the mining and quarrying sub-sector—comprising both large-scale and small-scale mining, including illegal mining (galamsey)—emerging as a primary engine of economic activity.

According to the International Monetary Fund (IMF), Ghana’s overall economic performance in 2024 exceeded expectations.

Following a two-week mission to Accra in early 2025, IMF Mission Chief Stéphane Roudet confirmed the role of mining in driving national output.

The IMF mission noted, “Growth in 2024 was higher than expected, underpinned by strong mining and construction activity.”

The 2025 Budget Statement delivered by Finance Minister Dr. Cassiel Ato Forson reaffirmed the IMF’s observations.

He credited the 5.7% GDP growth largely to the extractives sector, particularly mining, which has continued to expand despite global market uncertainties.

Call for Strategic Mining Framework

This strategy of immediate consumption has profound implications for the country’s developmental trajectory.

While short-term fiscal needs are certainly important, the failure to convert natural resource wealth into sustainable capital investments ultimately hampers economic growth over the long run.

“But to the extent that we discovered oil and developed a very fine framework for managing the oil—with clear rules on how to invest the oil revenues, how to allocate between the future and present generations—we are making much progress in improving the outcomes of the use of oil revenues than we are doing with mining revenues.”

Dr. Steve Manteaw, Co-Chair of the Ghana Extractive Industries Transparency Initiative (GHEITI)

This discrepancy, he argued, is reflective of a broader governance challenge. Unlike the Petroleum Revenue Management Act (PRMA), which provides a legal framework for saving and investing oil revenues for both current and future generations, Ghana’s mineral revenue management lacks a similar binding legal structure.

As a result, mineral wealth is more prone to short-term political pressures and fiscal mismanagement.

“At the national level, we tend to spend most of our mineral revenues on recurrent expenditure, and very little on capital expenditure.

“Even at the local level, we prioritize expenditure on recurrent.”

Dr. Steve Manteaw, Co-Chair of the Ghana Extractive Industries Transparency Initiative (GHEITI)

With Ghana continuing to attract mining investments, including those related to gold, bauxite, and lithium, the opportunity to harness these resources for transformative national development is real and urgent.

Experts have suggested that Ghana could adopt a mineral revenue governance model akin to the PRMA, ensuring that a portion of mining income is saved in a sovereign wealth fund or invested in strategic national projects.

This would not only provide economic resilience in times of commodity price volatility but also ensure intergenerational equity in resource utilization.

Moreover, local governments and Metropolitan, Municipal, and District Assemblies (MMDAs) are being urged to adopt more prudent financial practices when using mineral royalties and allocations.

“A lot of the money goes into garbage collection, buying of stationery and stuff like that, and very little into infrastructure development.

“And if we continue that way, chances are that we will produce gold for another hundred years and see very little benefit.”

Dr. Steve Manteaw, Co-Chair of the Ghana Extractive Industries Transparency Initiative (GHEITI)

As Ghana continues to experience impressive growth driven in part by mining and attendant sectors, the challenge remains to harness this wealth in a manner that secures long-term prosperity.

The time, as Dr. Manteaw argued, is ripe for rethinking and restructuring fiscal policies to capture the true potential of Ghana’s mining wealth, ensuring that the country not only mines gold today but also builds a prosperous future for generations to come.

READ ALSO: Ghana, Czech Republic Deepen Ties with President Petr Pavel’s Visit