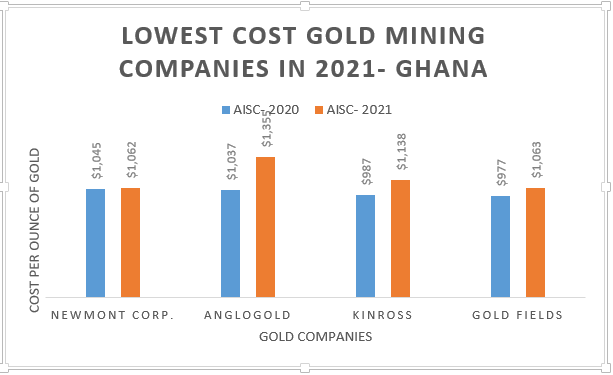

Newmont Corporation, a major mining firm in Ghana, emerged as the gold producer in Ghana with the lowest cost in full-year 2021, among a sample of mining companies operating in Ghana, according to a research conducted by the Vaultz Research.

The four gold mining companies were chosen on the basis of their vast portfolio of assets across the world, measured by total gold throughput for the calendar year 2021. The Ranking used companies’ all-in-sustaining costs (AISC) metric which is a globally accepted benchmark of a mine’s operating efficiency. These figures were compiled based on the companies’ 2021 full-year report.

Newmont Corporation, which operates the Ahafo mine in Ghana, produced a total of 5.97 million ounces of gold across all its mines, up from 5.91 million ounces of gold in 2020, representing a 1 percent increase from the prior year’s output. The company’s all-in-sustaining cost (AISC) for 2021 was $1,062 per ounce, up from $1,045 per ounce in 2020, reflecting a 1.63 per cent increase.

According to the company’s full year report, this was primarily due to higher cost applicable to sales (CAS) per ounce and elevated sustaining capital spend, “as several mines were placed under care and maintenance or experienced reduced operations in the prior year in response to the Covid pandemic”. The company expects to produce 6.2 million ounces of gold at an AISC of US$1,050 per ounce in 2022.

The company’s outstanding results in 2021 was “primarily due to higher mill recovery, a draw-down of in-circuit inventory and higher throughput in the current year, as several mines were placed under care and maintenance or experienced reduced operations in the prior year in response to the Covid pandemic,” according to Newmont’s full-year report.

In some of its mines, such as the Nevada Gold Mines (NGM), attributable gold production for the year was 1.27 million ounces with an AISC of $918 per ounce. The company’s Ahafo North mines is projected to add between 275,000 and 325,000 ounces per year with all-in-sustaining costs between $600 and $700 per ounce for the first five full years of production (i.e. 2024-2028).

Gold Fields’ Production & Cost Performance

This was followed by Gold Fields, which recorded an AISC of $1,063 per ounce of gold in 2021, only $1 per ounce of gold more than Newmont Corporation. The company’s 2021 AISC was an 8.8 per cent increase from that of the previous year ($977/oz), and slightly higher than the guidance range of between US$1,020/oz and US$1,060/oz for the year.

In the West Africa region, precisely Ghana, total managed production increased by 1% to 871koz in 2021 from 862koz in 2020, primarily driven by the increased production at Damang mine as it progressed into the main orebody at the base of the Damang Pit Cutback, the company’s full year report stated. All-in-sustaining costs for the Ghana operations increased to US$1,112/oz in 2021 from US$1,060/oz in 2020.

In the South Africa region, where Gold Fields is headquartered, gold production increased by 29% to 292,600oz in 2021 from 226,900oz in 2020 in its South Deep mine. The increased gold production was due to improved volumes. Total all-in-sustaining cost increased by 1% to US$1,310/oz in 2021 from (US$1,237/oz) in 2020 with the inflationary effect and higher capital cost fully offset with improved gold production and sales.

In the South America region, precisely, Peru, the company’s gold production decreased by 5% to 113,300oz in 2021 from 119,400oz in 2020 due to lower grade processed in its Cerro Corona mine. All-in-sustaining cost per gold ounce decreased by 68% to US$230/oz in 2021 from US$715/oz in 2020.

For its operations in Australia, gold production increased marginally to 1,019koz in 2021 from 1,017koz in 2020. All-in-sustaining cost increased by 10% to US$1,065/oz in 2021 from US$917/oz in 2020 due to higher capital expenditure, as guided, and higher cost of sales before amortisation and depreciation as a result of inflationary increases, the company’s report highlighted.

Kinross Cost Performance

Kinross, which operates the Chirano mine in Ghana, ranked third among all four mining companies, with an AISC of $1,138 per ounce of gold in 2021, up from $987 per ounce of gold in 2020, representing 15.30 per cent increase.

Annual gold production was 2.07Moz across its eight operating mines across the world: Tasiat and Chirano in West Africa; Paracatu, Fort Knox, Round Mountain and Bald Mountain in the Americas; Kupon and Dvoinoye in Russia.

At Chirano, full-year production decreased compared with 2020 mainly due to lower grades, partially offset by higher throughput. Tasiast’s full-year production was lower, and cost of sales per ounce sold higher, compared to 2020, primarily due to the mill fire in June 2021. Meanwhile, production at its Paracatu, Fort Knox mines, and Bald Mountain increased in 2021

The Company expects its attributable all-in sustaining cost to be $1,130 per equivalent ounce sold (+/- 5%) for 2022, which is largely in line with 2021 results.

AngloGold Cost Performance

AngloGold Ashanti had the highest cost, ranking fourth with an AISC of $1,355 per ounce of gold in 2021, up from $1,037 per ounce of gold in 2020, representing a steep rise in cost of 30.7%. The company attributed this cost to the challenges it faced in some of its operational mines, especially, the Obuasi mine.

Specifically, this was mainly due to an increase in sustaining capital expenditure and higher total cash costs. AISC for the year-end 2021 included an estimated $34/oz impact due to COVID-19 and an estimated $55/oz impact relating to the Brazilian TSF compliance programme, the report stated. Total production for year-end 2021 was 2.472Moz, which fell within the revised guidance range issued in the third quarter of 2021.

“Production was lower mainly due to the Company undertaking significant reinvestment across key assets, the temporary suspension of underground mining activities at Obuasi, the direct impact of COVID-19 in the first half of 2021, and secondary impacts of the pandemic, including on the mobility of labour, across the full year.”

AngloGold

With commodity prices on the ascendancy, higher gold prices will improve companies’ income streams, but rising energy costs, among other input costs will feature strongly in companies’ overall costs over the year.

READ ALSO: Rebound in Economic Activity Continues but at a Slower Pace- BoG