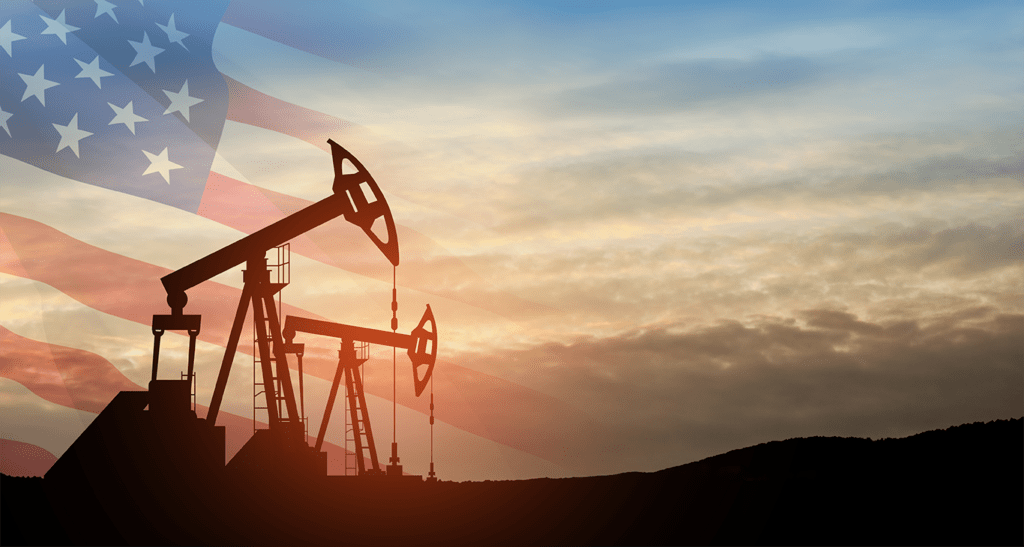

President Donald Trump has revealed that he would collaborate with Republican lawmakers in Congress to implement substantial tax cuts for domestic oil and gas producers.

The initiative aims to bolster U.S. energy production and potentially lower consumer costs amid rising gas prices. Additionally, Trump proposed allowing companies to fully expense investments in new factory construction and other capital expenditures.

Speaking at a conference organized by Saudi Arabia’s sovereign wealth fund in Miami, President Trump reiterated his commitment to boosting domestic energy production.

“As long as you invest in America, build in America, and hire in America, that means that I’m fighting for you.”

President Donald Trump

While he did not provide specific details on the tax cuts for the oil and gas sector, Trump claimed they would be part of the “largest tax cuts” in American history.

He also promised tax relief for families and workers, including eliminating taxes on tips and Social Security benefits.

Additionally, Trump emphasized the need to expand the Strategic Petroleum Reserve to ensure energy security.

“The world runs on low-cost energy, and energy-producing nations like us have nothing to apologize for.

“We have more energy than any other nation in the world, and we’re going to use it.”

President Donald Trump

The announcement comes at a time when gas prices in the U.S. have been steadily increasing, driven by a combination of seasonal refinery maintenance, fluctuating global oil prices, and geopolitical uncertainty surrounding Trump’s energy policies, particularly regarding sanctions on major oil-producing nations such as Iran.

The cost of fuel is a pressing concern for many American households, and Trump’s move seeks to address these challenges ahead of the 2025 elections.

Trump’s approval rating, according to FiveThirtyEight, has slightly declined from 49.7 percent to 48.7 percent between January 26 and February 19, partly due to economic concerns.

The success of his administration’s efforts to reduce energy costs could play a crucial role in shaping voter sentiment in the coming months.

Impact on U.S. Energy Production

Increased domestic oil and gas production could lead to lower prices at the pump by boosting supply. “Price is defined by supply and demand—unless stronger forces like government policies and control outweigh market forces,” said Karl Brauer, an executive analyst at iSeeCars.com.

If drilling restrictions are eased and tax incentives encourage higher production, the supply-side boost could potentially drive down oil prices.

However, industry insiders remain cautious. Many U.S. oil producers have been hesitant to ramp up drilling, citing concerns over volatile global prices and the long-term viability of investments in fossil fuels.

Even if domestic production rises, other market dynamics—including geopolitical factors and OPEC’s influence—could offset potential benefits.

As of Thursday morning, the national average price for a gallon of regular gasoline in the U.S. was $3.165, according to AAA, up slightly from $3.160 a week ago and $3.125 a month ago.

In states like California, where refining costs and regulations contribute to higher prices, the average stood at $4.849 per gallon.

One of the critical challenges in reducing gasoline prices is refining capacity. The U.S. refining sector has struggled to keep up with demand in recent years due to aging infrastructure and regulatory hurdles.

Refining capacity peaked in 2020 but declined in 2021 and 2022 before experiencing moderate growth in 2023 and 2024, according to the Energy Information Administration (EIA). However, it remains below pre-pandemic levels.

Trump has encouraged investment in new refineries, but experts doubt whether companies will commit the necessary capital.

“While there may be a desire for more refineries, good luck convincing a refiner that their heyday is still coming… and to invest billions in building new capacity.”

Patrick De Haan, head of petroleum analysis at GasBuddy

Refining constraints may limit the ability to process additional crude oil into gasoline, potentially counteracting the intended benefits of increased oil production.

According to De Haan, seasonal refinery maintenance and disruptions will likely push gas prices up by 25 to 60 cents per gallon by early April, with a peak expected around April 10.

President Trump’s proposed tax cuts for oil and gas producers represent a bold step toward reinforcing America’s energy independence.

However, challenges remain. Market hesitancy, refining bottlenecks, and the impact of tariffs could complicate efforts to bring down gas prices. Additionally, broader economic concerns, including inflation, could counteract potential gains.

As the administration moves forward with these policies, their effectiveness will ultimately be judged by their impact on American households and the broader energy market.

In the months ahead, consumers and industry stakeholders alike will be watching closely to see whether Trump’s energy strategy delivers on its promises.

READ ALSO: Government Urged to Reform TVET and Free SHS