The Freight Forwarding fraternity in Ghana has rebelled against government’s intended policy to allow the self-clearing of goods by importers without recourse to Customs House Agents.

According to the freight forwarders, not only does the policy threaten the security of their jobs, but if not well implemented, can have a terrible impact on trade facilitation and revenue mobilization for the state.

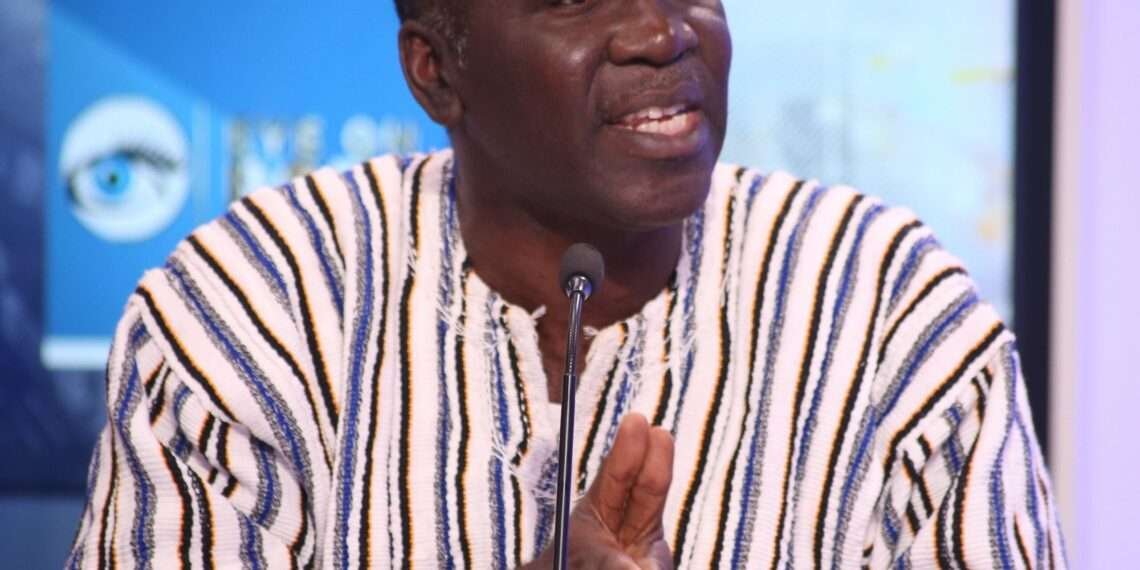

The President of the Association of Customs House Agents, Ghana (ACHAG) – Mr. Yaw Kyei, speaking during an interview noted that government may need to thoroughly reconsider the implementation of its new policy which was announced during this year’s budget reading in parliament, warning that: “If not, government will lose a lot.”

Mr. Kyei further explained that importers by themselves do not have the capacity to execute the clearance of goods due to the rigorous technical process involved in customs business.

“This system is not something you can take a day or two to go through. I wonder how we will train and educate the general public from all across the country to successfully do a declaration to clear goods at the ports. We believe that asking individuals to clear goods by themselves will be disastrous for the nation.

“Will we be able to identify the importer after the transaction has ended? What is his address? Our address system in Ghana is nothing to write home about.”

Mr. Yaw Kyei

More so, Mr. Kyei pointed out that customs house agents, or clearing agents – as they are commonly referred, are taken through training, certification, licensing, registration and other necessary procedures that ensure that their activities are accountable and traceable.

“We have our offices properly inspected. Our companies are properly instituted. We have board of directors, management teams and assets recognized by customs and by the state so that in the event where something goes wrong, you can fall on any of them.”

Mr. Yaw Kyei

Adverse Nature Of Government’s Self-declarant Policy

Accompanying Mr. Kyei is the President of the Ghana Institute of Freight Forwarders (GIFF) – Mr. Eddy Akrong, who doubled down on the notion saying millions of cedis are recovered by Customs during Post-Clearance Audit due to the existence of clearing and forwarding agents.

“If an individual clears goods, and for some reason customs detects any malfeasance, they come through us. Imagine if this individual comes from some far place across the globe, Customs will have to spread themselves to get hold of this person, without us.”

Mr. Eddy Akrong

According to Mr. Akrong, so far as companies can apply for training and licensing to be able to clear their own goods, his outfit isn’t entirely against the concept of self-declarants as Ghana’s law already makes provision for that.

He however stated that the freight forwarding fraternity will only feel short-changed if the rigorous and expensive processes undergone to train, certify, license, and register customs are relinquished in service of this new regime.

The President of GIFF explained that importers, already inundated with their business load, simply lack the time and knowhow to undergo customs house processes.

Mr. Akrong disclosed that Ghana’s clearance system as it stands has the clearing agent acting as a liaison between importers, shipping lines, customs administrations, several regulatory agencies, terminal operators, and the processes involved require some level of technical ability and tact to efficiently execute.

“The whole system will become confusing because the trader will have to deal with all these people.”

Mr. Eddy Akrong

The leadership of these freight forwarding associations expressed suspicion that this impending regime of self-clearing stems from the need to abide by the World Trade Organization’s objectives for trade facilitation. Yet, they asked government to tarry awhile while it takes initiatives that cater to the context of Ghana’s maritime trade.

In the meantime, they have continued to petition government especially parliament to clarify the nature of the impending policy action, with focus on the implications on job security, and security of state revenue.

Read also: GITC Turns Down Request to Waiver On Anti-Dumping Duty on Asadtek Group Consignments