The 2025 budget statement has sparked discussions across various sectors, particularly within the private sector and other key financial sectors of the Ghanaian economy.

One of the most notable analyses comes from Mr. Joe Jackson, CEO of Dalex Finance, who stated that the 2025 budget tries to live within its means. He offered a balanced critique of the budget, acknowledging its strengths and potential pitfalls.

In his commentary, Mr. Jackson commended the finance minister Dr. Ato Forson for his candid approach in outlining the country’s financial struggles. He said;

“First of all, you have to admit that the Minister of Finance did not shy away from telling us how dire things are and how he hopes to fix it. To that extent, he does address some of our concerns.”

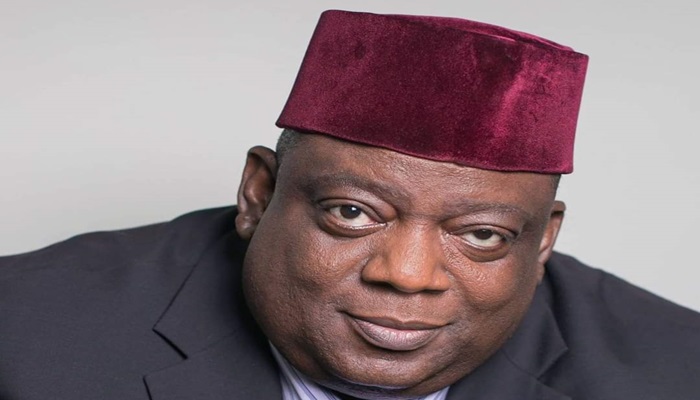

Mr. Joe Jackson CEO of Dalex Finance

According to Mr. Jackson, a critical issue the budget seeks to address is the commitment to reducing the budget deficit.

“Last year, all the targets that had been set and agreed with the IMF were thrown out of the window. The budget surplus turned into an over 3% budget deficit, which means we went back to borrowing even more. So, to that extent, this budget tries to live within its means [and] this budget tries to address some of the issues and its policy.”

Mr. Joe Jackson CEO of Dalex Finance

Tax Reductions and Revenue Strategies

One of the key aspects of the budget that Mr. Jackson lauded was the government’s decision to eliminate some unpopular taxes.

“On one hand, he’s taking certain taxes away. E-Levy gone. Betting tax gone… A lot of those taxes that irritated us are gone.”

Mr. Joe Jackson CEO of Dalex Finance

Despite these tax reductions, Mr. Jackson pointed out that the government has not significantly increased other tax handles. Instead, it has opted to focus on improving compliance and reducing tax refunds as a means of bridging the revenue gap. He described this as a reasonable approach. Thus, in his view, this approach reflects an effort to strike a delicate balance between generating revenue and not overburdening the private sector.

He emphasized that adherence to fiscal targets, policy consistency, and avoiding major policy reversals will be crucial. He said;

“A lot of this budget is going to be dependent on the willingness of this government to face up to the hard decisions it has to take in executing what it has set out.”

Mr. Joe Jackson CEO of Dalex Finance

He further noted that external factors, such as global economic conditions, could impact the government’s ability to implement its plans effectively. However, he noted;

“If the [government] does so, they will be hailed as one of the best governments we’ve had in a time of real crisis.”

Mr. Joe Jackson CEO of Dalex Finance

Mr. Jackson injected a touch of humor into his analysis, suggesting that the only missing element in the budget was the inclusion of biblical references, suggesting the budget was a perfect start up for the Mahama’s administration.

Private Sector Expectations and Concerns

From the perspective of the private sector, Mr. Jackson highlighted key areas that businesses would be monitoring closely. These include; Timely and Transparent Clearance of Arrears. He noted that the private sector expects the government to honor its commitments by clearing outstanding payments to businesses.

Clear Guidelines for Tax Reforms; Businesses need well-defined policies, particularly concerning VAT, to enable proper planning.

Reliable Infrastructure and Energy Services; The government must address the ongoing challenges in the energy sector, including resolving energy sector debt.

These, he argued, are non-negotiables if the government is serious about fostering economic stability and private sector growth.

A major focus of Mr. Jackson’s analysis was the financial sector. He noted that the government has allocated GHS 2.2 billion for the recapitalization of the Agricultural Development Bank (ADB) and the National Investment Bank (NIB). Additionally, the Bank of Ghana itself requires a bailout of GHS 53 billion to remain operational.

According to Mr. Jackson, the situation is dire, with some financial institutions struggling to survive and others folding up.“Some of them are dead men walking, some of them are blind in the land of the blind.” he said.

He commended the government for not shying away from the financial sector’s challenges but stressed that real solutions must follow, and these solutions must be backed by tangible financial commitments. Mr. Joe Jackson’s overall assessment of the 2025 budget is that it is a step in the right direction.

“If the government has the willpower to stick to this, we should be fine. If there are no major policy reversals, we should be fine. If there are no external events that will impact us badly, we should be fine.”

Mr. Joe Jackson CEO of Dalex Finance

In the end, Jackson’s message is clear; the budget provides a framework, but its success will depend entirely on disciplined implementation and a steadfast commitment to economic recovery.

READ ALSO; Ghana Needs Economic Shock Absorbers, Not IMF Interventions- Prof. Gatsi