Fitch Solutions, a UK-based economic research and risk analysis firm, has reaffirmed its 2025 Gross Domestic Product (GDP) growth forecast for Ghana at 4.2%.

This projection slightly exceeds estimates from other global financial institutions, including the International Monetary Fund (IMF), which forecasts a 4.0% growth rate, and the World Bank, which expects 3.9%.

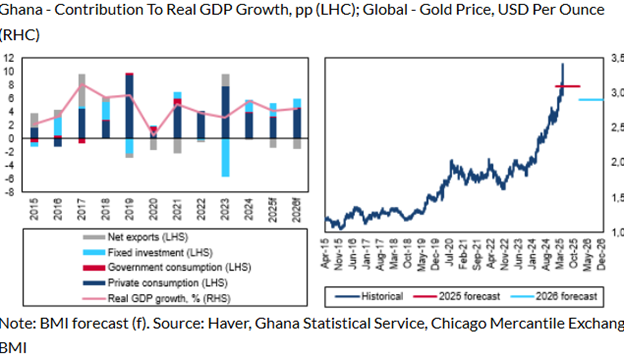

The optimism from Fitch Solutions reflects a growing confidence in Ghana’s resilience amid global economic uncertainties. In particular, Fitch cites Ghana’s strong gold export performance and limited exposure to certain global trade dynamics as key drivers for this maintained outlook.

Gold Prices Shield Ghana from Global Slowdown

One of the core reasons behind Fitch’s forecast is the impact of historically high global gold prices. Ghana, as one of Africa’s leading gold producers, is poised to benefit significantly from this development. Elevated gold prices are expected to increase export revenues and improve the country’s fiscal performance. According to Fitch Solutions, this trend will enhance government revenue collection and help stabilize the local currency.

“While we note that Ghana is exposed to the broader effects of a global economic slowdown stemming from US-China trade tensions, we believe the impact will be offset by the rise in global gold prices,” the report highlighted. The firm believes that this windfall from gold will not only bolster Ghana’s international reserves but also provide the Bank of Ghana with enough buffers to keep the cedi stable against major foreign currencies.

Another positive aspect outlined by Fitch Solutions is Ghana’s insulation from rising trade protectionism, particularly from the United States. The US, under former President Trump, implemented a number of tariffs affecting global trade, but Ghana’s major export commodities—gold and crude oil—remain unaffected.

Moreover, Ghana’s trade exposure to the US is relatively minimal. The United States accounts for only 4.0–5.0% of Ghana’s total exports, making it a less critical trading partner compared to others. Instead, Ghana’s primary export destinations include mainland China and European countries, particularly Switzerland and the Netherlands. This trade diversification acts as a buffer, helping Ghana manage external shocks more effectively.

Exchange Rate Stability and Fiscal Benefits

The stable outlook for Ghana’s GDP is also rooted in anticipated exchange rate stability. With increased gold earnings contributing to a more robust foreign exchange reserve, the Bank of Ghana is better positioned to defend the cedi from external volatility. This in turn supports macroeconomic stability, encourages investor confidence, and curbs inflationary pressures in the medium term.

Higher gold export revenues also mean increased tax and royalty income for the government, helping to narrow the fiscal deficit and improve the country’s overall economic health. With debt sustainability remaining a key concern for Ghana, especially following its recent restructuring efforts, improved fiscal space could allow the government to refocus on development spending and social investment.

Despite the broader global economic risks posed by US-China trade tensions and rising protectionist policies, Ghana appears well-positioned to navigate these challenges. Fitch’s assessment reinforces the idea that structural strengths—such as a diversified export base and resilient commodity sector—can shield the country from external headwinds.

The continued rise in gold prices, along with prudent macroeconomic management, will likely play a pivotal role in Ghana’s economic trajectory in 2025. While risks persist, especially regarding potential global demand slowdowns, Ghana’s position as a stable gold producer and the proactive steps taken by its central bank are expected to provide a significant cushion.

READ ALSO: Minority Joins Protest To “Defend Ghana’s Democracy”