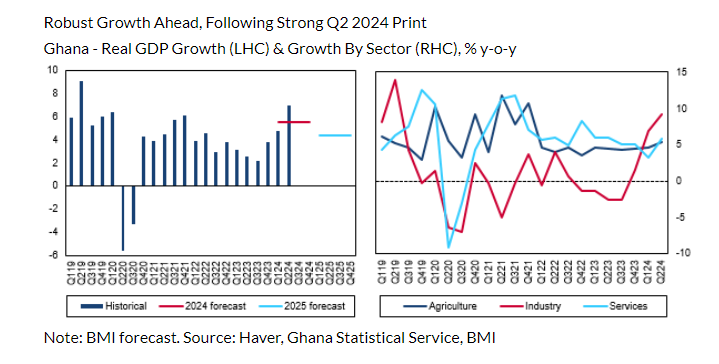

Ghana’s economy has seen an impressive rebound in 2024, recording a three-year high growth forecast of 5.5%, as predicted by Fitch Solutions.

The latest data from the Ghana Statistical Service reveals a remarkable expansion of 6.9% year-on-year in the second quarter of 2024, following a solid 4.8% growth in the first quarter. This growth has been primarily driven by stronger industrial output, particularly in mining and quarrying, as well as a robust recovery in the construction sector.

However, despite the positive outlook, Fitch Solutions has issued a word of caution regarding the sustainability of this growth in the second half of 2024. The firm forecasts a deceleration in the pace of expansion, particularly in export growth, which was a significant contributor to the country’s economic success in the first half of the year.

In the first half of 2024, Ghana’s economy benefited from several key drivers. One of the primary factors behind the strong performance was the surge in exports, which rose by 12.6% in the second quarter. This was largely due to a robust recovery in the oil sector, with international crude sales playing a pivotal role in driving overall economic growth.

Moreover, private consumption also showed impressive gains, increasing by 8.5% in the second quarter. Consumer spending had been on the rise since 2023, after a period of stagnation caused by high inflation. This recovery in private consumption, alongside a thriving export sector, created a favorable environment for economic expansion.

Ghana’s industrial output, particularly in mining and quarrying, also played a crucial role in the economy’s strong performance in the first half of 2024. The mining sector, buoyed by rising commodity prices, contributed significantly to GDP growth, while the construction sector showed signs of recovery after several years of sluggish performance.

Export Growth Faces Challenges in Second Half of 2024

Despite these early gains, Fitch Solutions has raised concerns that Ghana’s export growth may not be sustained in the second half of 2024. According to the UK-based firm, the surge in exports during the second quarter was partially driven by a robust recovery in crude oil production. However, this recovery appears to have peaked, and growth rates in oil exports are expected to moderate in the latter half of the year.

Fitch Solutions explained that while international demand for oil remained strong, Ghana’s crude production reached its peak in the first half of the year. This could lead to a slowdown in export growth, as the base of comparison becomes higher and the output growth rate begins to stabilize. With oil being a key component of Ghana’s export profile, any decline in its growth trajectory is likely to impact overall export performance.

Additionally, Ghana’s export sector faces challenges from global market conditions. With uncertainty surrounding international trade, fluctuating commodity prices, and geopolitical tensions, the country may encounter headwinds that limit its ability to maintain the strong export performance witnessed earlier in the year.

Moderation in Private Consumption Growth

Fitch Solutions also highlighted that private consumption growth, a critical driver of Ghana’s economic recovery, is likely to moderate in the second half of 2024. After a significant rebound in consumer spending in 2023, driven by a recovery from inflation-induced stagnation, the high base for comparison may result in lower growth rates.

In 2023, private consumption grew by 18.7% and 19.2% year-on-year in the third and fourth quarters, respectively. This rapid growth, while positive, has created a situation where sustaining similar rates in the second half of 2024 may be challenging. Fitch Solutions attributes this moderation to rising inflation, which continues to erode consumers’ purchasing power, and the high base effect from previous quarters.

Although inflation had shown signs of slowing down in early 2024, it remains a persistent concern. Rising food and fuel prices continue to put pressure on household budgets, potentially curbing spending in the latter half of the year. As a result, Fitch Solutions expects private consumption growth to decelerate, further contributing to the overall moderation in economic expansion.

Despite these challenges, Fitch Solutions remains optimistic about the resilience of Ghana’s consumer market. The report pointed to robust consumer fundamentals that suggest healthy spending levels will be maintained, even if growth rates slow down.

One key indicator of consumer confidence is the rise in mobile money transactions. Data from the Bank of Ghana shows that mobile money transactions grew by 21.1% year-on-year in June 2024. This suggests that digital financial services continue to gain traction, providing a convenient and accessible platform for consumers to conduct transactions. The growing adoption of mobile money indicates strong consumer engagement with the economy, which could help support private consumption in the face of inflationary pressures.

READ ALSO: NDC Commits to Religious Freedom and Moral Integrity