Ghana ranks among a few emerging and developing economies that have consistently attracted FDI inflows historically (over the long term), according to analysis by Fitch Solutions.

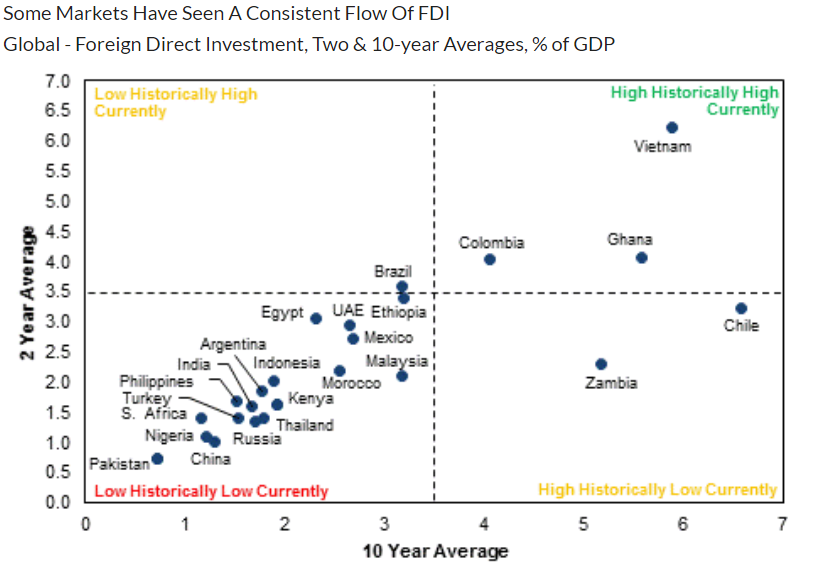

On a five and ten year average basis, Chile, Vietnam, Ghana, Zambia, Colombia and Ethiopia stand out as countries most consistent in attracting larger amounts of FDI as share of GDP.

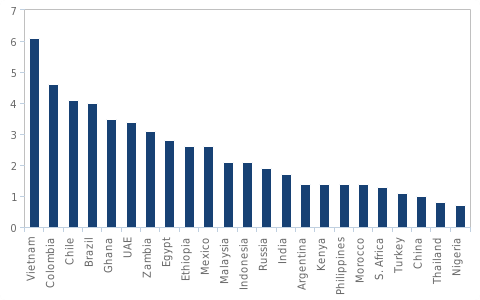

The inflow of foreign direct investment (FDI) was highest as a share of GDP in these countries. FDI as share of GDP in Ghana is 3.5%, Vietnam (6.1%), Colombia (4.6%), Chile (4.1%), Brazil (4.0%) and Zambia (3.1%), for instance.

Some Economies least Attract FDI Inflows

Although FDI is not necessarily the most important variable that could sling shot long term growth of an economy, a considerable amount of it at a consistent pace is important.

As they suggest a strong business climate in the receiving country, it allows for the transfer of technology, increases employment opportunities in host countries and productivity growth.

Notwithstanding the fact that every country attracts FDI inflows, there are disparities to the amount of inflows per country.

In contrast, economies such as South Africa, Nigeria, the Philippines, Turkey and India, but to mention a few typically attract the least of FDI as a share of GDP.

Comparing short-term averages to Long-term Averages of FDI among countries

That said, comparing two year averages of FDI inflows and ten year averages of same yields different results among countries.

By assessing the data sourced from UNCTAD and Fitch Solutions, economies such as Vietnam, Colombia and Ghana are highlighted as having attracted the most FDI as a share of GDP over both time frames (two years and ten years averages).

The other group Zambia and Chile experienced high FDI inflows as a share of GDP over the long term average. Unfortunately, both fell below the threshold of 3.5% in the short term average of two years. Based on Fitch’s analysis, this relative fall is likely due to commodity cycle. Both of these countries are major producers of copper.

It is also interesting to note that, Brazil seem to have fallen below the long term threshold of FDI inflow. But, have in recent times picked up in its share.

Furthermore, Egypt follows Brazil as economies that have begun experiencing increases in FDI inflows in recent times. However, they have historically seen falling FDI inflows as share to GDP.

Analyzing FDI Flows to Share of GDP by Brazil and Egypt

In Brazil’s case, FDI inflows increased on average by 3.6% of GDP in the past two years. Fitch postulates that, while these current trends are encouraging, they would not cause a great change in Brazil’s economy. And this is a result of structural challenges the country faces with growth.

Fitch argues that attention must therefore be driven towards major reforms as more investments are needed for the country.

In Egypt, the ten-year average FDI stood at 2.3% of GDP. Albeit in the past two years it rose to an average of 3.0%.

According to Fitch Solutions, this recent trend reflects the ongoing structural reforms of Egypt’s economy since it received the IMF package in 2016.

Furthermore, the attractiveness of a growing internal market coupled with growth in the country’s budding hydrocarbon sector also accounts for this trend.

READ ALSO: Tanzania’s economy to grow by 5.2% in 2021- Fitch Solutions