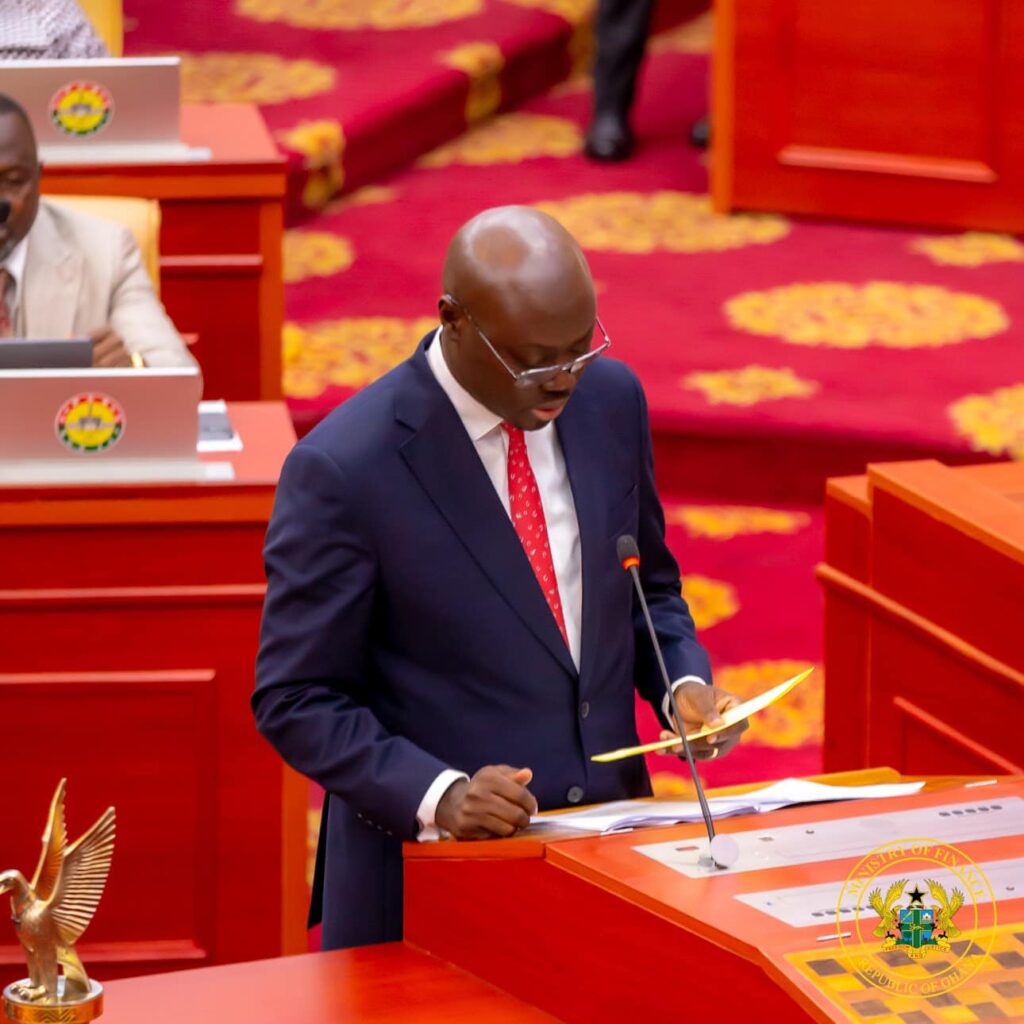

The 2025 Budget Statement, delivered by Finance Minister Dr. Cassiel Ato Forson, has ignited a fascinating debate on economic governance, tax policy, and fiscal sustainability.

Dubbed “Forsonomics”—a term introduced by Minority Leader Hon. Alexander Afenyo Markin—the budget, according to many industry experts, represents a departure from the previous administration’s approach by repealing a series of taxes without introducing new ones.

The bold policy direction has sparked discussions among analysts, business leaders, and political figures, with some lauding its ingenuity while others questioning its long-term viability.

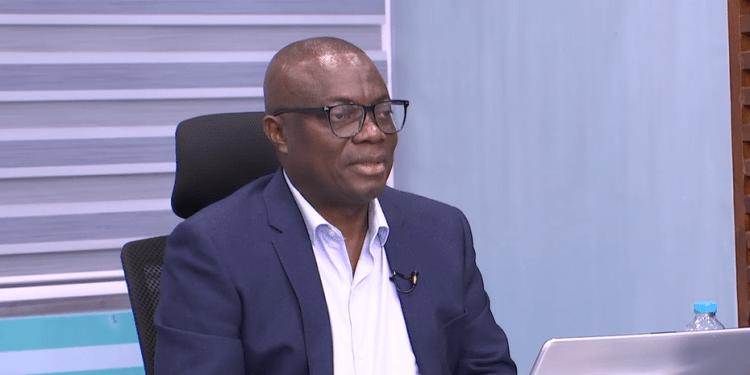

Mussa Dankwa, Executive Director of Global InfoAnalytics, sees the budget as an implicit admission that there was significant waste in the system.

“Dr Ato Forson’s tax giveaways in the midst of a turbulent economy without new taxes goes to show that there was huge waste in the system. I have not heard any group complaining about this budget yet. But glad to hear your points. Please let us know if this budget will affect you negatively”.

Mussa Dankwa, Seasoned Financial Consultant

Dr. Forson’s decision to abolish several contentious taxes—including the e-levy, betting tax, and the COVID-19 levy—has been met with optimism from businesses and the general public.

However, as Dankwa noted, the real test will be in the economic outcomes. “Ultimately, Ato’s performance will be measured by the budget outturn and not the statement he has just read.”

This underscores the reality that while policies may sound attractive on paper, their effectiveness will be determined by revenue inflows, inflation control, and GDP growth in the months ahead.

One of the most intriguing aspects of the budget is the strategic reduction in tax refund reserves from 6% to 4%. Mussa Dankwa described this as a “smart way to plug revenue loss due to tax repeals.”

This fiscal maneuver essentially reallocates funds to cover the shortfall resulting from tax eliminations without resorting to new levies.

The approach, according to Mussa Dankwa, reflects a careful balance of the minister’s areas of expertise, economics and accounting—providing relief while ensuring that the state does not bleed revenue excessively.

The 24-Hour Economy

One of the key policy proposals from the government, the 24-hour economy, received little attention in the budget, raising questions about its implementation strategy.

While the Finance Minister announced that the government would soon submit a policy document to Parliament on its implementation, Mussa Dankwa speculates that Dr. Forson may either introduce new legislation or amend existing laws to accommodate the initiative.

He asks, “Does he intend to legislate the policy or simply amend several pieces of legislation to make it consistent with other laws?”

The absence of a clear roadmap for the 24-hour economy has left some analysts wondering if the government is still fine-tuning the specifics before making any major pronouncements.

While the budget focuses on tax reforms and fiscal prudence, the long-term economic strategy—particularly with job creation and productivity growth—remains a work in progress.

Growth Targets and Sustainability

Ghana’s economic growth target of 4.4% has drawn mixed reactions. The opposition argues that this figure is not better than the 2024 5.7% it achieved as gainst the new administration’s so-called “resetting” budget. However, Dankwa challenged the government to ensure that growth is sustainable.

“Certainly, the growth target should not assume destroying the forest with illegal mining to achieve a higher GDP. I prefer 2.5% with reserves and water bodies intact.”

Mussa Dankwah, Seasoned Financial Consultant

His concerns are valid. Ghana has, in the past, relied heavily on extractive industries to drive GDP growth, often at the expense of the environment.

If the government is serious about a sustainable economy, it must ensure that economic expansion does not come at the cost of deforestation, water pollution, and ecosystem destruction.

One of the most surprising aspects of the 2025 budget is the relatively muted opposition. According to Mussa Dankwa, unlike previous years, where budget presentations were met with heated debates and rejections, this time, there seems to be a rare moment of convergence.

Mussa Dankwa observed, “Everyone appears to be happy somehow, and that should mean something, or?” The opposition’s main criticism is that while the growth target of 4.4% is commendable, it is not significantly higher than what the previous administration achieved.

They also argue that the four-month import cover, though an improvement from three months, still leaves room for economic vulnerabilities. However, these criticisms are relatively tame compared to the fiery budget debates of the past.

The Uncapping of Statutory Funds: A Bold Reversal

Another major policy shift is the uncapping of three key statutory funds: GETFund, NHIL, and the Road Fund.

These funds were capped by the previous administration, limiting their ability to allocate resources fully. By uncapping them, the government aims to increase spending on education, healthcare, and infrastructure.

This move has been welcomed by stakeholders who have long decried the artificial limitations placed on these critical funds. The Executive Director of Africa Education Watch, Kofi Asare, disclosed that the uncapping of the fund would make available GHS 49 billion for education investments from 2025 to 2028.

However, the real impact will depend on how efficiently these resources are utilized. If waste and corruption are not curtailed, the additional funds could still fail to translate into tangible benefits for Ghanaians.

The term Forsonomics—a label introduced by Hon. Afenyo Markin and humorously redefined by Mussa Dankwa—captures the essence of this budget’s philosophy.

According to Mussa Dankwa, it represents an economic management system that seeks to reverse several taxes that previously stifled businesses while rationalizing existing tax regimes to stimulate real growth.

Dankwa’s own definition suggests that Forsonomics is about giving businesses and individuals some breathing space without creating fiscal chaos. However, he playfully challenged the Minority Leader to provide his own definition of the term since he coined it.

While the initial reactions to the budget have been largely positive, its true impact will unfold over time. As Dankwa rightly pointed out, “Let’s see how business sentiments respond in the next coming days and weeks.”

Business sentiment will be a key indicator of the budget’s success. As Dankwa noted, the coming weeks will reveal how the market reacts to the announced measures. Entrepreneurs and investors will assess whether the tax reductions translate into improved profitability and economic expansion.

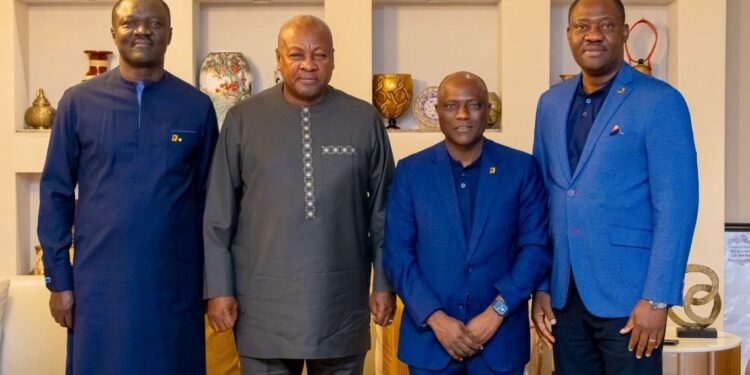

Meanwhile, Global InfoAnalytics intends to conduct a poll to gauge public satisfaction with the budget. According to Mussa Dankwa, the poll will ask Ghanaians whether they believe President Mahama’s first budget, as delivered by Dr. Forson, meets their expectations.

Dr. Theo Acheampong, a political risk analyst and fellow at the IMANI Centre for Policy and Education, weighed in on a crucial element of the budget—Ghana’s Value-Added Tax (VAT) system.

He pointed out that the effective VAT rate currently stands at around 22% due to the combination of the GETFund Levy (2.5%), NHIL (2.5%), and COVID-19 Levy (1%).

He welcomed the abolition of the COVID-19 levy but insists that Ghana needs to bring its VAT rate down to 15%-17% to remain competitive as suggested by the Finance Minister.

Additionally, he called for an increase in the VAT registration threshold to exempt small businesses from collection, as compliance remains a significant challenge.

The 2025 budget presents a bold experiment in economic management. By eliminating taxes while maintaining fiscal balance through strategic cuts and reserves, Dr. Forson has charted a new path that is worth pursuing.

The government will need to prove that Forsonomics is more than just a catchy phrase—it must deliver tangible economic relief, sustainable growth, and fiscal stability for the benefit of all Ghanaians.

READ ALSO: Starmer’s Leadership Gains Strength After Rocky Start