The government has re-affirmed its commitment towards increasing its revenues to meet the increasing expenditures to consolidate the progress made in the recovery of the economy. According to the Finance Minister, Ken Ofori-Atta, the government will increase its tax revenues from the current 14% to 20% in the medium term.

“Government is aware of the critical importance of additional revenue to finance all these initiatives that underpin our recovery and transformation agenda. Indeed, we are committed to raising our tax to GDP from the current 14% to 20% as our peers in the sub-region”.

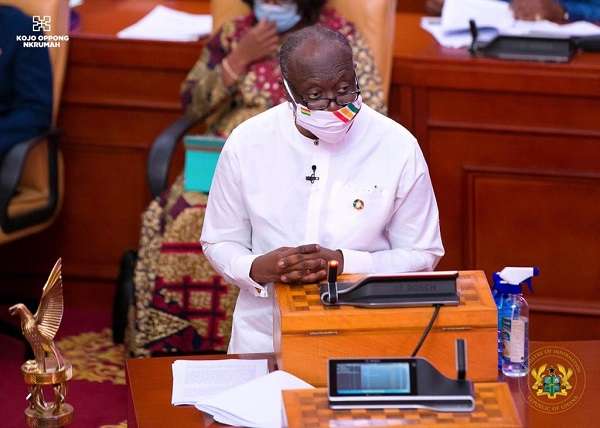

Mr. Ofori-Atta

Presenting the Mid-Year Budget Review on the floor of parliament today, Mr. Ofori-Atta highlighted the significant role of digitization in the country’s revenue mobilization drive. According to him, the Ghana Revenue Authority (GRA) is rolling out measures to increase revenues by pursuing strategies that address revenue leakages leveraging digitization.

“The Ghana Revenue Authority is therefore implementing a transformation agenda to block the huge leakages in key sectors of the economy. This transformation agenda is not just about mobilizing more, it is equally about mobilizing efficiently through technology and integrated data systems”.

Mr. Ofori-Atta

The RACE initiative

Also, Mr. Ofori-Atta indicated that the government has established the Revenue Assurance and Compliance Enforcement (RACE) Initiative to complement the efforts of the GRA. According to him, the remit of RACE is to identify and prevent revenue leakages while reinforcing the culture of compliance nationwide. The Finance Minister further revealed that a formal launch of this Initiative is scheduled for 2nd August 2021.

2021 half-year fiscal performance

Mr. Ofori-Atta further provided highlights of the 2021 half-year fiscal performance, emphasizing that the implementation of the 2021 Budget has been successful so far.

“We remain fully committed to achieving the fiscal deficit target of 9.5 percent of GDP for the year in order not to derail from the objective of returning to the Fiscal Responsibility Act (FRA), fiscal deficit and primary balance thresholds of 5 percent of GDP and positive primary balance, respectively, by 2024” .

Mr. Ofori-Atta

According to the Finance Minister, provisional fiscal data for January to June 2021 show that Total Revenue and Grants amounted to GH¢28.3billion, equivalent to 6.5 percent of GDP, against a programmed target of GH¢32.4billion or 7.5 percent of GDP. This means that the government has missed its revenue target for the period by GH¢4.1 billion.

For the same period, Total Expenditure, including the clearance of arrears, amounted to GH¢50.6billion, equivalent to 11.7 percent of GDP, against a programmed target of GH¢55.1billion or 12.7 percent of GDP. The fiscal deficit for the period was financed from both foreign and domestic sources. Net Foreign Financing of GH¢15.2billion constituted 68.3 percent of the total financing and included inflows from Eurobond proceeds. On the other hand, Total Domestic Financing amounted to GH¢7.1billion, representing 31.7 percent of total financing.

Public debt development

These developments, according to Mr. Ofori-Atta, caused the total public debt stock, as a percentage of GDP, to increase from 76.1 percent at the end of December 2020 to 77.1 percent of GDP at the end of June 2021. However, excluding the Financial Sector Bailout, the nominal debt stock as percentage of GDP is 72.9 percent as of End-June 2021. The Minister attributed the rise in the debt stock to pandemic-induced spending and contingent liabilities.

“The increase in the debt stock was mainly because of the Eurobond issuance in April 2021, COVID-19 pandemic effect, contingent liabilities, and front-loading of financing to meet cash flow requirements for the first half of the year” .

Mr. Ofori-Atta

READ ALSO: GRA Misses Revenue Target in the First half of 2021