The Ghana Revenue Authority (GRA) has addressed concerns about the Electronic Value Added Tax (e-VAT) system’s implementation.

This response comes after a publication on Wednesday, May 8, 2024, titled “E-VAT in limbo: Retail outlets suck economy dry – Nation loses billions in revenue”.

According to the publication, the Value Added Tax (Amendment) No. 2 Act, 2022 (Act 870) requires thousands of eligible companies to adopt the e-VAT system.

However, despite this mandate, nearly all the listed companies obligated to integrate their billing and receipting systems with GRA-designated systems are resisting compliance.

This non-compliance is resulting in significant monthly revenue losses for the state, amounting to billions of Ghana cedis annually.

In a statement, the GRA explained that the e-VAT system is being introduced gradually in phases to ensure effective implementation.

It stated that a highly successful pilot was completed with 50 taxpayers, adding, “The test and pilot phase provided a pathway for successful and seamless e-VAT implementation, which prioritized minimal disruption to taxpayers’ back-office processes.”

During the Pilot Phase of the Electronic Value Added Tax (e-VAT) system, the Ghana Revenue Authority reported a significant growth in VAT revenue, exceeding GH¢384 million in additional contributions, representing a 58% increase.

Electronic VAT invoicing efficiency played a key role, contributing GH¢124 million, or 32% of this growth.

In Phase 1, which is currently underway, the focus is onboarding large taxpayers responsible for 80% of VAT contributions. This phase, initially set from April 22 to May 31, 2024, has shown promising progress, achieving a 175% onboarding rate against weekly targets.

The subsequent phase aims to onboard medium and small taxpayers by the end of December 2024.

Regarding Phase 3, the final implementation phase targets the integration of all other VAT-registered taxpayers into the e-VAT system.

The Ghana Revenue Authority is optimistic about the e-VAT system’s potential to boost VAT contributions significantly. It reassures stakeholders of its unwavering commitment to swiftly implementing the e-VAT system.

The GRA believes that the successful rollout of e-VAT will improve revenue collection, combat tax evasion, and enhance transparency in tax administration, based on the positive outcomes observed during the Pilot Phase.

Electronic VAT System

The Ghana Revenue Authority introduced the updated e-VAT system under the Taxation (Use of Fiscal Electronic Device) Act, 2018 (Act 966) in October 2022 to enhance VAT revenue collection.

This system involves an invoice validation process where each invoice submitted to the GRA receives a unique “sales data controller” (SDC) code containing a timestamp and QR code. The SDC code must be included in PDF invoices sent to customers.

Retail outlets then report their sales invoices to obtain an electronic tax clearance certificate (e-TCC), enabling taxpayers to generate certificates online.

The e-VAT system covers invoices, and credit notes, and requires companies to provide information about inventory and purchases to ensure compliance with tax regulations.

Expert Comment On E-VAT

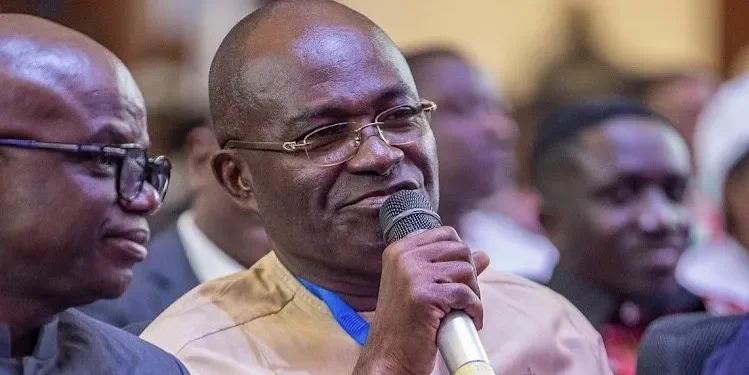

Mr. Abeku Gyan-Quansah, a Tax Partner at PricewaterhouseCoopers (PwC), commented positively on the implementation of the e-VAT initiative. He noted that the government’s intention to address VAT challenges in Ghana makes the introduction of e-VAT a commendable initiative.

“It is expected that so long as we are billing you through this system, it reduces the propensity for VAT fraud because the GRA will have almost instantaneous information. So in our view, what the government intends to achieve with the electronic VAT is a good thing.”

Mr. Abeku Gyan-Quansah

He however highlighted challenges such as entities not remitting collected VAT to the revenue authority and others not collecting VAT despite eligibility.

Mr. Gyan-Quansah, who is also the PwC West Africa Indirect Tax Leader, stated that when a business operation was placed on the e-VAT, the expectation was that it would give the GRA almost real-time information about the revenue due it.

READ ALSO: U.S To Halt Weapons Supply To Israel If It Invades Rafah