A partner from Deloitte, Yaw Appiah Lartey, has iterated that some members of the informal sector are not captured in the tax bracket, hence poses a critical threat to Ghana’s revenue mobilization.

Because the economy is highly characterized by cash transactions, Mr. Lartey explained that the Ghana Revenue Authority (GRA) is unable to tax the incomes of informal-sector workers such as masons and carpenters.

“… beyond the professional services, we also know that the artisans are outside the bracket… Sometimes we forget, [and] we only mention the lawyers, the accountants and all the professional service providers. But your usual Masons, Carpenters, and so on; they are the bigger challenges that are outside the bracket and we haven’t found a way to get them into the tax net. That is because of the same problem that we are still operating a cash society where most of our transactions are through cash payments.”

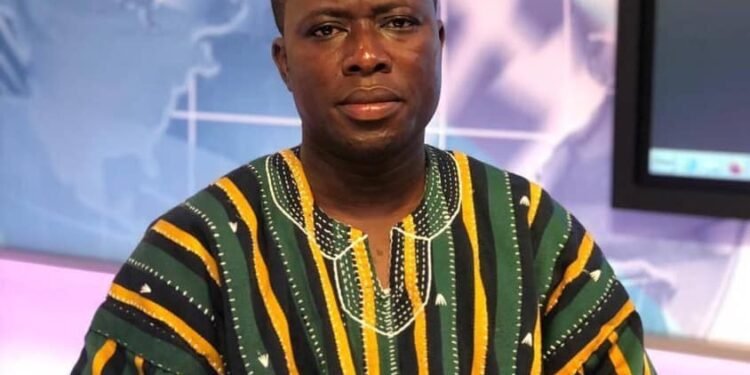

Yaw Appiah Lartey

That notwithstanding, Mr. Lartey, stated that the issue of tax evasion on the side of some recognized professionals is real. However, to ascertain the real tax evaders, it depends on the sector of professionals you look at.

Unlike employees in the public sector or non-profit organizations whose taxes are deducted right from their employment income, Mr. Lartey noted that workers in the private organizations do not pay taxes on their business incomes.

“So, the point about professionals evading tax is one of a perception as well as real. So, depending on which type of professional you are looking at; those who earn business income and are not paying taxes on their business income are certainly evading taxes. But those who are just earning employment income and are paying PAYE on their employment income, they are not evading taxes.”

Yaw Appiah Lartey

It is complex to tax a cash economy

Alluding to Mr. Lartey’s explanation, the Assistant Commissioner of the Ghana Revenue Authority (GRA), Dominic Naab indicated that it is much difficult to tax an economy that is highly characterized by cash transactions.

As a result of the untraceable nature of cash dealings, it becomes quite impossible to even identify before one can even think of taxing, Mr. Lartey asserted.

“Now let’s talk about the structure of the economy, in Ghana, we are operating cash economy and if you are operating a cash economy, it becomes very difficult. If someone gives you a gift in cash, how does GRA identify it for them to tax it?”

Dominic Naab

However, Following the President’s request, Mr. Naab revealed that GRA is putting up measures to ensure the digitization of cash transactions, especially with tax payments. This, according to him, will enable GRA to close the tax revenue gap.

“There’s a clarion call by government to actually create what we call ‘Cashlite’ or cashless economy. So GRA has taken the lead to actually ensure that we go cashless. We are trying to do that to ensure that we are able to block the loop holes within the system to ensure that we are able to mobilize the revenue.”

Dominic Naab

Also, the Assistant Commissioner highlighted that aside the COVID-19 pandemic, tax evasion is another major challenge that confronts the GRA’s revenue mobilization.

As a result, he explained that it is legally mandatory for every taxpayer to truthfully disclose their earnings to GRA as well as perform their respective tax obligations as required by law.

“A lot of factors have really conspired against collection of tax. COVID-19 is actually a big challenge, then of course persons evading taxes; that is also another challenge for the GRA. Article 41J of the constitution talks about the fact that, as a citizen, it is our responsibility to disclose our income honestly to GRA.”

Meanwhile, the CEO of Private Enterprise Federation (PEF), Nana Osei Bonsu, revealed that the Federation in partnership with GRA undertook research to ascertain the reason why people evade taxes. Based on their findings, Nana Osei Bonsu indicated that because tax laws are not easily comprehensible, taxpayers tend to dodge them.

However, The Assistant Commissioner of Ghana Revenue Authority noted that the Authority will re-visit the tax framework and then educate the public on its provisions.

Read Also: If you are operating a cash economy, it is very difficult to collect taxes- Dominic Naab