Hon. Frank Annoh-Dompreh, the Member of Parliament (MP) for Nsawam-Adoagyiri has predicted that the cedi is prepared for another significant accomplishment.

The MP in a tweet holds the believe that Ghana will experience a significant accomplishment in terms of the strength of the Cedi.

“The Cedi has gained 61% of its value against the $… We are set for another historic feat! Yes, we can Ghana.”

Annoh-Dompreh

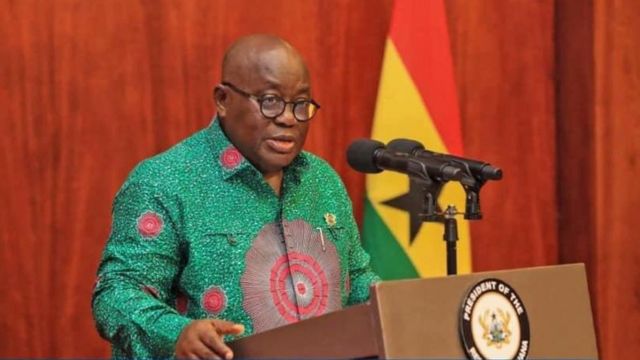

Prior Mr. Annoh-Dompreh’s tweet, Nana Addo Dankwa Akufo-Addo, the President of the Republic of Ghana also in a recent address to the nation, gave the assurance that the government will continue with its current economic programs, which have contributed to the strengthening of the Cedi and other economic indicators.

The President further said that Ghana will experience positive changes with the right policies implemented, determination and hard work. However, the President noted that Ghana is still on a journey out of the economic duress and will come back resting on the collective efforts of government and the Bank of Ghana.

“We are definitely not yet out of the woods. However, today, the Cedi is rapidly appreciating against the US Dollar and all major currencies, making up for its losses and the prices of petroleum products are reducing at the pump.

“The strengthening of the Cedi has not happened by chance but through the implementation of deliberate policies by government in collaboration with the Bank of Ghana.”

Nana Akuffo – Addo

Speaking during a Christmas address to the nation December 24, the President expressed optimism about the Ghanaian economy recovering in 2023 due to some positive advances made in the last few weeks.

The President likened the Ghanaian economic situation to the biblical narrative that captured the Israelites in Babylon, yet he held that with hardwork, dedication and prudent management, the country will bounce back.

“Over the last three years, we have been confronted with our own captivity in Babylon moments. We had to ride turbulent storms and we were faced with the unknown.

“I am happy that in spite of it all, we are beginning to emerge out of the difficulties which encourages me to say that with hard work, dedication and continued prudence in the management of the affairs of our nation, we will rise up again.”

Nana Akuffo – Addo

Interest rates continue to fall

Interest rates continued to fall on the treasury market as it went down marginally for the third week running.

The latest auction of treasury bills shows a decrease in the yields of the short-term instruments with the 91-day T-Bill seeing the largest drop at 0.64%, bringing its yield to 34.93%. The 182-day bill also saw a decline of 0.50%, bringing its yield to 36.03%. The one-year bill had a smaller decrease of 0.09%, bringing its yield to 36.10%.

These decreases in yield, while small, will save the government some cost when repaying the principal and interest at maturity.

The declining interest rates may also be due to improved liquidity as the government has been securing more than its target in the T-bill auctions. However, this may be partly due to the debt exchange program where the government bonds have been affected by haircuts, unlike T-Bills.

According to the Bank of Ghana, the trend of interest rates over the first 11 months of the year has generally been upward due to a tight monetary policy and relatively tight liquidity in the money market.

However, the recent downward trend of interest rates is seen as a positive development for the economy.

READ ALSO: As For Politics And Elections You Must Consider That It Is Not Always Win-win- John Boadu