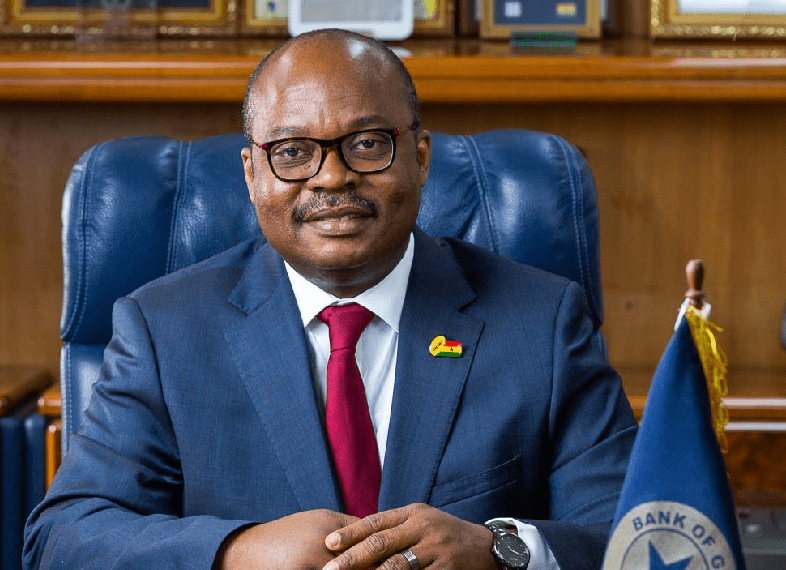

The Governor of the Bank of Ghana, Dr. Ernest Addison has revealed that despite positive results yielded from regulatory reliefs given to banks amid the global crises, the COVID-19 pandemic “either unearthed or intensified” some risks in the banking sector, which must be efficiently managed by banks to avoid any unintended consequences on the industry.

Dr. Ernest Addison made these comments while delivering his keynote address at a Webinar recently organized by the Ghana Association of Bankers (GAB) under the theme ‘Managing Banking Risks in Uncertain Times – Covid-19 Test Case’. Highlighting three major risks the pandemic has posed on the Banking industry, he mentioned that the sector faces cyber security risks, credit risks, and operational risks.

Touching on cyber security risks, the Bank of Ghana Governor further asserted that although the outbreak of the coronavirus pandemic boosted the move towards digital transactions and financial inclusion, promoting economic growth, it also brought in its wake a heightened sense of cyber-attacks within the financial sector. As such, if adequate investments are not made for effective protection of the information technology and security infrastructure, this will erode all the successes banks have chalked from digitization”.

“Yet, the drive towards more digitisation has heightened cyber risks and fraud, and therefore calls for effective cyber risk management policies and procedures by banks.

“In this regard, the Bank has issued directives and guidelines such as the Cyber Security Directive that banks must meet on an on-going basis to effectively manage cyber risk and fraud”.

Dr. Ernest Addison

The sharp slowdown in economic activity has ramifications for the solvency of some households and businesses with lenders within sectors strongly hit by the impact of the pandemic, particularly those in industry and services sectors, being more vulnerable, Dr. Addison said, adding that “This is why the introduction of the regulatory reliefs has proved timely and banks have responded appropriately with some form of forbearance for customers,” increasing the Banking sector’s exposure to credit risk.

“The challenge going forward is how well banks account for the impact of the reliefs in terms of loan classification, expected credit losses, provisioning, credit risk weightings and the overall impact on their capital ratios/ key performance indicators. For instance, loan loss provisions grew by 28.0 percent, higher than the 23.6 percent a year ago reflecting elevated credit risks in 2020.

“In response to these developments, banks may need to strengthen credit risk management policies and engage in risk-sharing arrangements through syndications”.

Dr. Ernest Addison

The Bank of Ghana Governor further hinted that the COVID-19 related partial lockdowns and restrictions to contain the spread instigated the work-from-home concept, which poses some operational risks to the Banking industry, which if not well managed can affect the smooth operations of any bank. The engagement of third-parties by some banks to perform some non-core functions could also be threatened by weaknesses in financial and operational resilience.

“Part of the increase in other operating expenses was related to costs associated with implementing safety protocols and containment measures of COVID-19, as well as activation of Business Continuity Plans (BCPs) by banks.

“Notwithstanding the pandemic-induced increases in the industry’s cost of operations, banks did not pass on those costs to consumers in the form of higher interest margins but adopted other cost control measures to cushion their bottom line”.

Dr. Ernest Addison

Finally, Dr. Addison cautioned that regulatory reliefs proved timely for the banking sector as it navigated the unchartered paths during the first wave of COVID-19 but disruptions in banks’ operations and business continuity concerns, orchestrated by the pandemic, remains critical in these uncertain times, especially with the recent rise in the infection rate following a resurgence.

“We must all adapt to this ‘new normal’ of working and going forward, BCPs must focus on end-point and network security measures with robust user authentication protocols to minimise abuse of banks’ systems. Risk-based business continuity plans and innovation stands out as key to survive in uncertain times”.

Dr. Ernest Addison