The Ghanaian government is set to introduce a new Microfinance Policy by the end of the year, a move aimed at transforming the sector and driving economic growth.

The policy is expected to provide a structured framework for microfinance institutions, enabling them to operate more effectively and support small businesses and low-income individuals.

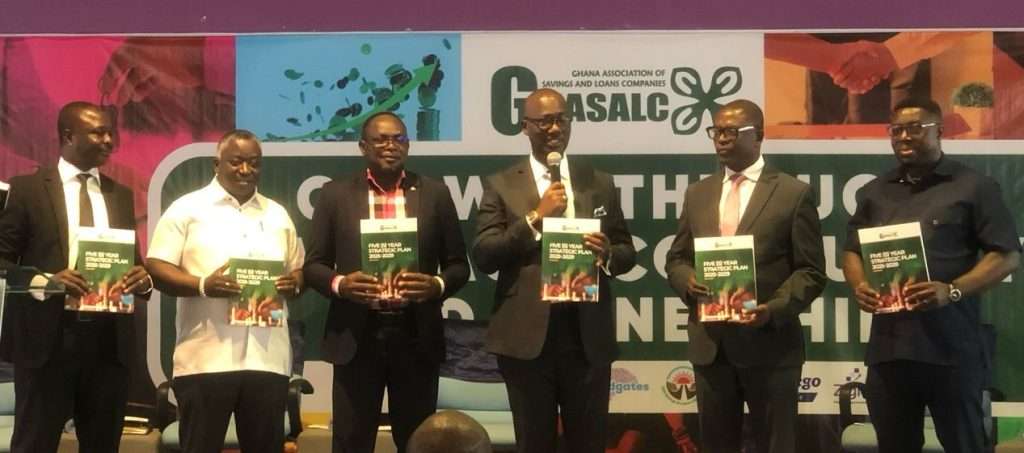

The announcement was made by Andrew Amerckson, Head of Banking and Non-Banking at the Ministry of Finance, during the launch of a five-year strategic plan by the Ghana Association of Savings and Loans Companies (GHASALC). Speaking on behalf of Finance Minister Ato Forson, Amerckson underscored the importance of the new policy in streamlining the microfinance industry.

“To streamline the operations of the sector, the Ministry of Finance, in collaboration with the Central Bank and other stakeholders, has been working on the introduction of a new microfinance policy to serve as a blueprint to guide microfinance operations in Ghana. We need it to be passed because the risk there is very high.”

Andrew Amerckson

The microfinance industry plays a critical role in Ghana’s financial sector, particularly in providing access to credit for micro, small, and medium-sized enterprises (MSMEs) and unbanked populations. However, the sector has also faced significant challenges, including high-risk lending practices and an elevated non-performing loan (NPL) ratio of 15%.

Policy Implementation and Expected Impact

Amerckson indicated that while the policy is expected to be passed this year, its implementation may not require a Legislative Instrument (LI) but rather an Executive Instrument to take effect. “We are sure that the policy we are working on will get passed this year, but I don’t think it may need an LI, rather an Executive Instrument to get it implemented,” he explained.

This policy is expected to provide clear guidelines for microfinance institutions, reducing financial risks and ensuring the sustainability of the sector.

Meanwhile, the Chief Executive Officer of GHASALC, Tweneboah Koduah Boakye, has urged the government to prioritize the microfinance policy in the upcoming national budget. He emphasized that an effective framework will enhance capital access for MSMEs, which are the backbone of Ghana’s economy.

“We want to see the microfinance policy that was developed with the help of GIZ being adopted by cabinet and also being translated into an LI. In that policy, we all agreed that the non-banked sector needs to be restructured.”

Tweneboah Koduah Boakye

GHASALC also advocates for a regulatory reclassification of the sector, arguing that its current designation does not accurately reflect its financial strength.

“The current designation does not serve us well. We need the regulator to support the development of the middle tier and recognize that we deserve to be called a bank, given that our balance sheets now exceed those of some banks five or ten years ago.”

Tweneboah Koduah Boakye

This call for reclassification highlights the growing importance of microfinance institutions in Ghana’s financial landscape. Many microfinance firms now possess larger balance sheets than some banks had in the past, further underscoring their role in the economy’s financial stability.

Microfinance Sector: Current Challenges and Future Prospects

The microfinance sector currently serves over 7 million customers across the country, with a cumulative asset base of GHS 9.7 billion. However, the sector has been plagued by high default rates, weak financial structures, and regulatory inefficiencies.

As part of its five-year strategic plan, GHASALC aims to reduce the non-performing loan (NPL) ratio from 15% to 5%, a move that would strengthen the industry’s stability and sustainability.

The strategic plan also focuses on expanding financing for MSMEs and households, reinforcing the sector’s role in enhancing financial inclusion.

The introduction of a comprehensive microfinance policy is expected to create a stronger and more resilient microfinance industry. By implementing clearer regulations, addressing financial risks, and promoting increased access to credit, the policy will serve as a roadmap for sustainable financial inclusion in Ghana.

With the sector playing a vital role in supporting MSMEs and individuals with limited access to traditional banking, the success of this policy will be crucial in shaping Ghana’s economic growth and development in the years to come.

As the government finalizes the policy framework, all eyes will be on how effectively it will address key concerns and enhance the stability of Ghana’s financial ecosystem.

READ ALSO: South Sudan Elections at Risk Amid Delays