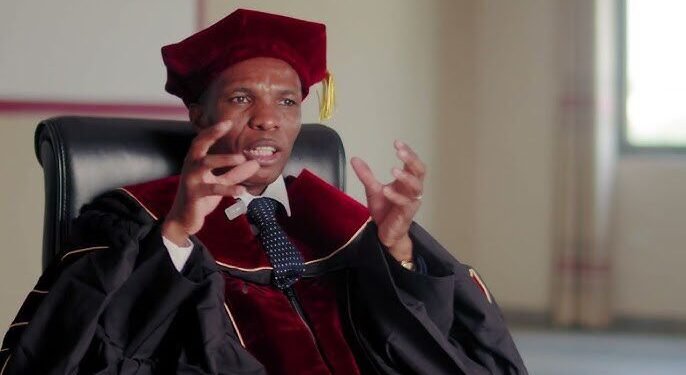

Jason Cao, Chief Executive Officer of Huawei Global Digital Finance, has indicated that it’s time to transform banking and build smarter and greener finance together. He thus shared his thoughts on how stakeholders of the industry can shape smarter and greener finance together.

According to the CEO, global digital transformation investments are expected to reach US$1.8 trillion in 2022, and financial institutions are under immense pressure to digitally transform so they can anticipate and prepare for the next new normal.

At the same time, Mr. Cao noted that they are also expected to address new business needs by improving efficiency and sustainability, complying with environmental, social, and governance (ESG) and financial requirements, and enabling security and data convergence with real-time intelligence for improved customer experience to name a few.

“Technology continues to drive the development of the financial industry, especially in connectivity and intelligence. We’ve seen how the ATM broke the time limit and mobile banking broke the space limit. Now, super apps are reshaping customer engagement.”

Jason Cao

According to Cao in his address to key industrial players, financial institutions are entering a new era, with new services and products emerging one after another. “These ultimately present as many challenges as there are opportunities”.

Smarter and Greener Finance

Mr. Cao explained that smarter and greener finance enables connections with intelligence for all scenario services to capture opportunities and meet these challenges. “With fully connected and fully intelligent connections optimising agile and flexible customer engagement solutions for improved digital experience, smarter and greener finance delivers three key capabilities; data, intelligence, and scenario integration.”

An Intelligent converged platform builds real-time data capabilities based on a hybrid multi-cloud architecture, making cross-cloud management easier with agile services to meet the requirements for different scenarios. Although hybrid multi-cloud architecture is trending, there are technical challenges such as multi-cloud one-network collaboration and multi-party data encryption and computation. But according to Cao, new technologies can make modernisation a reality with a distributed cloud microservice platform to support a seamless re-architecture and migration experience.

Huawei has collaborated with partners to build an all-scenario intelligent financial solution to integrate data, intelligence, and scenarios for an improved customer experience

All-scenario Digital End-user Experiences

Having low-code capabilities go a long way to aid in the development of native super apps and a Customer Engagement Centre (CEC) that connects customers with digital services for better end-user services. Huawei has collaborated with partners to build an all-scenario intelligent financial solution to integrate data, intelligence, and scenarios for an improved customer experience in scene interaction, perception, and decision-making.

“From the intelligence perspective, we are experiencing the era of intelligent decision-making. 2022 is a milestone for intelligence. We have officially entered ZFLOPS times with the development of intelligence an era of super-personalisation, and we have to think about what that means for us. We see smart contracts that will make decision-making possible everywhere.”

Jason Cao

Huawei has been building innovative solutions with leading partners to support customers’ digital needs, one of which is the Digital Banking 2.0 Solution which leverages Temenos’ open platform. This is designed to support the rapid launch of digital banks, empowering banks to accelerate modernisation in the cloud and improving rollout efficiency and customer satisfaction.

READ ALSO: Countries could cut emissions by 70% by 2050- World Bank Report