John Awuah, the Chief Executive Officer (CEO) of the Ghana Association of Bankers has indicated that implementation of the No Ghana Card No Banking rule, will improve access to loans.

The CEO made this comment while reacting to the data from the Bank of Ghana (BoG) which stated that the growth in gross loans and advances remained subdued for most parts of 2021. According to John Awuah, apart from the No Ghana Card No Banking policy improving the quantum and quantity of loans given out, the policy would help reduce the level of non-performing loans in the financial ecosystem.

“Particularly for personal loans, this policy should help in tracing and tracking defaulters. In the past, people take loans and then jump from one job to the next job and end up not paying for loans taken. The new Ghana card system has your SSNIT number integrated, the card is linked to your tax ID, your passport and also pins you to a location.”

John Awuah

The CEO of Ghana Association of Bankers further iterated that he is confident banks will be willing to give out more loans after the Ghana Card becomes the only card accepted for all financial transactions.

“Now access to loans should also improve, given that now we have better ways of knowing the persons we are dealing with. We believe that if the card is properly embedded into our sanctions structure, it should help speed up loan approvals and ultimately help reduce the lending rates of banks”.

John Awuah

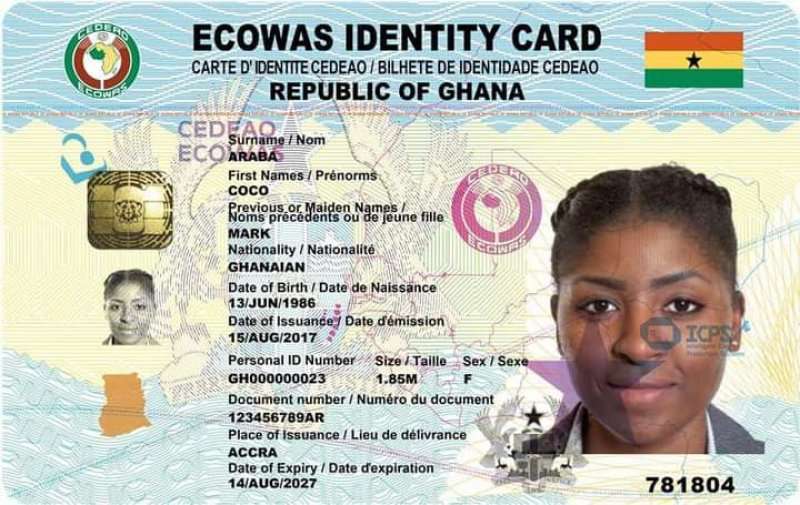

The Bank of Ghana has directed all licensed and regulated financial institutions under the Central Bank, to accept only the Ghana Card for transactions from July 1, 2022.

“In furtherance of its objective of ensuring the safety of the financial system, Bank of Ghana pursuant to Regulation 7 of the National Identity Register, 2012 (L.I. 2111), hereby directs that with effect from 1st July, 2022, the Ghana Card shall be the only identification card that will be [used] to undertake transactions at all Bank of Ghana licensed and regulated financial institutions”.

BoG Statement

John Awuah, while reflecting the sluggish credit demand and supply conditions and the increased appetite of banks for government securities due to the elevated credit risks, noted that the Ghana card will help address the situation.

Inferring from the BoG report, Mr John Awuah noted that the Gross loans and advances recorded a year-on-year increase of 8.7 percent to GH¢48.9 billion as at end-August 2021, which is lower than the 15.7 percent growth recorded in the previous year.

Following a similar trend, net loans and advances (gross loans adjusted for provisions and interest in suspense) also recorded a modest growth of 8.5 percent to GH¢42.3 billion, compared with a 14.5 percent growth in August 2020.

In terms of sector classification, Mr Awuah indicated that the services sector held the largest share of 30.2 percent in total credit as at August 2021.

READ ALSO: GITFiC Begins Countrywide Survey to Assess Ghanaians Knowledge on AfCFTA