Zenith Bank Ghana and CalBank PLC have emerged as leaders in customer satisfaction in Ghana’s banking industry, topping the maiden edition of the Customer Satisfaction and Brand Health Survey conducted by Strategic Communications Africa (StratComm Africa) in collaboration with Global Info Analytics.

Launched at the StratComm Africa office in Accra, the survey sought to evaluate and rank commercial banks operating in Ghana based on key service delivery indicators. The research, conducted from January 17 to 20, 2025, assessed 20 traditional banks and gathered feedback from 3,097 customers across all 16 regions of the country.

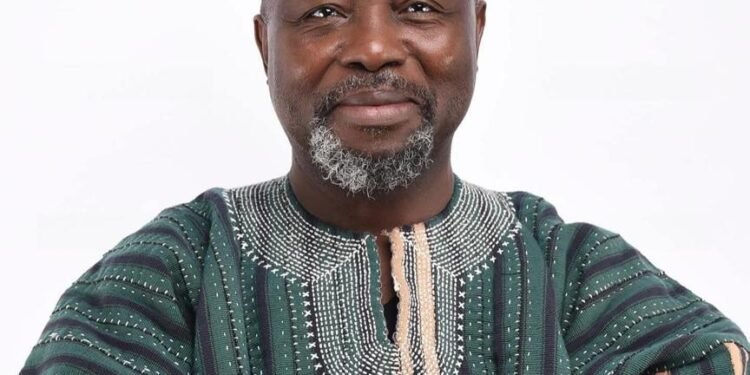

According to the findings presented by Mussah Dankwah, CEO of Global Info Analytics, both Zenith Bank and CalBank scored an impressive 81% in overall customer satisfaction, placing them at the top of the rankings and significantly above the industry average of 72%.

The survey measured customer service delivery across five key dimensions: Tangibles, Reliability, Responsiveness, Assurance, and Empathy.

Zenith Bank stood out in the “Tangible” and “Reliability” dimensions. Tangibles assess physical aspects of service, including facilities, equipment, and staff appearance. Here, Zenith led with 84%, followed by CalBank at 80% and Fidelity Bank at 74%. In the Reliability category, which evaluates the bank’s ability to perform promised services accurately and consistently, Zenith again led with 83%, ahead of CalBank (79%) and Consolidated Bank Ghana (CBG) at 75%.

CalBank Excels in Responsiveness, Assurance, and Empathy

CalBank showed significant strength in customer responsiveness, assurance, and empathy. The bank topped the responsiveness metric with 80%, which measures staff willingness to help and provide prompt service. Zenith followed closely with 78%, while ABSA scored 76%.

In the Assurance category—covering staff competence, courtesy, and the ability to inspire trust—CalBank led again with 81%. Fidelity Bank and CBG followed with 74% and 73%, respectively. CalBank also outperformed all competitors in the Empathy dimension with another 81%, highlighting its personalized attention and care toward customers. ABSA came second with 76%, while Fidelity and CBG tied for third place at 72%.

Although not topping the overall rankings, Fidelity Bank emerged as a strong performer across multiple service areas, finishing third in overall satisfaction with 73%. Its consistent presence in the top three across various metrics reinforces its position as one of the country’s leading customer-oriented banks.

Beyond Customer Service: Brand Health Indicators

The study also delved into brand health metrics, focusing on customer perceptions beyond service encounters. These indicators included Unprompted Brand Recall, Brand Purchasing Intent, Brand Loyalty, and Brand Equity.

Ghana Commercial Bank (GCB) led in Unprompted Brand Recall with 14.3%, followed by Agricultural Development Bank (ADB) at 11.9%, and Ecobank at 9%. This suggests these banks have strong brand visibility and recognition among Ghanaian consumers.

CalBank topped the Brand Purchasing Intent metric—how likely customers are to use the bank in the near future—with 85%. Access Bank and GCB followed closely at 84%, while Fidelity Bank came in at 83%.

In terms of Brand Loyalty, First National Bank (FNB) outperformed its peers with a remarkable 92% of customers indicating they would remain with the bank. Universal Merchant Bank (UMB) followed at 86%, while Standard Chartered, ABSA, and Stanbic shared the third spot with 82% each.

FNB also led in Brand Equity with 84%, reflecting its strong sway and value perception in the minds of customers. Stanbic Bank and CalBank followed with 80% and 79%, respectively.

This first-of-its-kind survey sets a new benchmark for the banking industry in Ghana. It offers not only a performance mirror for banks but also a valuable resource for customers, regulators, and stakeholders who seek transparency and accountability in service delivery.

The report reinforces the fact that while many banks operate in the same regulatory space, customer experiences differ widely based on how each institution prioritizes quality service, trust, and empathy. As expectations rise and customers become more informed, service excellence and brand strength will continue to be critical competitive advantages.

READ ALSO: President Mahama Hails Ghana-EU Trade Ties, Boasts of Strong Economic Gains